We sold Select Sands for a quick 27% profit a couple of weeks ago, fearing a reaction that could have been made worse by a Fed rate rise, which in the event didn’t happen, and now the stock has crept back up to about where we sold it – and there is no prospect of the Fed raising rates until at least December.

The fundamental outlook for Select Sands is excellent. The company is a pure fracking sand play that has the best and only major high quality approved fracking sand resource outside of Wisconsin – it is in Arkansas, and very close to major markets in Texas, in particular Eagle Ford and the Permian basin, which gives it a competitive advantage because transport costs and times are greatly reduced, which is a big deal when you are moving countless thousands of tons of sand – just one well can use many thousands of tons of high quality frac sand. Another important point is that although drilling has been severely curtailed in recent years due to low oil prices, there are signs that it is starting to pick up again. In addition the company has exposure to a rising gold price via its holding of 20 million shares of Comstock Metals (CSL.V).

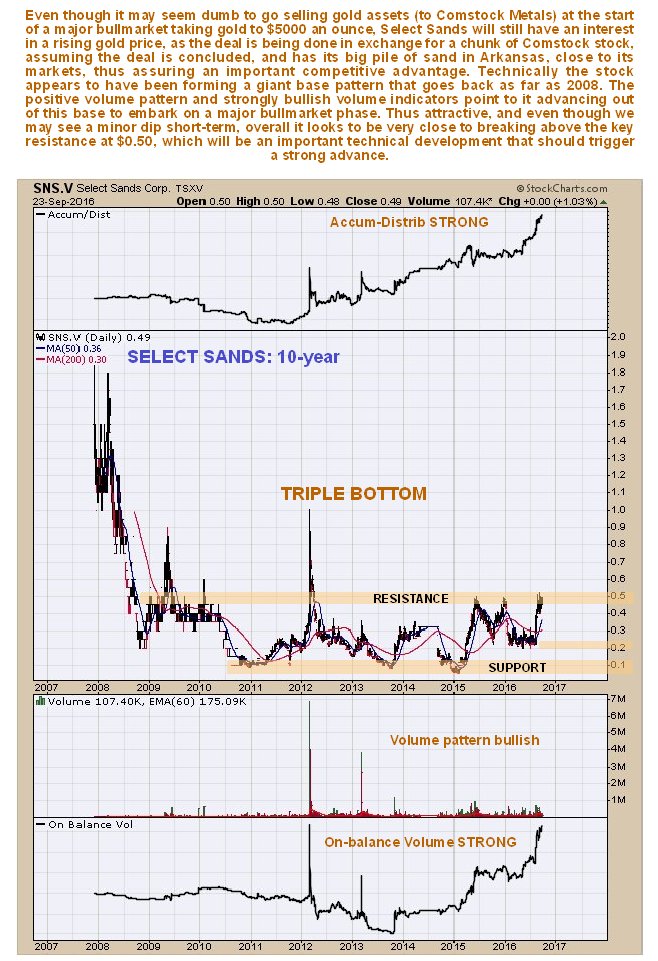

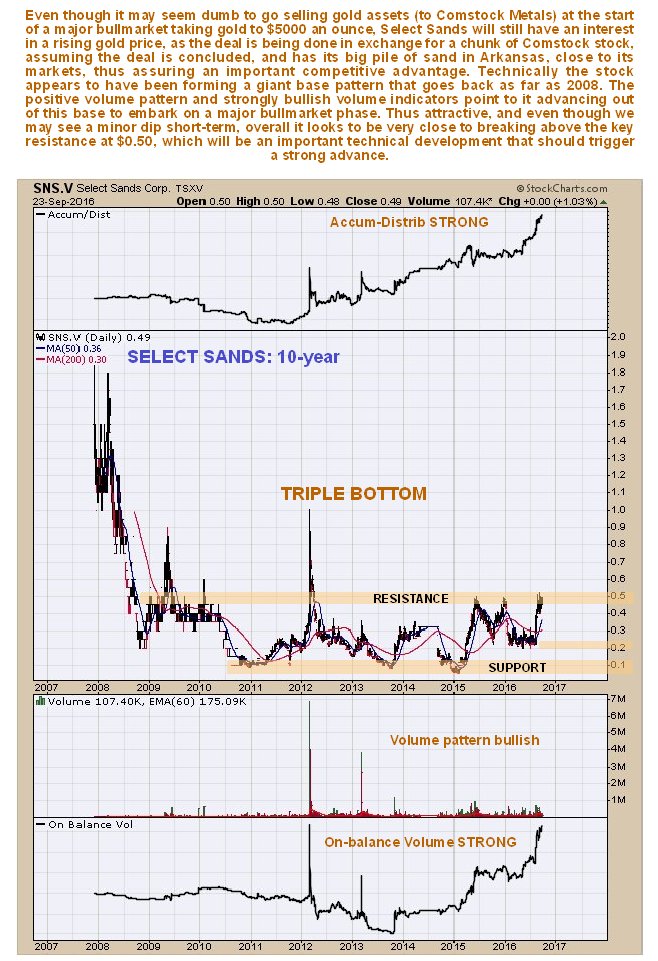

The charts are also saying that Select Sands is powering up for a major bullmarket, which would only be derailed by an all-out economic implosion, and while that is probably going to happen someday, it’s not something we should be too concerned about at least over the medium-term.

Starting with the 3-month chart we can see how, after a sharp advance in August, which we caught the latter part of, the price has gone into a rectangular trading range. We

bought it at the point shown and

took a quick 27% profit up near the strong resistance approaching $0.50, in fear of a reaction, which we got, that would have been made worse if the Fed had raised rates. After reacting back to support at the lower boundary of the range, it turned up again and has crept back up towards the highs over the past couple of weeks. On Thursday and Friday it put in some slightly bearish looking candles suggesting that it may react back again short-term, which is made more likely by the broad market looking set to open down today. However, any such short-term dip should be bought because there are strong signs that it is getting ready to vault above the resistance at $0.50. In the 1st place this is the 3rd attempt during August and September to break above this resistance, and the 3rd major attempt of the past 2 years (see 3-year chart lower down the page), and the 3rd attempt is often successful. Secondly, the volume pattern is strongly bullish, so that both volume indicators shown on the chart are making new highs already, which certainly augurs well for an upside breakout.

The 3-year chart is interesting as it shows us that not only is this the 3rd attempt of the past 2 months to break above the resistance around $0.50, but the on a larger scale, the 3rd attempt of the past 2 years. Again, the bullish volume pattern and strong volume indicators suggest that there is a high chance that it will soon break above this resistance.

On the 10-year chart we can see that a giant base pattern has been forming since as far back as 2008, which may be classified as a Triple Bottom. With the company getting its act together so that it will soon bring its giant frac sand resource into production, the time is nigh for it to break out of this base pattern and embark on a major growth phase, which this huge base pattern will certainly support.

Select Sands is rated a strong buy, especially on any minor dip in coming days. A major long-term bullmarket is in prospect. The stock trades in rather light but reasonable volumes on the US OTC market.

Select Sands is rated a strong buy, especially on any minor dip in coming days. A major long-term bullmarket is in prospect. The stock trades in rather light but reasonable volumes on the US OTC market.

Select Sands

website

Select Sands Corp SNS.V, CLICF on OTC, closed at C$0.49, $0.37 on 23rd September 16.

Select Sands will be filed under Mineral Stocks in the Archive.

Posted at 8.20 am on 26th September 16.