Even though there has been virtually no movement in Tisdale Clean Energy since we last looked at it on 8th December, so a month ago, it remains a potent setup that is continuing to gather strength and for this reason I want to bring it to your attention again, especially as this is a junior uranium stock with an exceptionally low float and so has great upside potential, especially as the larger uptrend in the uranium sector looks like it will soon reassert itself.

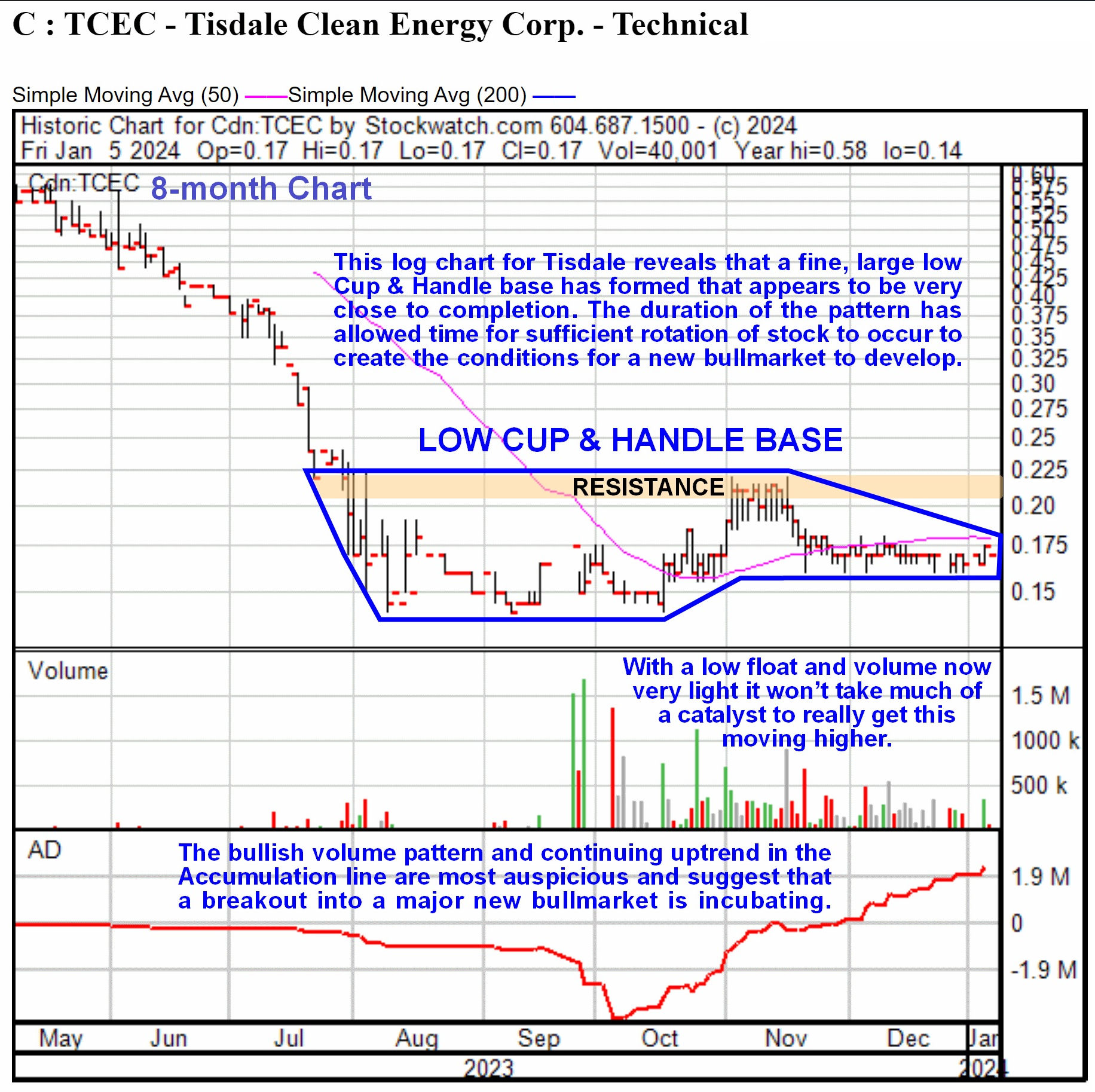

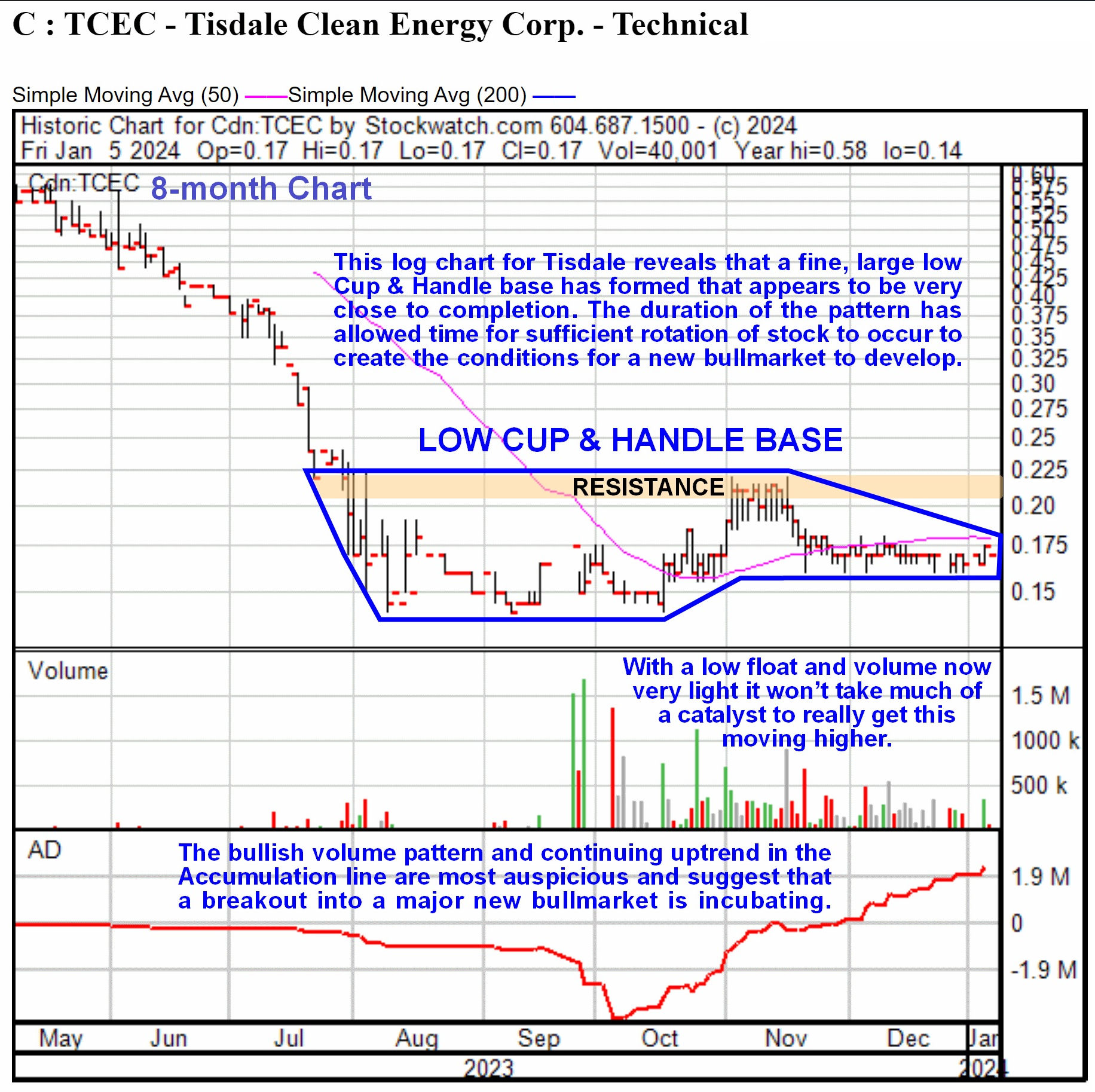

When I reviewed its chart yesterday I realized that the use of a log chart instead of an arithmetic chart really “opens out” the base pattern enabling us to see the fine Cup & Handle base (or Pan & Handle since it is still rather flat) to advantage. On the 8-month log chart below we can really see the base pattern well and the three key points to note are that the pattern looks to be complete, or very close to complete, the Accumulation line continues to ascend strongly and make new highs which calls for an upside resolution of the pattern, and last but not least, it is still at a very favorable entry price.

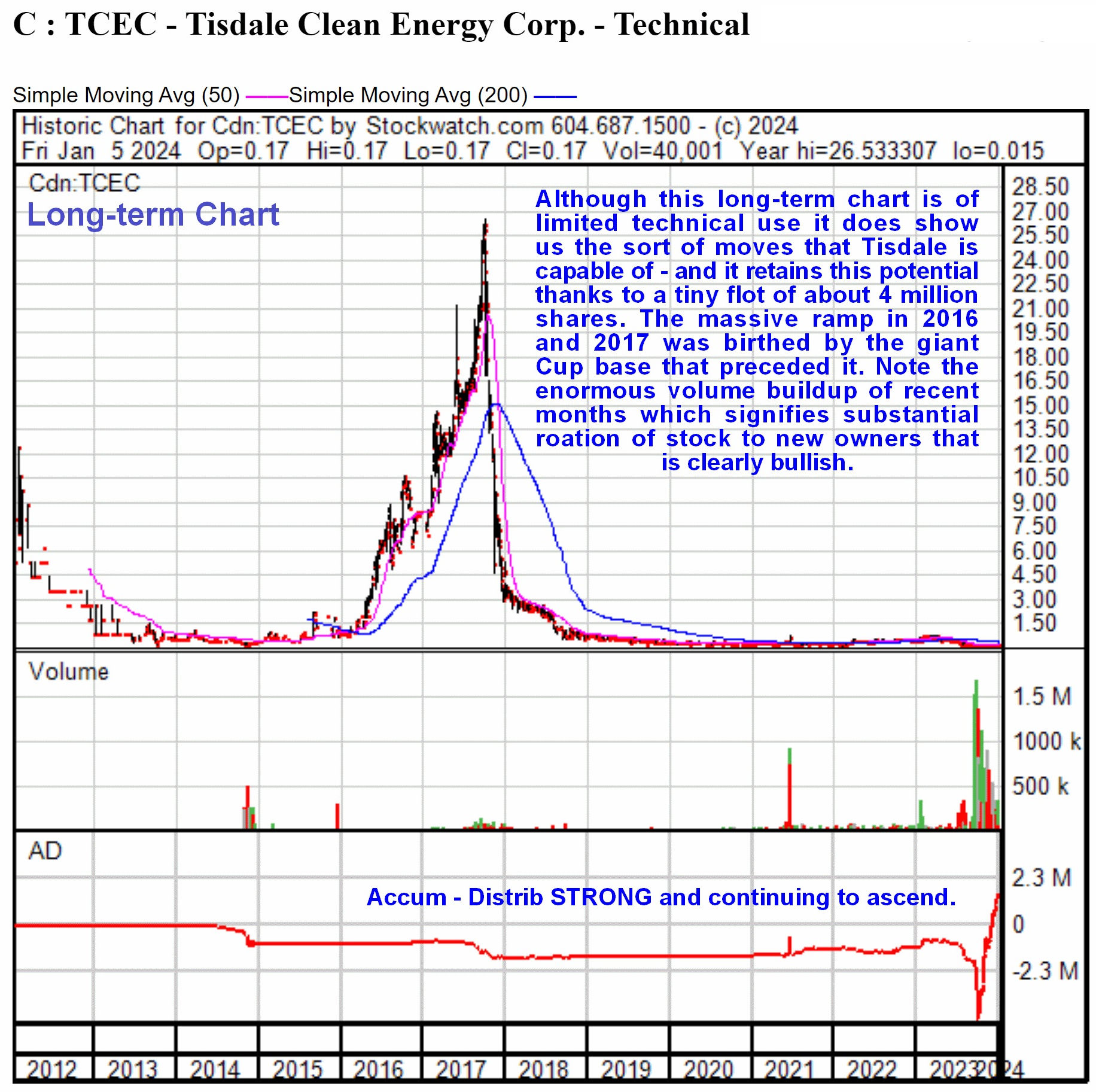

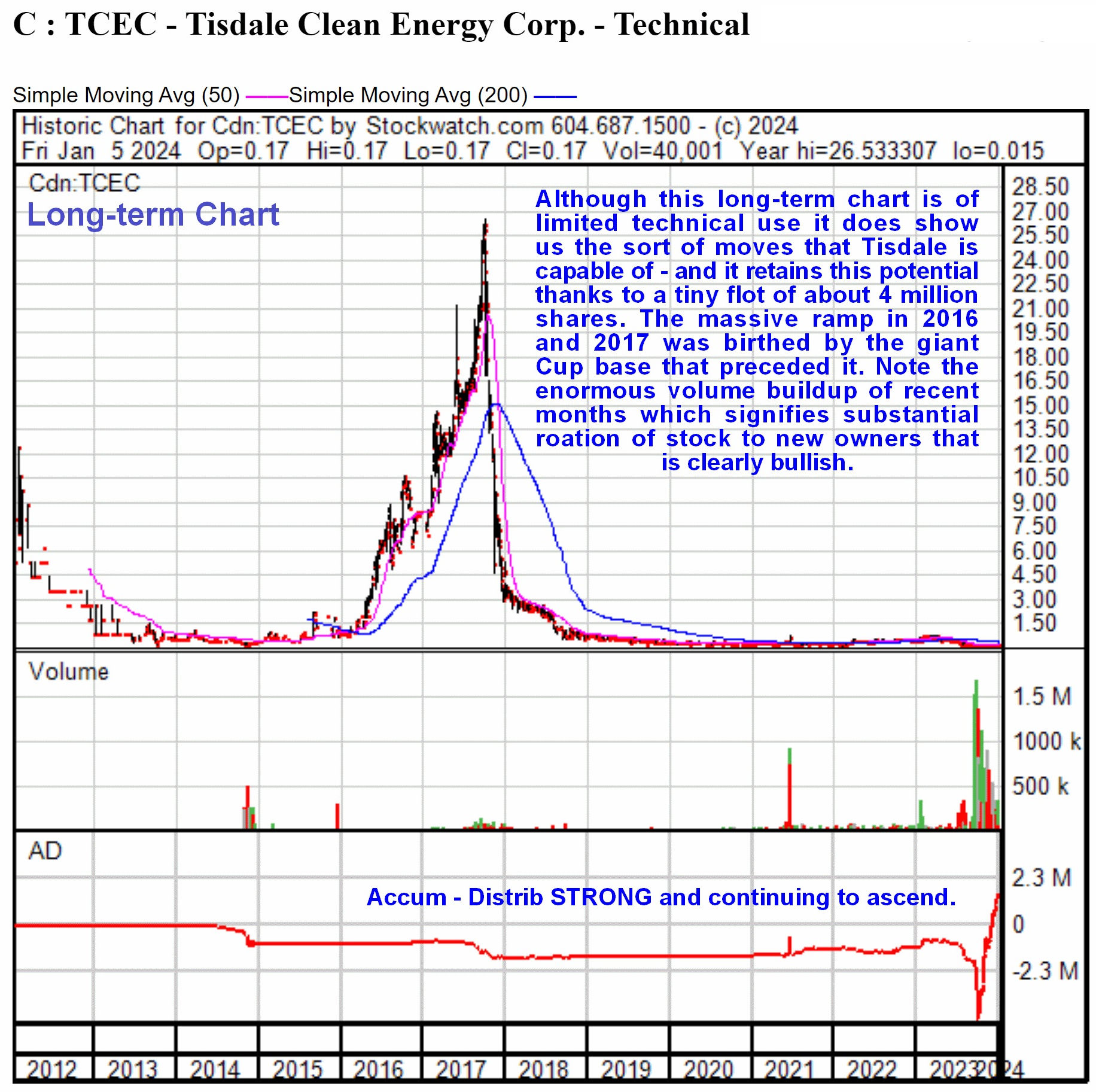

Whilst it is of limited use technically the following long-term chart that goes back 12 years is also interesting as it shows the massive ramp in Tisdale in 2016 and 2017 and it is made all the more interesting by the realization that with only about 16 million shares in issue and only 4 million in the float, it is capable of making a similar move in the future and should be helped in this by the continuing bullmarket across the uranium sector.

So, whilst acknowledging that this is a low-priced stock that must be classed as speculative, for those who are comfortable investing and trading in such stocks it is looking most attractive here, and worth going overweight on while it is still at a low price.

Tisdale Clean Energy website

Tisdale Clean Energy Corp., TCEC.CSX, TCEFF on OTC, closed at C$0.17, $0.128 on 5th January 24.

Posted at 6.40 am EST on 8th January 24.