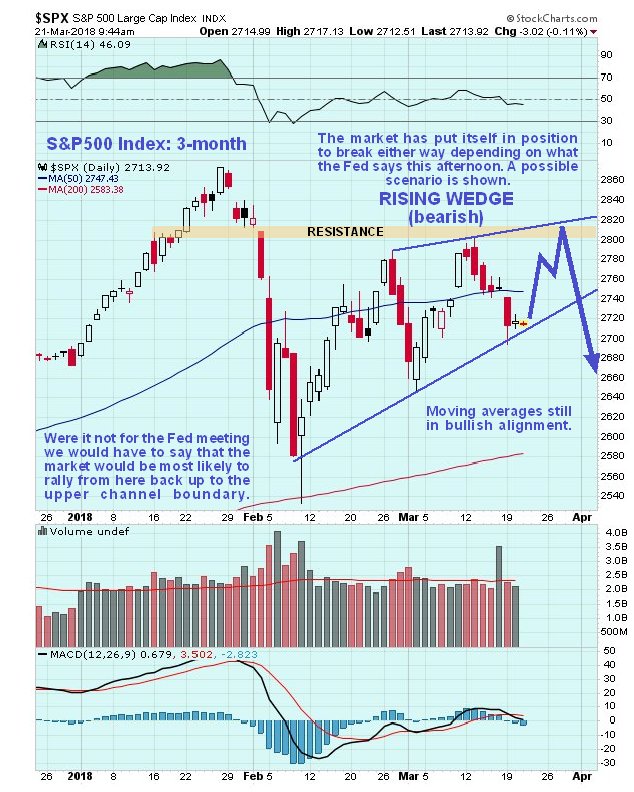

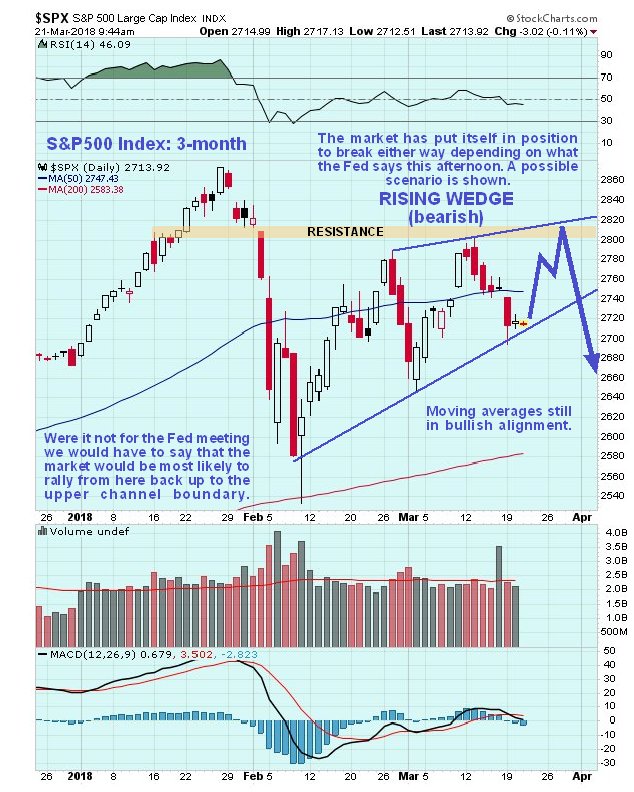

The market has put itself in position to break either way this afternoon, depending on what the Fed says (interest rate announcement 2 pm Eastern), and obviously a “coin toss” at this time is not very helpful. However, we can make some broader observations about the situation by means of the 3-month chart for the S&P500 index shown below.

The main point to make is that, following the plunge early in February, the market’s relief rally has taken the form of a bearish looking Rising Wedge, which should mean that it will be heading lower before much longer and should not make new highs – it is considered unlikely that it will break above the resistance level shown. However, there is scope first for a minor rally back up towards or close to the upper boundary of the converging channel. This could happen if the Fed doesn’t say anything to upset the market, which turns lower later perhaps because of rising interest rate concerns. If the Fed shocks the market then clearly, from this position, it would quickly break lower and could drop steeply.

So let’s set what happens this afternoon.

Posted at 10.20 am EST on 21st march 18.