Aware of the company’s stellar fundamentals we seized the opportunity to buy its stock again this morning at a better price following a 2-day dip. Am email alert was sent out mid-morning which read as follows…

“Outcrop Gold Corp buy alert

The fundamentals for this gold stock are SUPERB, which might explain why Eric Sprott and Newmont are interested in it. We already own it having bought back it in February, and it has done well to date. The dip of the past couple of days is providing an opportunity for those who don't own it to buy, and for those who do own it to buy more, if so desired.

Full update on it later with fundamental insights. Right now I am working on finishing the charts to add to the big silver stocks article posted a couple of days ago, which I hope to get posted this morning.

Outcrop is unchanged at the time of writing.”

Your buying then drove it higher to close up 13.9% on the day on the 2nd highest volume in the stock ever.

On the latest 6-month chart we can see the day’s gain with a quite large white candle. We can also see the point indicated where

we bought it at a good price back in February and how after an initial sharp runup it settled into a trading range whose duration allowed the falling 200-day moving average to drop down to meet the rising 50-day which has set it up for the bullish moving average cross which is occurring right now and marks the start of a new bullmarket. The volume pattern in the recent past has been very bullish and the MACD indicator shows that there is plenty of upside potential from here.

Zooming out to a 2-year chart we see how the price is slowly lifting itself out of the 2nd low of a large Double Bottom pattern. On this chart we can also see the origins of the resistance level that has capped the price in recent months, which is the trading range that formed above this level in the middle of last year. With moving averages set to swing into much better alignment and the volume pattern strongly positive it looks like it is readying to take out this resistance which will set it up to run at the next important resistance level approaching last year’s highs approaching C$0.42 approximately. Obviously, if silver strengthens sufficiently to break out of its giant base pattern, which is expected to happen before too much longer, then Outcrop is likely to accelerate rapidly higher.

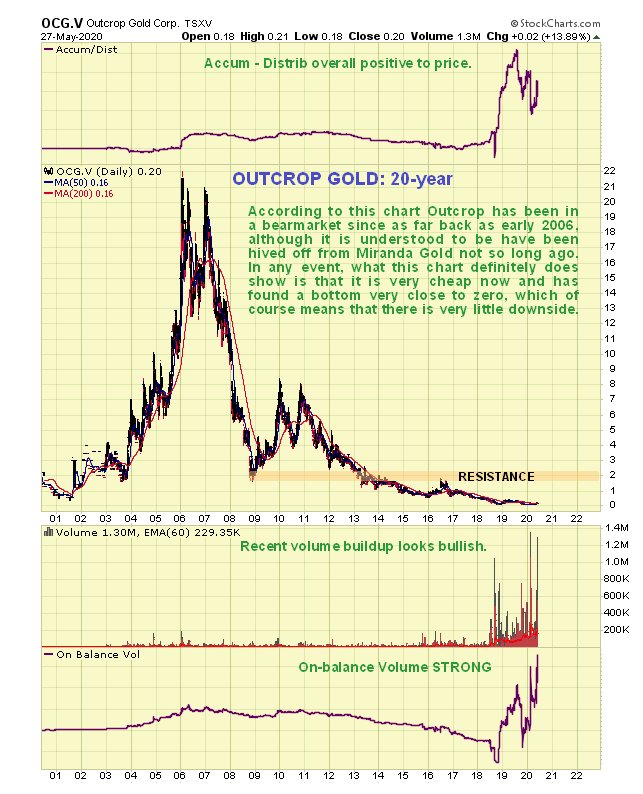

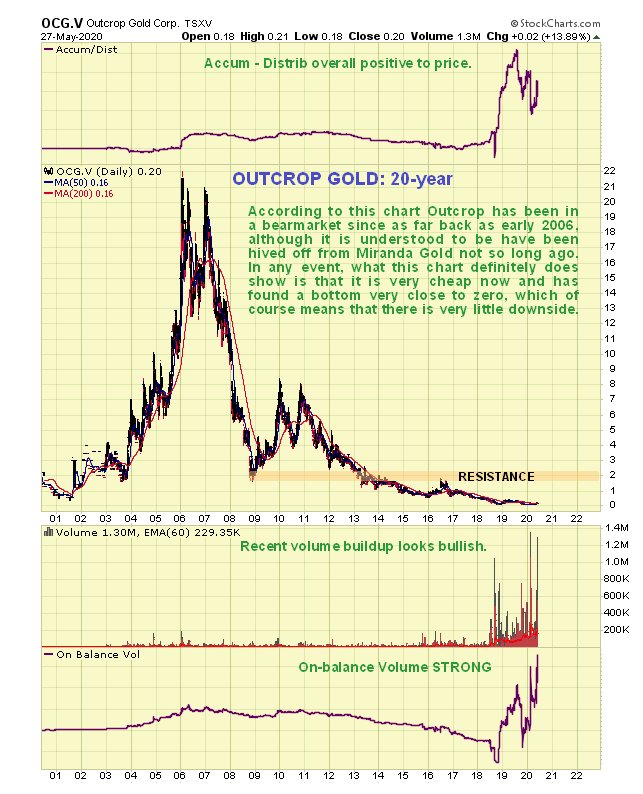

Finally, the very long-term 20-year chart shows that Outcrop is historically very cheap indeed and that it has been bumping along at rock stony bottom in recent months, and the good news is that it is not this cheap because of stock dilution, because there are only a relatively modest 78.3 million shares in issue. Having said that I’m not sure what we are looking at here, because it is understood that Outcrop was hived off from Miranda Gold not so long ago, so this chart may be back extrapolated.

Lastly I am in receipt of the following valuable fundamental insights from subscriber Gordon, which you may be interested to read…

“I have several silver company ideas but only have time to share one right now. The one I wish to share is Outcrop Gold Company, which is really a company you are aware of and one I learned about from you.

When you recommended it back in February about the time I started my subscription, I took a substantial position in it, and have been watching it continually ever since.

I think if you re-visit it you will find it has everything going for it:

- A great technical stock chart, long term and short term, as you have pointed out.

- A very significant silver and gold discovery that is in the process of being mapped, but that is largely unknown except for activity in the stock this week which indicates Outcrop has broken out. In the early samples, I have never seen higher content silver ore in my life, i.e. 4,600 gr per ton.

- An extremely smart and experienced new significant investor, Eric Sprott.

- He made a $1,000,000 investment two months ago.

- My very old stock broker and friend, who specialized in mining companies, once said to me that “if a large company, like Newmont Mining, thinks there are minerals on the small company property, it is good enough for me.” About a year ago, Newmont made an investment in Outcrop, to develop one of the less significant properties (not the extremely high silver content property). But that isn’t why I love Outcrop - I just like having them along for the ride, and of course when the new asset is developed Newmont will want to acquire it.

- After you read the last four news releases concerning their recent silver and gold discovery, I believe you will conclude with me that Outcrop will have one of the best silver mines in existence. It would seem Eric Sprott has a great hope for the company., based on early assay reports.

- Since this current Precious Metals bull market will last three to four more years in my opinion, Outcrop is going to be a long term hold for me. I have heard Rick Rule describe the joy in holding a stock position which eventually becomes a “hundred bagger” or more. It has always been my hope to own one as well. In my opinion Outcrop will become an 80-Bagger.

- The last thing I like is that Outcrop has very large insider share ownership and insiders have made additional recent purchases.

The conclusion is that Outcrop is a strong buy here and an excellent PM stock to hold for the longer-term. It trades in healthy volumes on the US OTC market.

Outcrop Gold

website

Outcrop Gold Corp, OCG.V, MRDDF on OTC, closed at C$0.205, $0.149 on 27th May 20.

Posted at 10.00 pm EDT on 27th May 20.