This quick update on oil is to point out that the latest oil COTs and Hedgers positions were at frightening extremes, as oil has struggled and failed thus far to break higher.

This is viewed as meaning trouble, BIG TROUBLE for the oil market, where we could see a precipitous drop as in 2014.

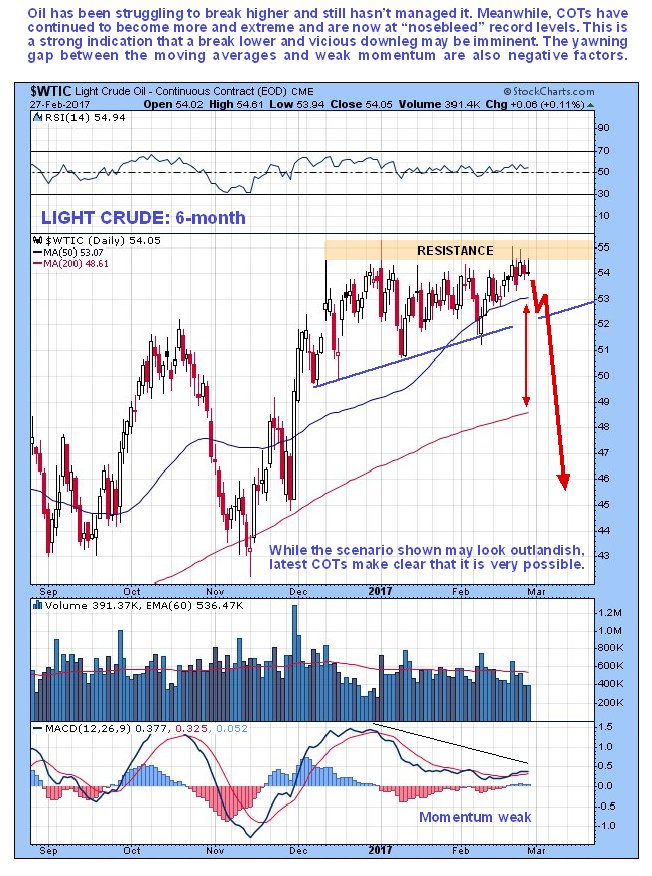

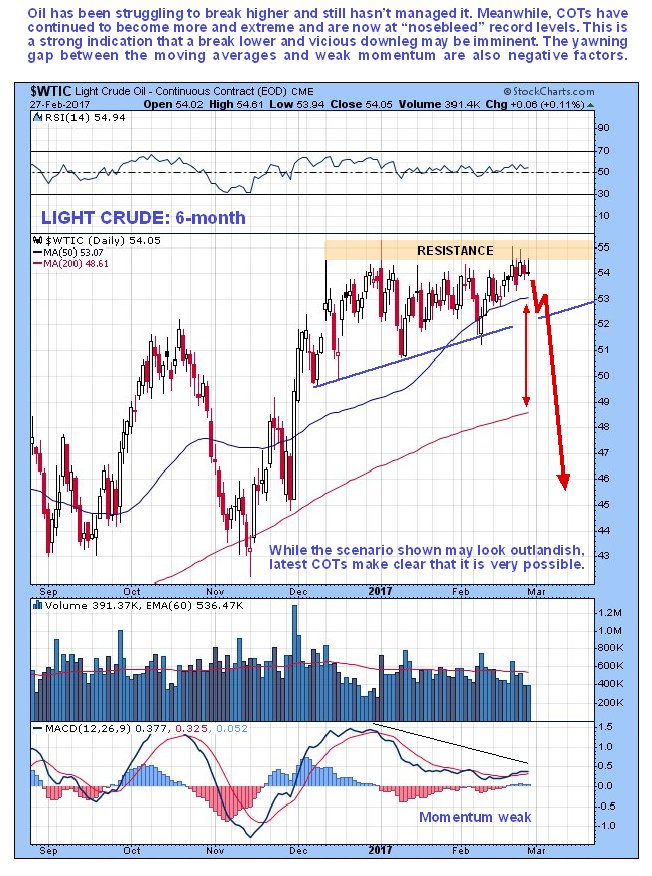

First we review the latest 6-month chart for Light Crude, on which we see that oil has tried again to break above the line of resistance in the $55 area at the top of a triangular range, and so far failed, and the quite large gap between the moving averages and weak momentum (MACD) are viewed as additional bearish factors…

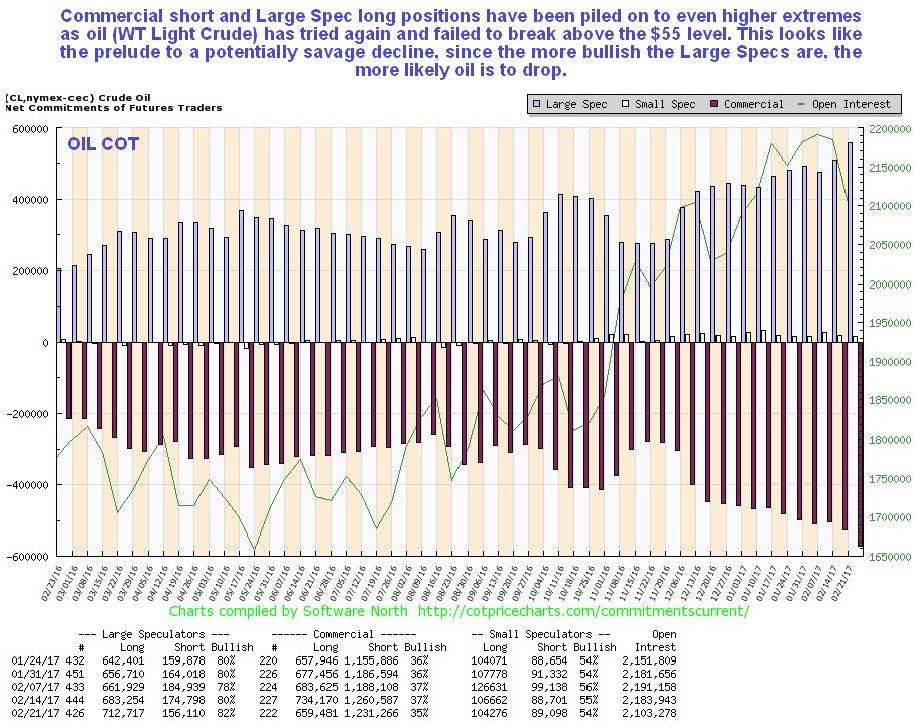

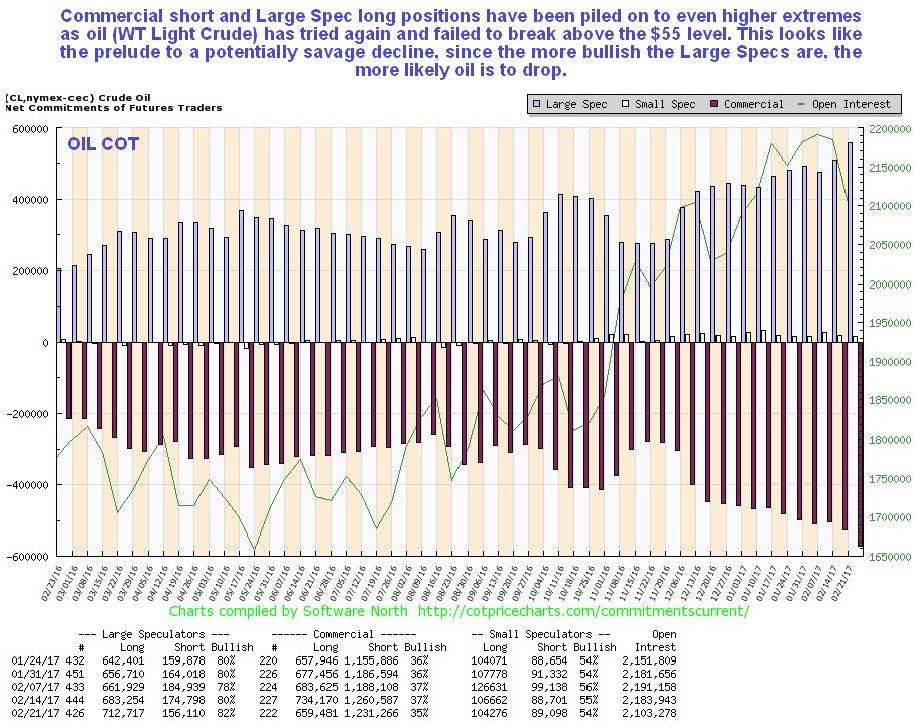

On oil’s latest COT chart we see that the usually wrong Large Specs are raving bullish, while the Commercials now hold record heavy short positions…

Click on chart to popup a larger, clearer version.

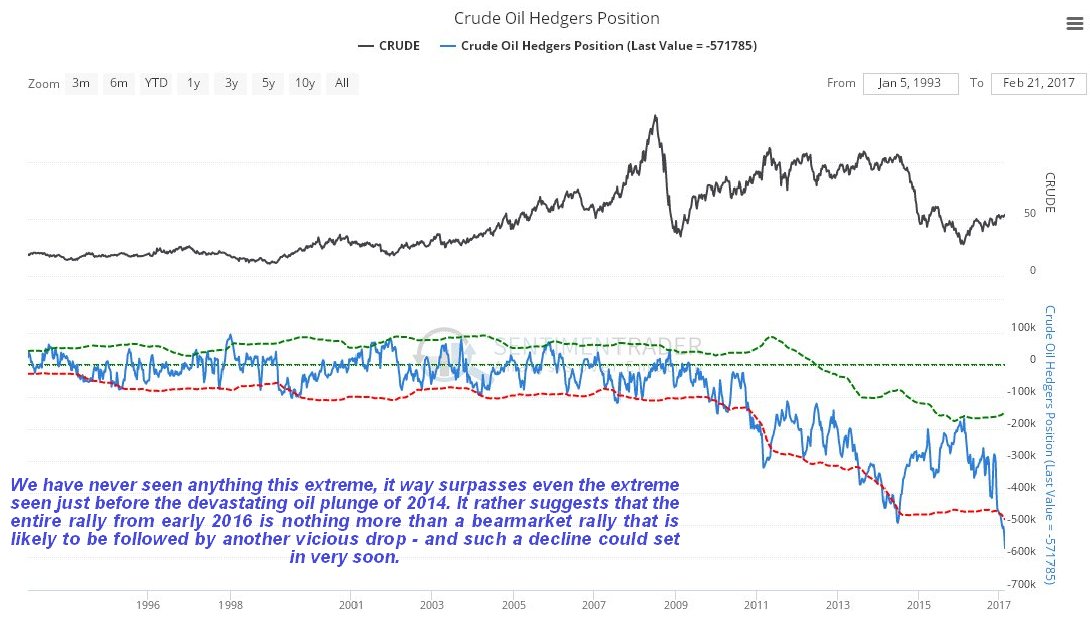

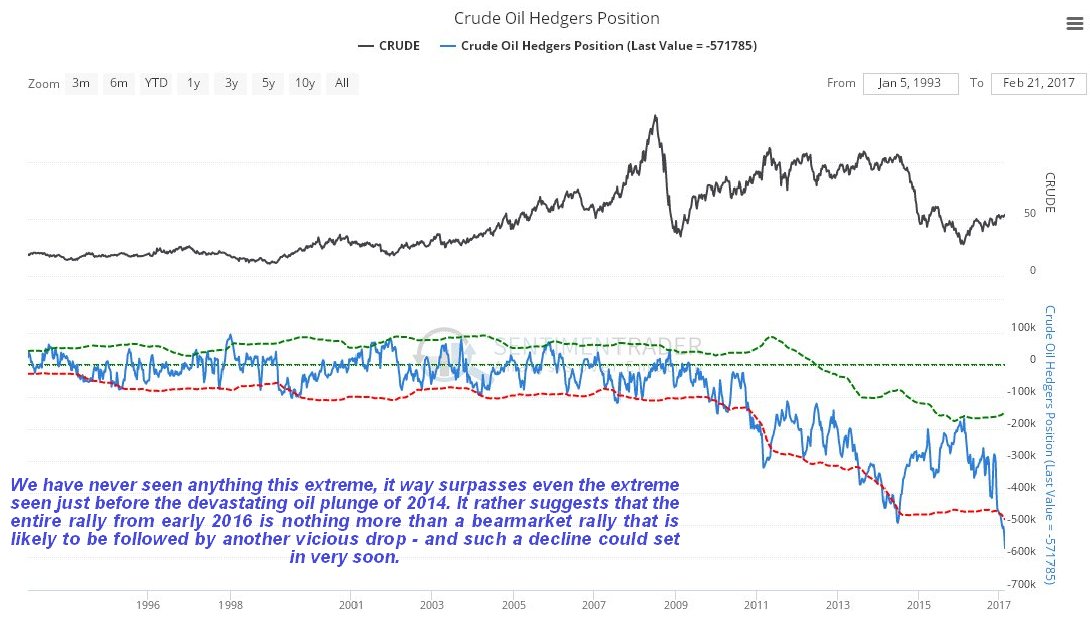

Meanwhile the latest Hedgers chart, which is a form of COT chart going back much longer, shows positions at “off the scale” extremes. Even right before the 2014 bloodbath, they were not as extreme as they are now, and they were seriously extreme then.

Click on chart to popup a larger, clearer version.

Chart courtesy of www.sentimentrader.com

Meanwhile oil stocks are not at all confirming the bullish attitude of Large Specs in the oil market. While oil itself has held up, oil stocks have gone into retreat, and although superficially they look like a buy here, because on the 6-month chart for the XOI oil stock index shown below they can be seen to be oversold now, at support and above a rising 200-day moving average, this big disconnect between oil and oil stocks against the background of an extremely bearish COT structure suggests that oil is going to plummet soon.

The conclusion to all this is that a brutal decline in the oil price could be just around the corner, and the heavy drop in GDX today suggests that gold and silver are about to get taken down too (gold is completing a bearish Rising Wedge). Copper COTs call for a copper price smash too.

End of update.

Posted at 9.15 pm EST on 27th February 17.