Two sectors set for massive growth are Cannabis / Marijuana and Lithium, and fortunately we are on to both of them. An update on lithium stocks will be prepared a little later, but first we will review Cannabis stocks in this update.

The Cannabis / Marijuana sector is set for huge growth, and not because of old hippies sitting around getting stoned, but because of the potentially profound medical applications, which are now being rapidly developed by companies pioneering the field. After the initial legalization in Colorado stocks went through a lunatic growth phase, where anything with cannabis or marijuana in its name did a moonshot. Then reality set in leading to a widespread cull, leaving behind the more worthwhile companies as background conditions for the sector continued to improve. Now what we are seeing is the second growth wave, involving for the most part the better quality companies. For investors this presents a huge opportunity, which I was alerted to some weeks back when I observed some of the better stocks in the sector taking off like a rocket, signaling that the 2nd more sustainable upwave was beginning. I therefore scrambled to find good stocks that had not yet taken off, and found some which we bought at excellent entry points, and we will now proceed to review these, and end with looking at a new one to add to our little portfolio of these stocks.

It is quite normal for more conservative investors to ridicule investing in a young growth industry like this, as they have down right down the ages, with their classic observations like “It’ll never catch on “, “It ‘ll all be over in 6 months” etc. They did this with the steam engine, the car, tech stocks and many other nascent industries. It doesn’t bother me if they stand on the sidelines and watch – it’s their choice. It’s the same with the lithium sector – by the time these conservative investors are converted they’ll have missed out on the lion’s share of the gains, as usual.

Right, let’s now review the charts for the 3 stocks we bought several weeks back. There’s a 4th, Cannabis Sativa, but as that was only written up a couple of days ago, there’s no point in reviewing it here. Note that clicking on the name takes you back to the original report on the stock.

American Cannabis AMMJ, $0.29

Bought at the perfect entry point right before a big move, American Cannabis has blasted higher and has doubled already. The volume pattern and volume indicators are mega bullish, so we are not selling, even if it is overbought, and if you feel like you can buy some more as it looks set to go much higher. Set a stop to make it a relatively risk free trade, and with a bit of luck it won’t be triggered.

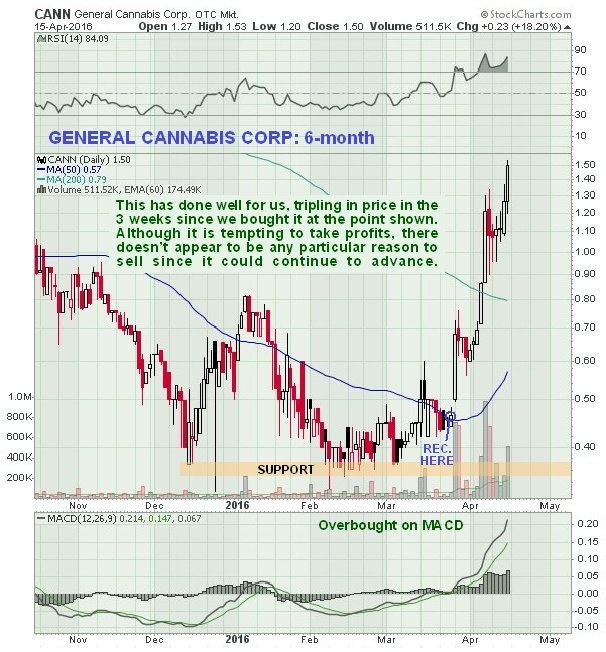

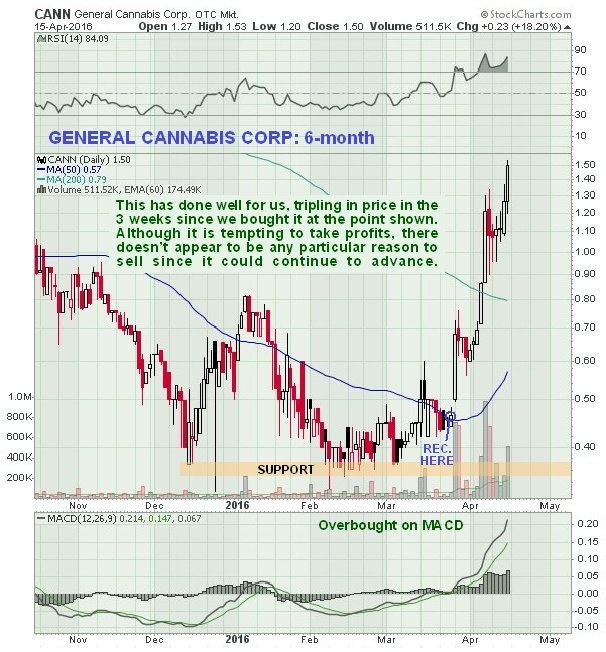

General Cannabis

General Cannabis CANN, $1.50

Bought at the perfect entry point right before a big move, General Cannabis has blasted higher and has trebled already. The volume pattern and volume indicators are mega bullish, so we are not selling, even if it is overbought, and if you feel like you can buy some more as it looks set to go much higher – but if so on a minor dip as it is heavily overbought on its MACD, although it is unlikely to react back much. When you buy set a stop to make it a relatively risk free trade, and with a bit of luck it won’t be triggered.

Cannabix Technologies

Cannabix Technologies BLOZF, $0.215

Although Cannabix Technologies has not done as well as the two stocks described above, the good news is that the volume pattern and volume indicators remain strongly positive, so it looks like it is preparing to take out the resistance level shown on our chart with a sharp move higher soon. Good point to buy / buy more, but set a stop to limit loss just in case.

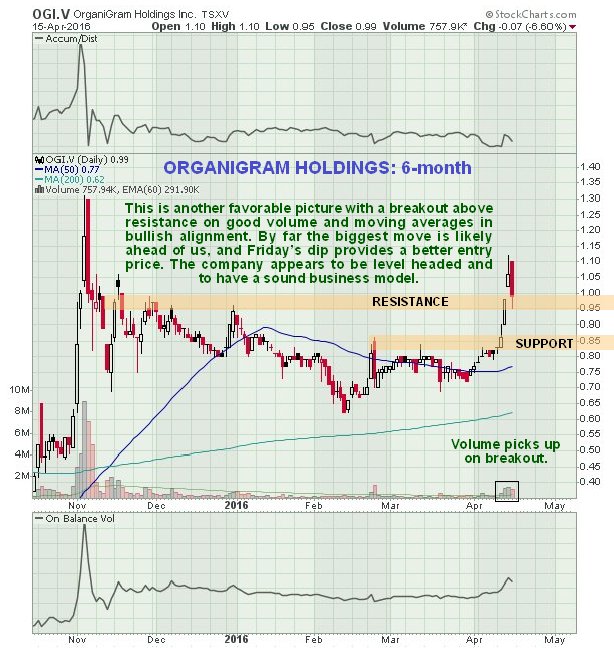

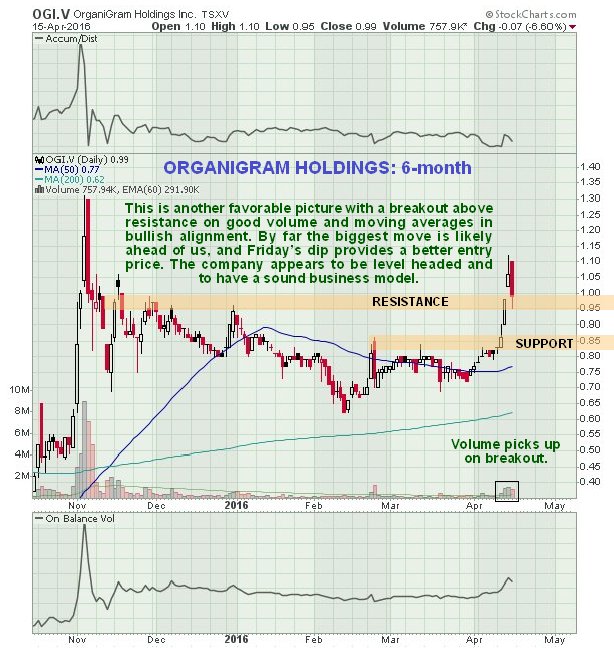

OrganiGram Holdings

OrganiGram Holdings OGI. V, OGRMF on OTC, C$0.99, $0.77

Now we come to a new one, pointed out to me by a subscriber in Tuscon, Arizona (thanks Peter), which is a good one for Canadian subscribers. This company appears to have a sound business model and caters primarily to the Canadian market. On its 6-month chart we can see that Organigram Holdings stock broke above an important resistance level last week, although the rather bearish looking candlesticks late last week suggest that it could react back some short-term, which would be viewed as presenting a buying opportunity. Longer-term charts suggest that it could go on to spike higher again, as it did in 2014. It may react back towards C$0.90 and may be bought on any such reaction with a stop, although it is recognized that waiting for a reaction may involve missing it. It will be kept under observation going forward.

End of update.

Posted at 1.15 pm EDT on 17th April 16.