Although the technical condition is not as tight in General Cannabis as in

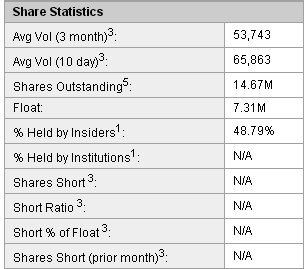

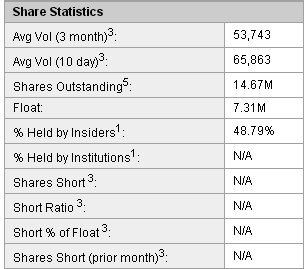

American Cannabis, we can see on its 1-year chart some promising developments that point to a reversal and strong advance, and given how these stocks act when the momentum traders show up, when we say strong advance it could well mean of the straight up like a rocket variety. Although moving averages are not tightly bunched like AMMJ, we can see that the price appears to have been basing above the support level shown, and upside volume has been increasing quite dramatically with the passage of time. The relatively low number of shares in issue at 14.67 million, and the fact that only 7.31 million are on the open market, due to insiders holding 48.8% of the stock, clearly creates the potential for a very sharp advance in the right conditions, which may exist very soon.

The 5-year chart for General Cannabis shows that it has already been through a boom and bust cycle, with the big boom occurring after the state of Colorado relaxed laws regarding the use of Cannabis. After that heady time, reality set in and the stock price is back where it started, but as mentioned above, business conditions continue to improve for the surviving companies in the sector.

General Cannabis

website

General Cannabis Corp, CANN on OTC, closed at $0.47 on 24th March 16.

Posted at 5.00 pm EDT on 27th March 16.