Naive investors who thought that the multi-State vote on November 8th in favor of legalizing the pharmaceutical and recreational use of cannabis would lead to further big gains in cannabis stocks and bought the sector shortly after the vote got a nasty lesson in the reverse logic of the stockmarket. What happened is that the market had already discounted the favorable outcome of the elections before the votes were even counted, and after the results were announced, and even before to some extent, the sector was hit by a wave of self-feeding profit taking that caused most would be buyers to shy away from it. Hence the persistent punishing downtrend in the sector that has resulted in severe losses for anyone who bought near the top 6 months ago.

We made big money in this sector last year and hit the exits shortly after the vote, so were unaffected by the downtrend that followed, and have stayed on the sidelines until now. However, the outlook for the industry continues to brighten, with the pharmaceutical use of cannabis set to become mainstream, a development which has the approval of most older citizens keen to use it to treat various ailments, while the more controversial recreational use of cannabis will probably end up being treated similar to alcohol, which is not subject to a blanket ban because a percentage of fools abuse it. Thus we have had a profoundly paradoxical situation develop over the past 6 months, where the cannabis industry has been continuing to advance and move forward, whilst the stocks of most companies in the industry have been locked in an ongoing downtrend. This is the sort of situation that must incubate a new major uptrend, and so the challenge for us now is to determine at what point it is likely to reverse to the upside – and the reason for this update is to point out that the sector looks ready to reverse to the upside very soon or even immediately.

Growing interest in the sector has lead among many other things to the birth of an interesting website,

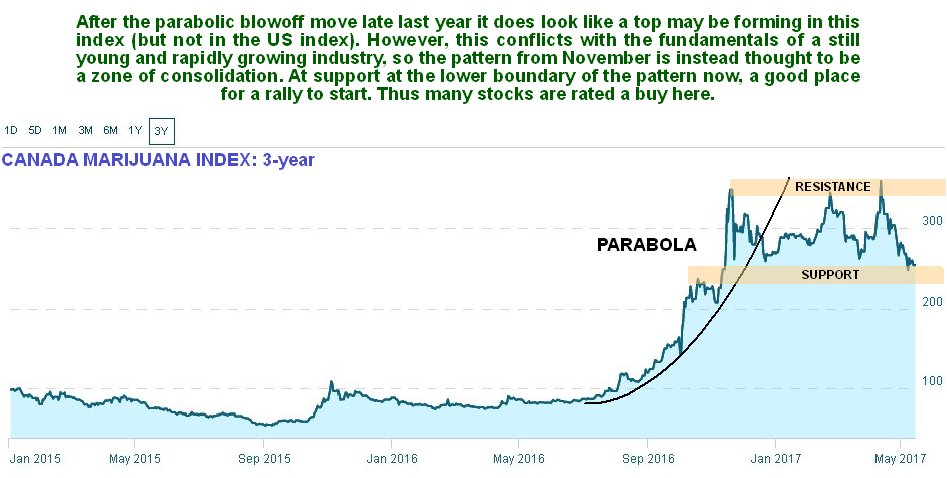

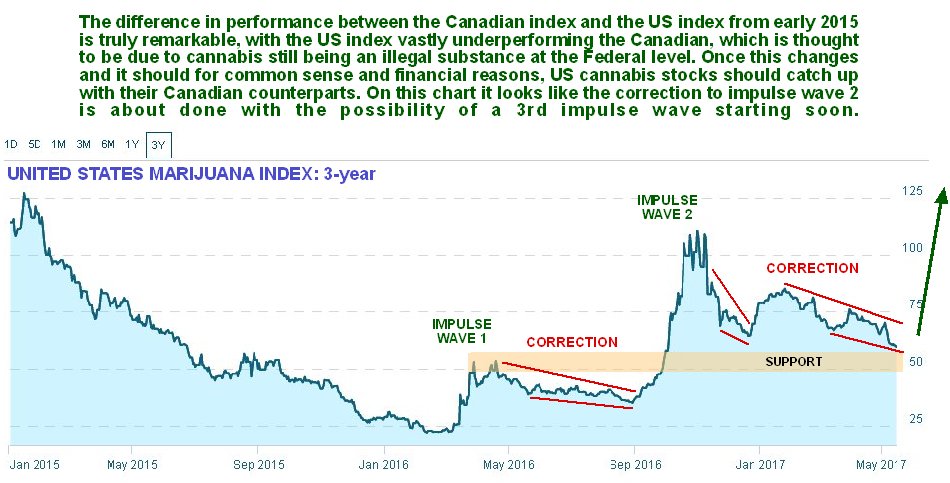

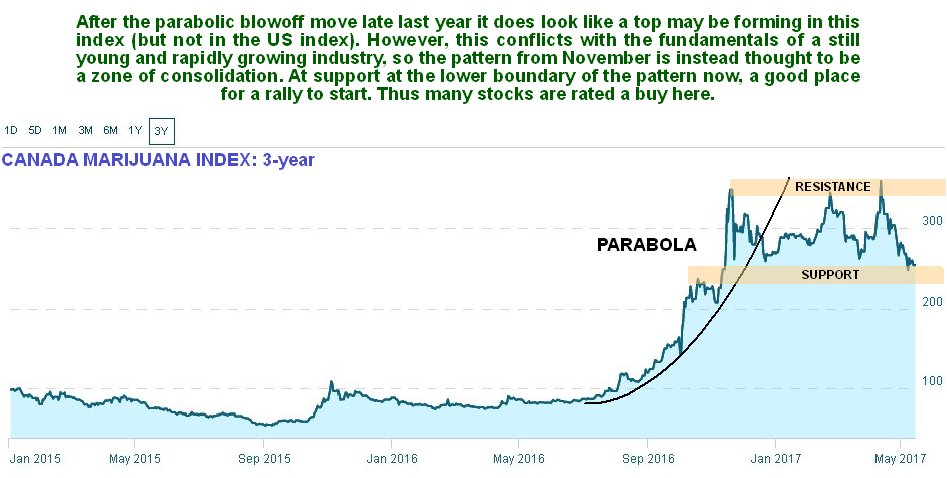

marijuanaindex.com which has usefully created several indices for the sector, a Canadian index, a US index, and a North America index which appears to be a composite of the two. We will look at these now to see if they give us any clue as to when the expected reversal might occur.

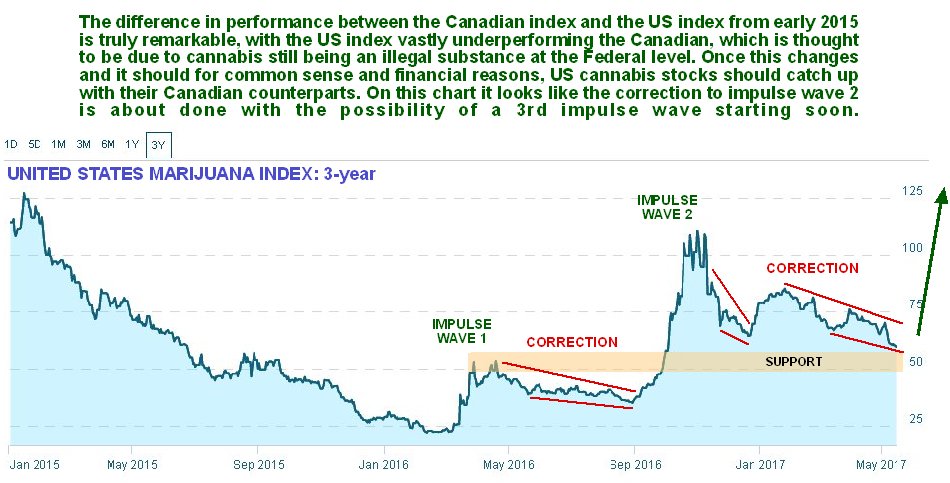

We will start with the Canadian index and stack the US index beneath it for direct comparison. Comparison of the two indices of the neighbor countries immediately reveals that Canadian cannabis stocks have been much stronger than US stocks. The reason for this is that in Canada, the cannabis industry is not illegal at the Federal level as it is the US, and the young Canadian Prime Minister, who has the ladies swooning, has a more relaxed attitude towards it than some of the old fogies on Capitol Hill. In the US, investors fear that the government will crack down on the industry and possibly stifle it. However, this seems increasingly unlikely for various practical reasons. One is growing public pressure for legalization. Another is that the government must realize that it is better to make money out of taxing the industry than force it underground so that criminal cartels walk off with the money instead. Cannabis taxation has provided windfall revenues for Colorado which has used the money to make widespread improvements across the State, and if the Feds try to crack down on Colorado, and other States, there is likely to be a revolt. A further motivating factor for the US government to relax its attitude is the fact that if it doesn’t, the business will simply go to Canadian companies.

Click on charts to popup a larger clearer version.

Charts courtesy of marijuanaindex.com

On further consideration of the Canadian and US cannabis index charts, we see that the Canadian index is currently at about two and a half times what it was at the start of 2015, whereas the US index has halved. The takeaway from this is extremely important – it makes clear that should the Federal threat to the US industry ease, there is huge scope for US cannabis stocks to catch up with Canadian stocks, resulting in big gains. Canadian stocks are unlikely to drop instead because the industry continues to expand rapidly. Another technical point to observe is that the retreat from the November highs to the present looks like a normal correction to the big impulse wave from September through November, and the drop of recent weeks has brought the index sufficiently close to the strong support at the peaks of last March and April that is likely to arrest the decline and reverse it into a new upleg. Whilst it does look superficially like a major top may be forming in the Canadian index following the parabolic ramp into November, the only fundamental circumstances that would permit this scenario would be intense competition in the industry collapsing the price of product combined with a stockmarket crash. With regards to competition, the pie is already so big and growing so rapidly that most competent companies should make money, and while a market crash will happen one day, it is more likely that we see a meltup first.

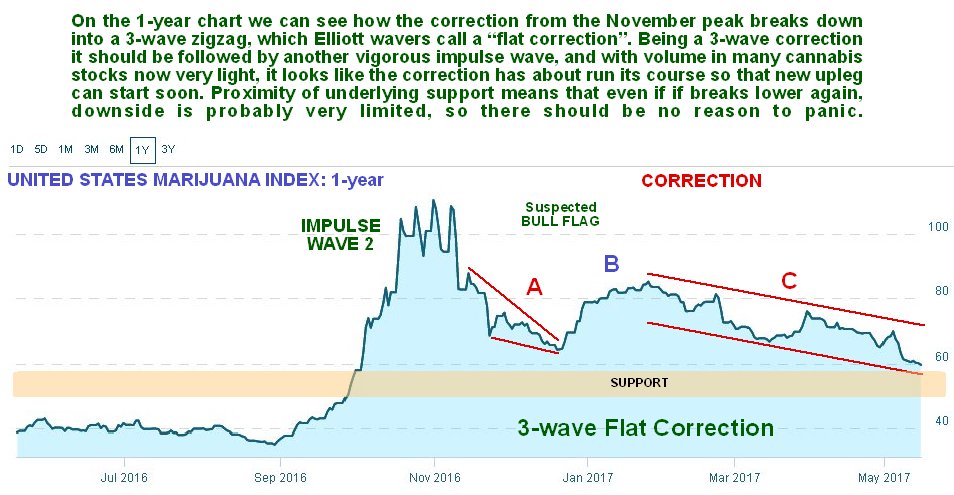

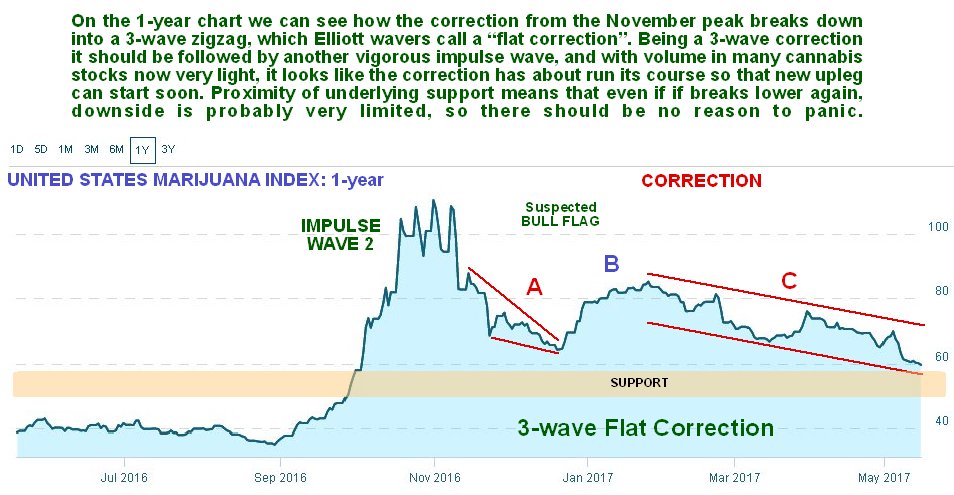

If we now zoom in on the US marijuana index chart and look at the 1-year, we see that the correction from the November highs may be a 3-wave A-B-C correction, what the Elliott wavers call a “flat correction”. If this interpretation is correct, then it will be followed by another powerful uptrend – and there are indications on the charts of various individual stocks that the correction has about run its course, not least of which is current light volumes.

Click on chart to popup a larger clearer version.

Chart courtesy of marijuanaindex.com

A roundup of various individual stocks, some of which we have gone for in recent days, will be presented in a separate article on the site.

End of update.

Posted at 1.10 pm EDT on 20th May 17.