We

caught the last sharp runup in Eguana nicely towards the end of June, but in retrospect it would obviously have been best to take profits after a couple of weeks, because it then proceeded to run off sideways in a triangular range before dropping back to support just above where we bought in June, as we can on its 6-month chart below. It has to be said that generally this stock has been a bore, but that is not a situation that is expected to continue for much longer, hence this update.

On the 6-month chart we can see various indications that it is set to break higher again. One is that it has been stuck in a narrow trading range for about a month now, with downside momentum, as shown by the MACD indicator, dropping out. Volume has generally been decreasing, and if we look carefully we can see that upside volume has been picking up in recent days – a sign that it is getting ready to break out to the upside. So, despite moving average alignment being unfavorable, it is expected to advance from here shortly, and mainly for reasons that we will now proceed to observe on its 4-year chart.

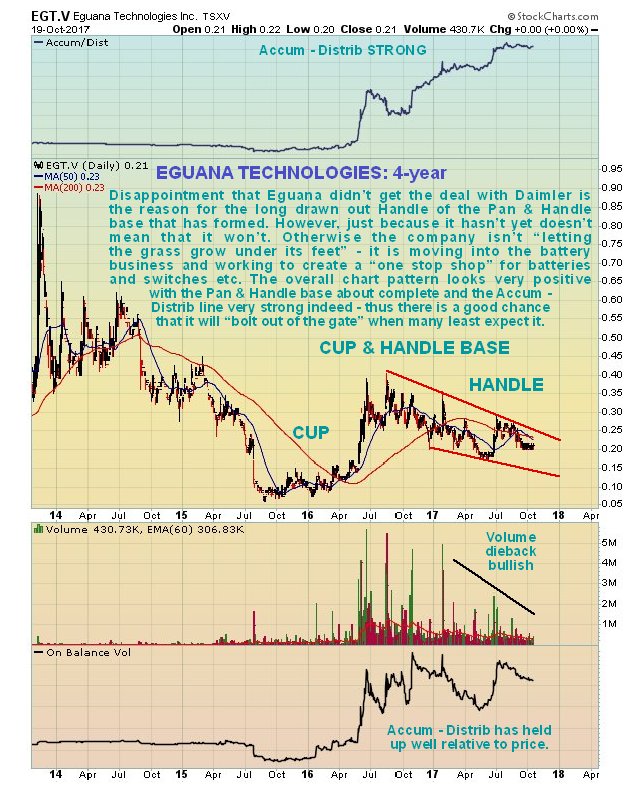

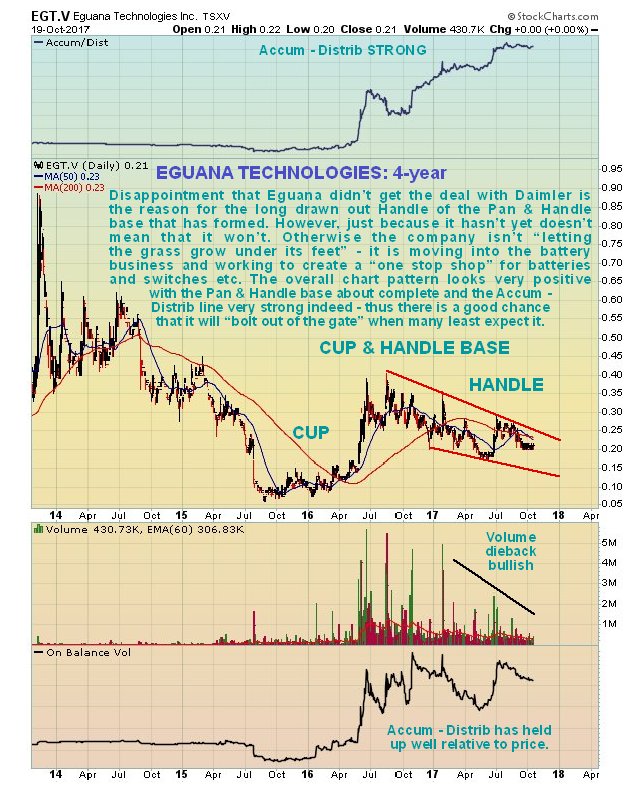

The 4-year chart for Eguana provides a good perspective on the large Cup & Handle base that has been forming since the middle of 2015. Fundamentally, the reason for the lengthy Handle of the pattern has been market disappointment that the company hasn’t clinched the deal with Daimler, which was a big expectation last year – but this doesn’t mean that they won’t, for it is understood that this is still a possibility. Another key point is that the company doesn’t “have all its eggs in one basket” – it is proceeding to move into the battery business in a big way, and such that it can provide a “one stop shop” for big industrial buyers for batteries, switches, the lot. Overall this chart looks very positive with the large Cup & Handle base looking very close to completion. The volume pattern is positive, with volume dying back steadily over the past year as the Handle has formed, and most importantly, volume indicators are STRONG, especially the Accum - Distrib line which looks remarkably robust – this is a sign that a sizable bullmarket is incubating in this stock. Because a lot of players have gotten bored and frustrated with it and walked off, we could see a startling rally soon that comes as a surprise to many. The rather high number of shares in issue at about 200 million won’t stop it either, because the scope for sales in this sector is huge and in any case about 60% of the stock is believed to be tightly held by insiders.

Conclusion: we appear to be at a very good entry point for Eguana here, which is off the radar of most, due to its long downward drift. So holders should stay long and it is rated an immediate buy.

Eguans Technologies

website

Eguana Technologies Inc, EGT.V, EGTYF on OTC, closed at C$0.21, $0.17 on 19th October 17.

This update will be filed under Mineral Stocks in the Archive.

Posted at 6.40 am EDT on 20th October 17.