The purpose of this update is to remind subscribers that Amazing Energy Oil & Gas remains very cheap here with the potential to make big percentage gains. When you read up on the fundamentals of the company and then look at the stock price, you wind up thinking that most investors can’t see further than the end of their nose, for whilst the fundamental outlook for this company has been steadily improving for a long time now, the stock price has remained depressed.

The fundamental story

may be read here, but the key points are as follows – the company has acquired a large block of land in the Permian Basin in Texas at an extremely cheap price, which is adjacent to the prolific Yates Oilfield, and therefore very likely to contain a lot of oil and / or gas, and is embarking on an aggressive drilling program at a time when the oil price is advancing after being depressed for some years, and more than 90% of its stock appears to be tightly held by insiders, so the float is very low. It is therefore logical to suppose that any speculation regarding positive drilling results could cause a significant runup in the stock price.

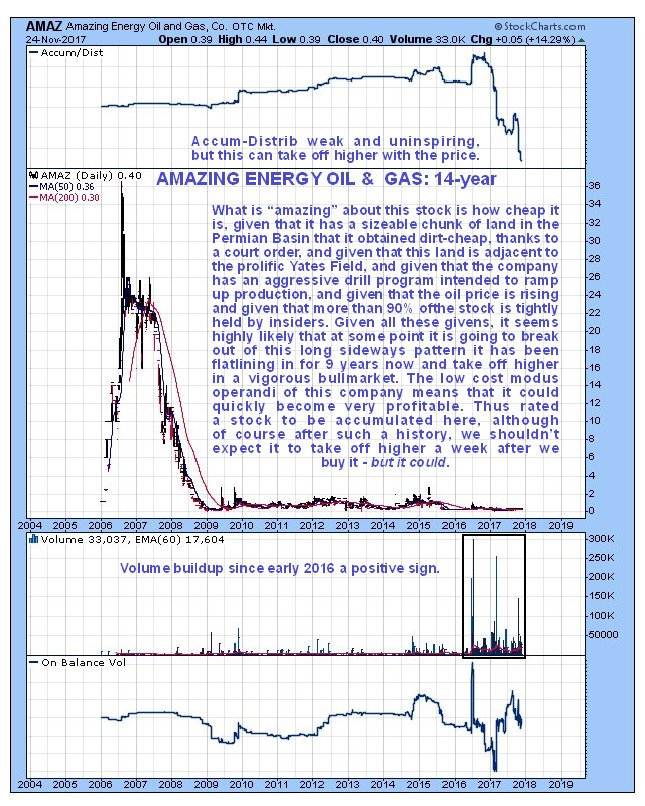

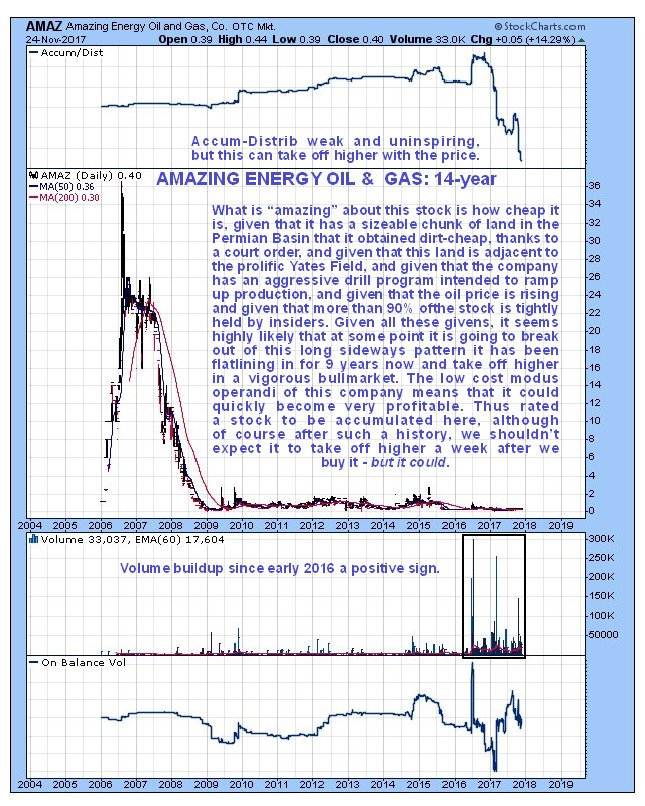

We will quickly look at 3 different charts for different timeframes. The first 14-year chart shows us the big picture, which reveals that after collapsing back from a relatively high price between 2006 and late 2008, the stock price has essentially been flatlining, which was fair enough when the oil price plummeted during the period several years back when they were trying to destroy the Russian economy (and failed), but no longer makes sense now that the company, which has no financial problems to the writer’s knowledge, is embarking on a drilling program at a time when the oil price is looking better than for years.

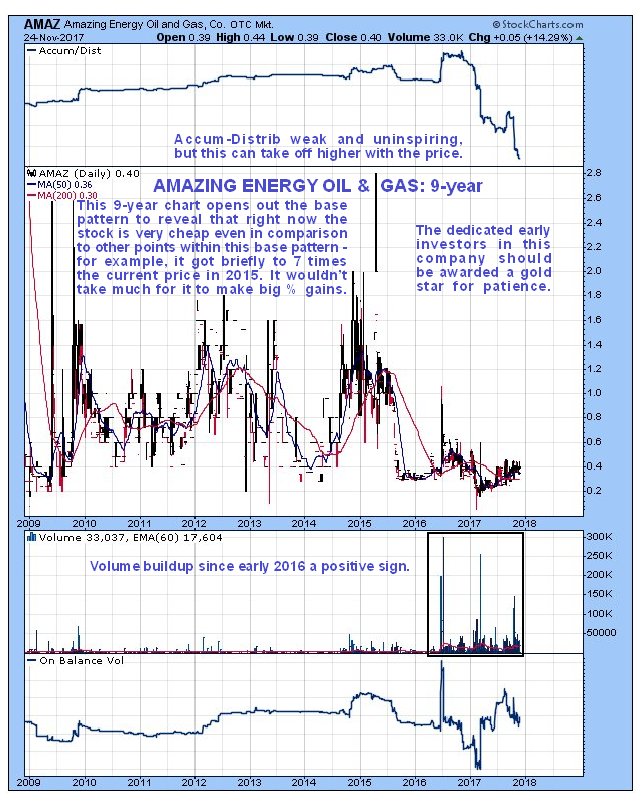

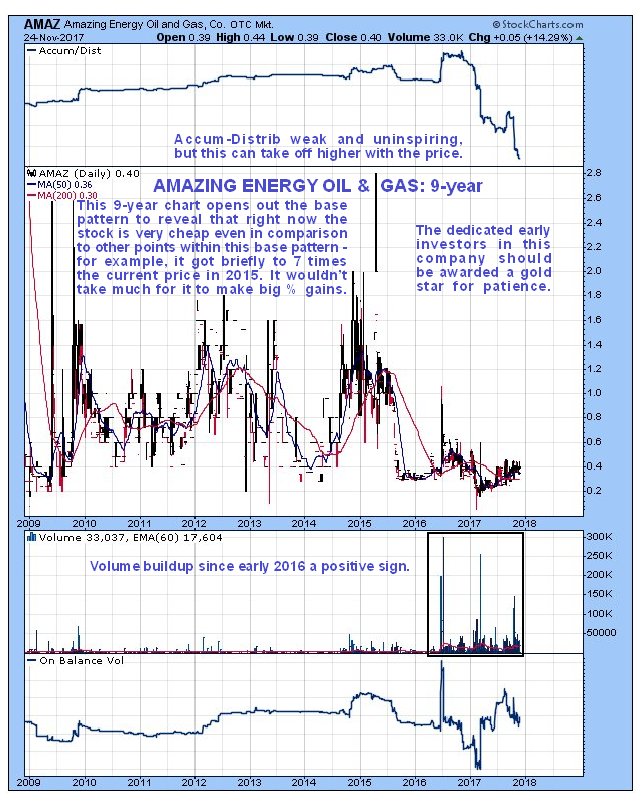

A 9-year chart, which deliberately excludes the earlier high stock price, shows us this low base in its entirety, and because it “opens it out”, it enables us to see that right now the price is very cheap compared to most of the time during the formation of this base pattern – at several points during this base pattern it got to $2.00, or 5 times the current price, and at one point in 2015 it even got to 7 times the current price – so clearly it could make big percentage gains without even leaving the base pattern, but as we have seen it has increasing reason to do just that. True, the Accum-Distrib line looks very weak, but this can sometimes improve with the price, rather than ahead of it, and of course we will be on the lookout for an improvement in upside volume.

The year-to-date chart shows that a gentle uptrend has been in force since last February, with the trend of higher lows viewed as bullish, and the pattern that has formed is a suspected Cup & Handle base.

The conclusion is that Amazing Energy Oil & Gas is very cheap here and remains an attractive speculative play with big upside potential.

The conclusion is that Amazing Energy Oil & Gas is very cheap here and remains an attractive speculative play with big upside potential.

Amazing Energy Oil & Gas

website

Amazing Energy Oil & Gas Co, AMAZ on OTC, closed at $0.40 on 24th November 17.

Posted at 6.25 pm EST on 26th November 17.