It’s been a rough week for the latecomer Millennial lemmings trying to get rich without doing any work –

MANY WENT STRAIGHT OVER THE EDGE OF THE CLIFF, JUST AS WE PREDICTED THEY WOULD, and are now lying in a squirming heap at the bottom of it.

Those who warned of the danger like Adam Hamilton, Bob Moriarty and myself were laughed at and derided – we were whistling in the wind and we knew it –

BECAUSE YOU CAN’T STOP A DETERMINED FOOL. Hopefully though a few more thoughtful souls heeded the warnings and either took a whacking great profit or stayed away, which makes our efforts worthwhile. On clivemaund.com a

Bitcoin Total Wipeout Alert was posted on Wednesday 13th December and followed by

The Greatest Fool on Monday 18th December, so that Bitcoin’s peak approaching $20,000, which occurred during last weekend, was framed by these two stark warnings.

So what now – is this a “buy the dip” situation as some believe, or is the final top in? That is the question we will now attempt to answer.

There are hordes of young and not so young fools out there who are now “champing at the bit”, wanting to buy Bitcoin. They watched enviously as it rose into the Stratosphere, and now after last week’s smackdown, they can seize their chance to buy at a heavy discount from the peak price, thinking they have gotten hold of a bargain - ignoring the fact that this “heavy discount” is from a massively overinflated price. After all, “buy the dip” has worked like clockwork now for years, right? – and this is another dip, is it not?

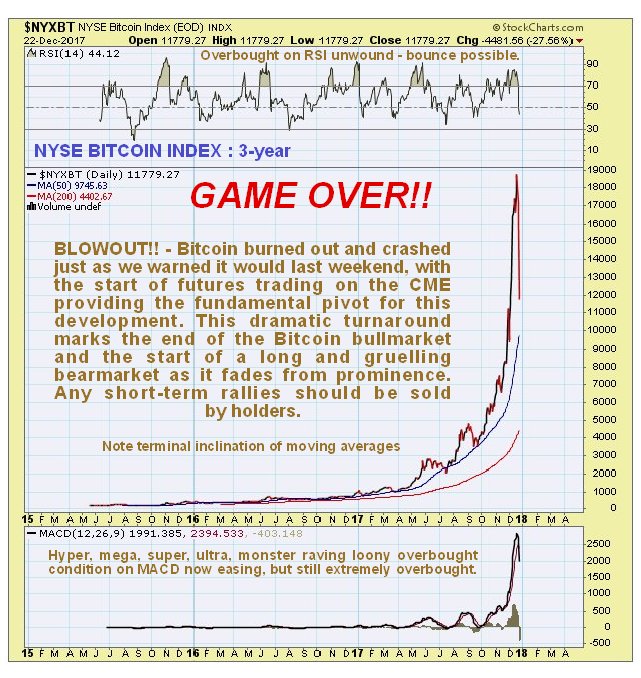

WRONG!! – this is not a dip, it is the initial plunge of a bearmarket in something that got insanely overbought and has now burned out.

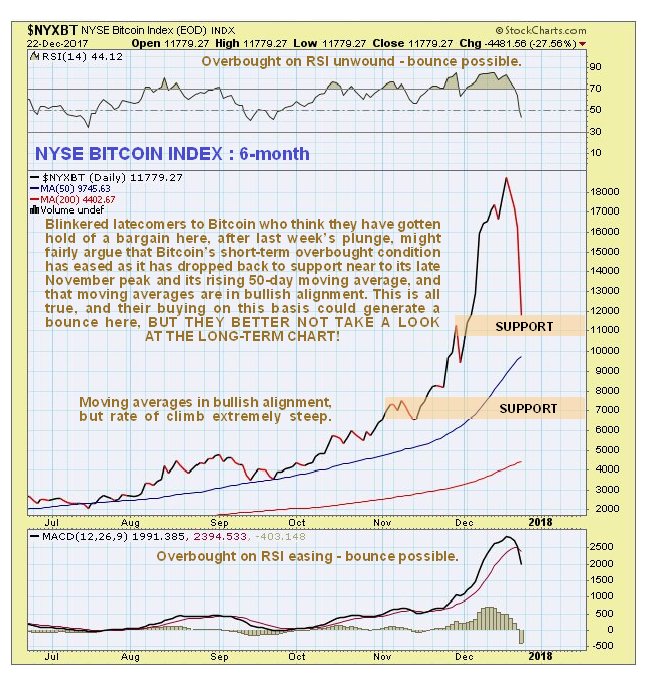

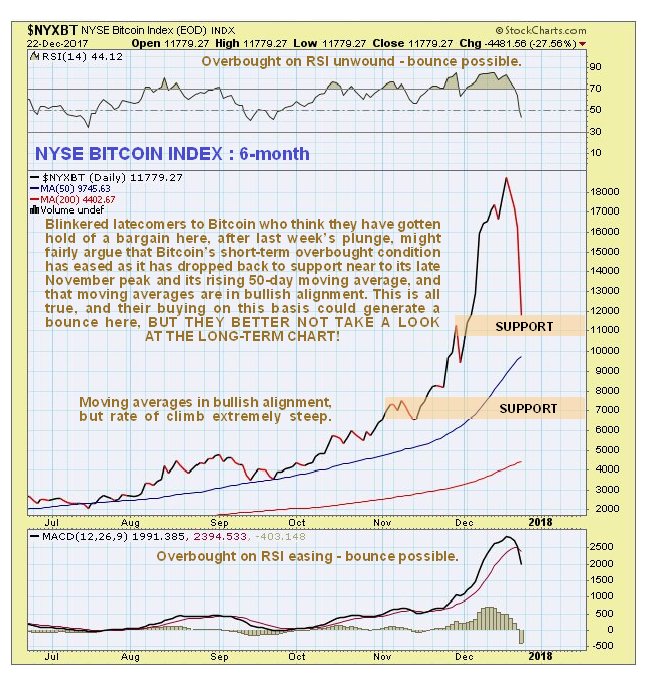

On the shorter-term 6-month chart we can see why the “buy the dip” crowd, who started to appear in the late trade on Friday, might succeed in generating a bounce here, which could be quite sizeable, because the Bitcoin price has arrived back at support in the vicinity of its late November highs, and above its rising 50-day moving average. They can quite rightly claim that moving averages are in bullish alignment and the earlier horrendously overbought condition has eased, and they will certainly get all the encouragement they could possibly hope for from their vociferous cheerleaders, who have a vested interest in talking this market up, but what they may be less aware of, or willfully ignoring, is what we will now look at on the 3-year chart.

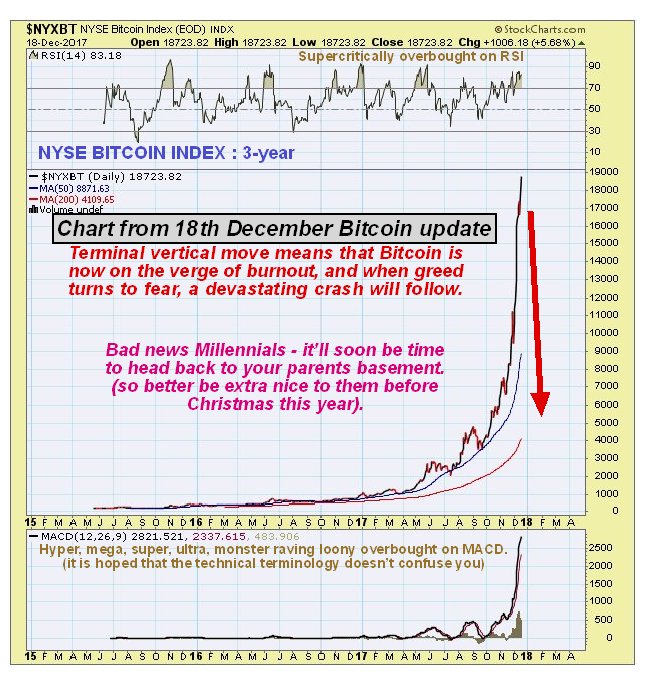

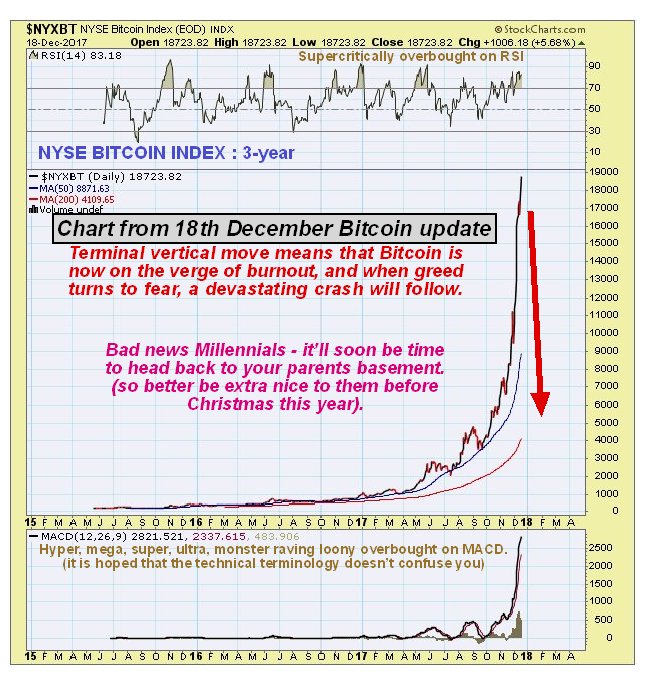

Here is the chart from the warning posted last Monday…

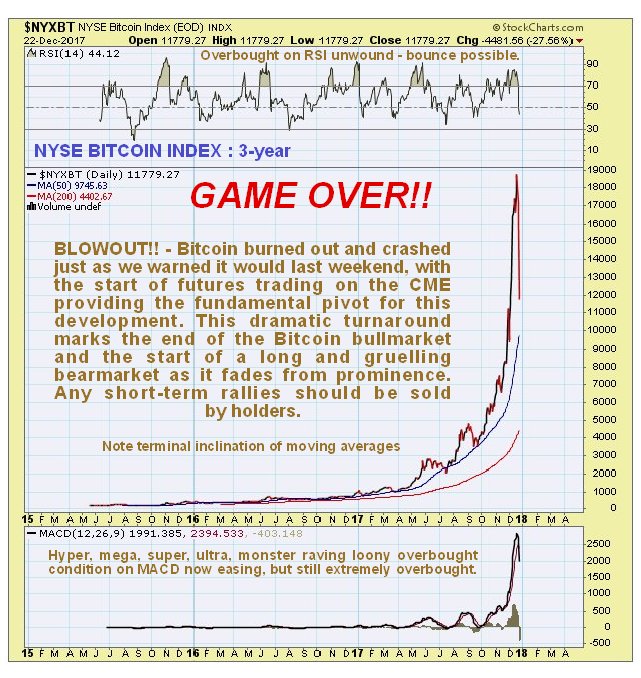

The latest 3-year chart below shows that Bitcoin has just blown out following a terminal vertical meltup that marked the final stage of a parabolic blowoff. Just how extreme it got is made plain by the fact that an attempt to draw a parabolic uptrend on this chart proved to be non-productive, because the price got so far ahead of the parabola as to render it obsolete. This chart also shows a gap of stupefying magnitude between the Bitcoin price at its peak and its moving averages, and an unsustainably steep rate of climb of the 50-day moving average. Those market commentators who were talking Bitcoin up to $40,000 or even $100,000 - and some were well-known and respected - should be ashamed of themselves.

This chart says that Bitcoin is done, finished, and anyone thinking that they have gotten hold of a bargain here, unless they are an artful short-term trader, is going to get their head handed to them on a plate – and it will be the same all the way down, as it drops lower and lower. Fundamentally we can easily see why this is so as cryptos are proliferating like weeds in a tropical jungle clearing, and the competition will soon be snapping at Bitcoin’s heels, and speaking of other cryptos you better not go thinking that the global elites are going to stand idly by forever and watch their fiat money system supplanted by a free roving virtual currency or currencies that are beyond their control. They will either get together and outlaw them on the basis that they are used by terrorists or for money laundering etc, or they will buy the lot up and squelch them, and they have the power to do it, and in this regard the start of Bitcoin futures on the CME was an ominous sign – it means that they are on the road to gaining the same kind of power over Bitcoin – and other cryptos – that they have had over gold and silver, with one big difference – at the end of the day Bitcoin is just a worthless line of code that fools have been jockeying to buy and overpay for. Gold and silver are very real, physical and their value is timeless, which is why the Chinese have been stashing gold away as fast as the West will sell it to them, and why the ability to control its price is destined to slip from the grasp of the Western paper market.

One of the most tragi-comic signs of a bubble at its terminal stage was the pitiful sight of investors of modest means buying percentages of a Bitcoin at a vending machine, because they couldn’t afford a whole coin.

So there you have it Bitcoin aficionados – GAME OVER!!

End of update.

Posted at 7.15 am EST on 24th December 17.