We

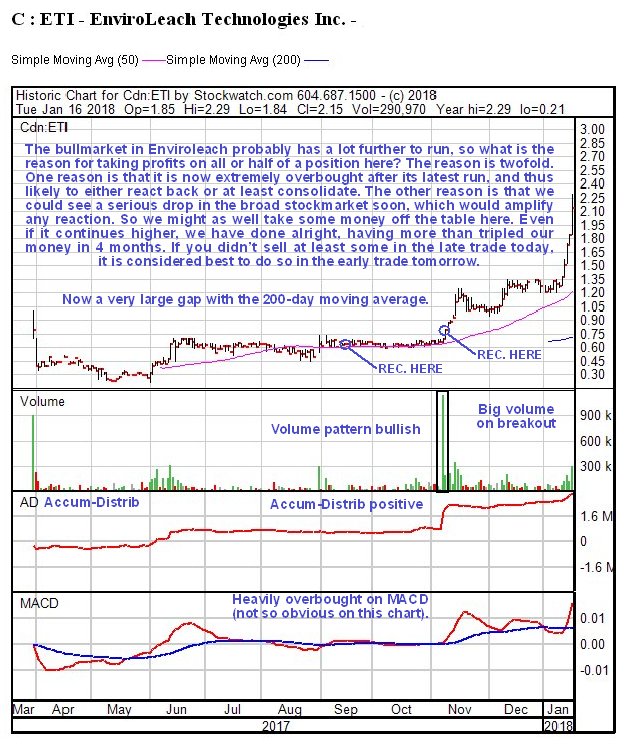

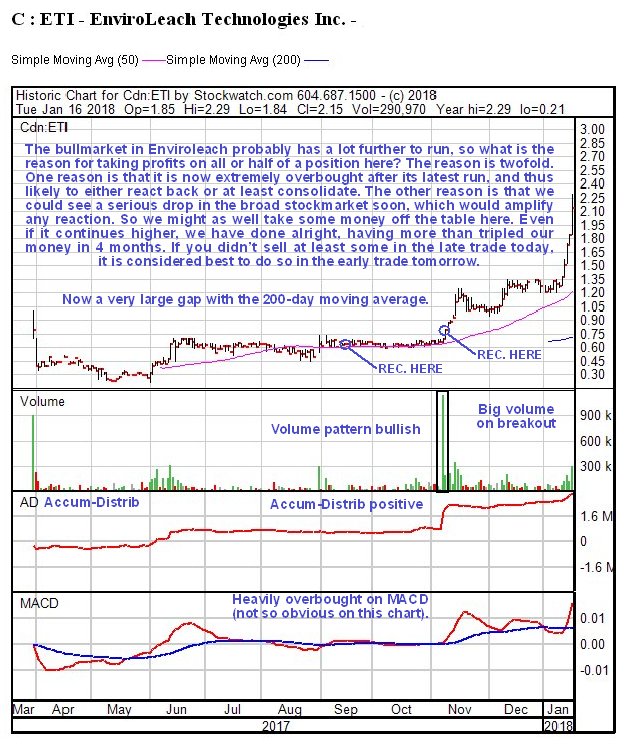

got the story right with the related companies Enviroleach and Mineworx, and

first bought Enviroleach back in September, and

then bought it again when it broke out of a trading range in November, and

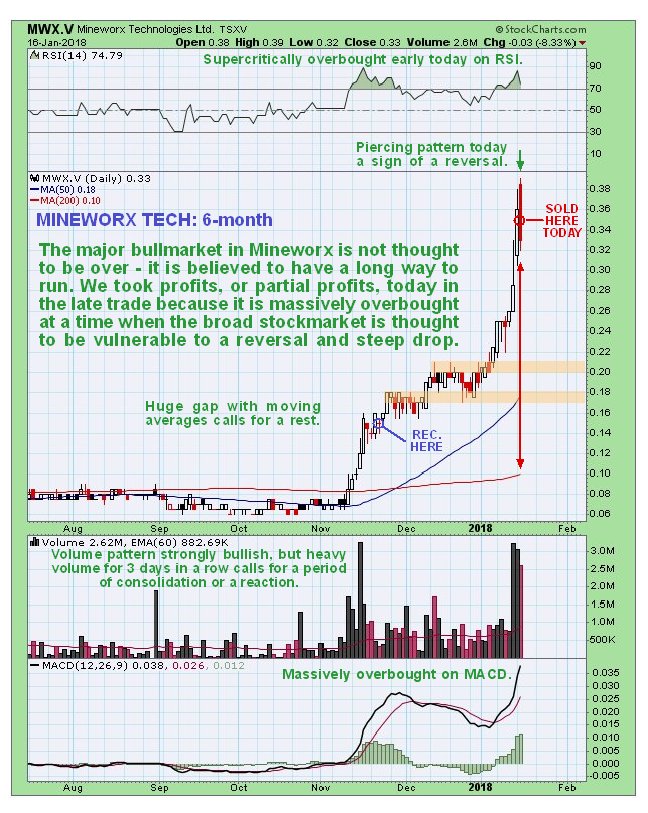

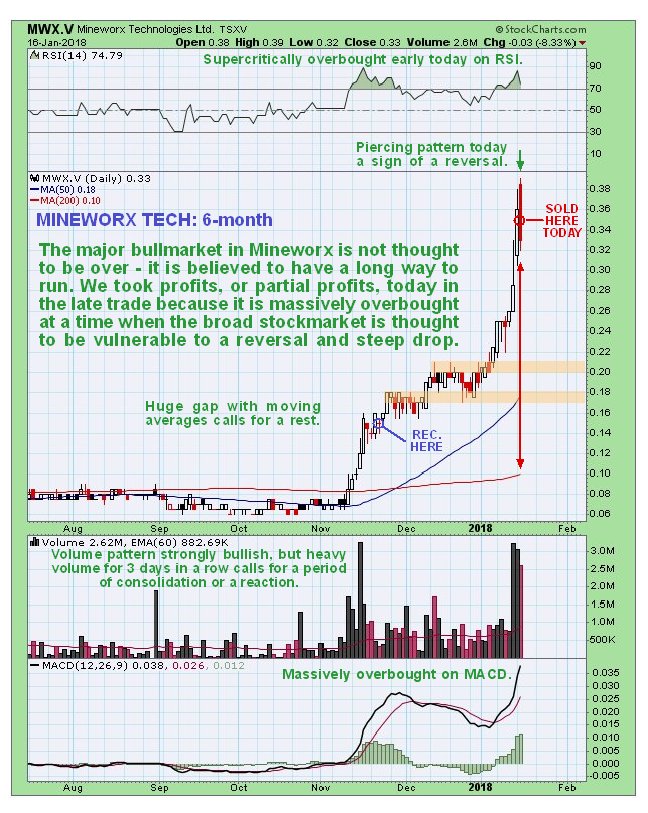

on 23rd November bought Mineworx for the 1st and only time.

They have both since soared, with Enviroleach more than tripling in price from when we first bought it, and Mineworx more than doubling, and as a result they are both now extremely overbought technically at a time of high risk for the broad stockmarket, which itself is at wild overbought extremes. In addition, a bearish “Piercing Pattern” appeared on its chart yesterday.

The story for both companies remains very positive and over the longer-term their stocks are expected to continue to advance within ongoing bullmarkets and make further new highs. However, their current extremely overbought status at a time when the market as a whole is vulnerable to a downturn that could be quite severe, means that it probably makes sense for us to take profits on at least half of our positions here, in order to sidestep a reaction that could be significant, or at least a period of consolidation. This is why the following Email alert was sent out at about 3.35 pm EST yesterday afternoon….

“We have more than tripled our money in Enviroleach Tech (ETI.CSX, EVLLF on OTC) in 4 months, and after its latest strong run it is extremely overbought at a time when the entire market is starting to look fragile. So it is considered prudent to take profits on at least half of a position today before the close if possible, or failing that in the early trade tomorrow. ETI is trading at C$2.14 and EVLLF at $1.67 at approx. 3.35 pm EST.

Ditto related stock Minework Tech (MWX.V, MWXRF on OTC), which is trading at C$0.34, $0.27, where we have more than doubled our money.”

After this alert was sent out Enviroleach closed up a touch at C$2.15, but Mineworx dropped a couple of cents to close at C$0.33.

Conclusion: with both Enviroleach and Minework extremely overbought at a time when the broad stockmarket is wildly overbought and vulnerable to a significant reaction, it is considered prudent to TAKE PROFITS HERE IN BOTH, or at least sell half and let the rest run, if you haven’t already done so yesterday afternoon. We remain bullish on them longer-term, and we will be back after either a reaction or a period of consolidation, accepting that they could possibly continue even higher from here. The broad market looks set to open higher, so there is a good chance that they can be sold at favorable prices in the early trade.

Enviroleach Technologies

website

Enviroleach Technologies Inc, ETI. CSX, EVLLF on OTC, closed at C$2.15, $1.74 on 16th January 18.

Mineworx Technologies

website

Mineworx Technologies Ltd, MWX.V, MWXRF on OTC, closed at C$0.33, $0.26 on 16th January 18.

Posted at 1.35 am EST on 17th January 18.