When GREED turns to FEAR...

Friday, January 30, 2026

DOLLAR OUTLOOK AFTER STEEP DROP AND IMPACT ON PRECIOUS METALS...

Wednesday, January 28, 2026

BIG METALS ROUNDUP - GOLD, SILVER, COPPER, PLATINUM, PALLADIUM...

Friday, January 16, 2026

The normal and natural business cycle where periods of growth were punctuated by healthy recessions has been all but eliminated by government and Central Bank interference. The recessionary phases which saw bearmarkets and retrenchment were a part of the cycle that is essential for the maintenance of a healthy economy, because it involved the correction of excess and the elimination or reduction of companies and processes that were inefficient or wasteful.

We have already noted on a number of occasions that true democracy is an absurd concept, for the simple reason that you cannot give the same say to the great mass of ignorant and often stupid people as to the much smaller number of educated and discriminating people. The result is politicians pandering to the lowest common denominator with a “bread and circuses” approach. This has been going on for many decades of course, with politicians of all stripes who usually don’t mix with “the great unwashed” turning out before elections to kiss babies and make outlandish promises to the masses that they have no intention of keeping– it works every time.

Politicians do not like the recessionary part of the business cycle, especially if it bites when they are the ones in office leading into an election, and so, if they can find a way to forestall it, they will. Before the gold standard was eliminated by Nixon in 1971 there was a limit to what they could do by pumping money to head off economic contractions, even if the Central Bank would cooperate, but after 1971, they found themselves free to print more and more money and they could not resist the temptation to expand the money supply and rather than exercise fiscal restraint in order to balance the books, they found it much easier to expand debt in order to indulge in a “have now pay later” ethos that has since become a universally accepted new normal, and so slowly started the parabolic debt curve that has now gone vertical and been further fuelled by derivatives that have allowed debt to ascend to astounding, giddying heights.

Years ago, long before debts rose to their current crushing levels, it would have been possible to straighten things out and balance the books for the common good. It would have involved sacrifice and unpopularity and so was untenable with politicians, especially those in power. It was far easier to simply keep kicking the can down the road, and of course, the bigger the expansion in the money supply and the bigger the debts, the more sacrifice would be required to fix things, adding to the incentive to just keep on can kicking, and that is what they have done. The last great chance to straighten out this mess was back during the financial crisis of 2008, but powerful vested interests were not going to permit that – instead they contrived ways to stick the taxpayer with the bill for it all, and concoct an enormous wealth transfer system that has since enabled them to drain the resources of the middle of lower classes into their coffers. The way this worked was simple – the money supply was to be vastly expanded via “quantitative easing” which, in addition to being used to maintain liquidity, enabled the elites to borrow money at extremely low rates of interest and then plough it into various speculative bubbles like Real Estate and the stockmarket, while the little guy would be forced to pay usurious interest rates if he needed to borrow money. To add insult to injury, prices of the basics of life have been steadily rising as a result of all this money pumping, far faster than the officially stated level of inflation, which is why the little guy has been forced further and further into debt to maintain the same lifestyle – debt at high levels of interest for him. To put it into everyday parlance, he’s screwed, and this is the reason for all the populist uprisings around the world of the past couple of years – the Brexit vote, the election of Trump, the Gilets Jaunes in France etc. The elites are determined to crush all these populist uprisings of course and reinstate the old feudal Master – Servant relationship where the servant knows his place, and knows better than to protest. This is why they have thwarted Brexit in Britain which is a seemingly endless fiasco – if it finally happens it will be BRINO (Brexit in name only) and if it really happens they will make sure the Brits pay in spades for daring to confront them. They have already delayed a process that should have taken about 6 months to getting on for 3 years. In the US they have started an impeachment process which even if it doesn’t remove Trump, is intended to sling so much mud at him that he can never be re-elected. In France the Gilets Jaunes have been simply ground down by being subject to violent repression, week after week, with their cause intentionally underreported, in marked contrast to what is going on in Hong Kong. True democracy has long since ceased to exist in the Western world and has been replaced by a sham – and the same is true of once free financial markets that are now to a large extent controlled by Central banks, making Western economies more like the old so-called Command Economies of the communist bloc.

Now we come to the purpose of this treatise which to point out that the exponentially expanding debt and money creation has now gone vertical and resulted in such monstrous economic distortions that it has brought the global economy to the brink of collapse. There is now no way back – things have gone way beyond the point of no return. The emergency measures introduced after the global financial crisis in 2008, that were supposed to be a temporary state of affairs, such as QE and zero interest rates, have now become a permanent state of affairs, so that they are accepted by many as a “new normal”. But they aren’t normal at all and never can be – they are highly abnormal. The zero interest rates discourage saving, the basis of capital formation and instead encourage rampant speculation in often intrinsically worthless ventures. All the newly printed money is no longer stimulating the economy which is instead verging on contraction, so their response is what one would expect – to print more and more money, but you can’t generate real economic growth by simply pumping more and more money – all you wind up doing is destroying the currency and creating hyperinflation.

The Fed is already like an out of control weather vane in the eye of a hurricane – first it blows one way and then the other. Having detected the first winds of the backwall of the hurricane – we have been in the eye since 2009 – they are scrambling with indecent haste into QE4, which of necessity, given the much more extreme conditions that now prevail, will end up being on a much vaster scale than the previous bouts of QE. What this means is that the dollar is toast, or will be before much longer. We should not be fooled however by the dollar

index holding up, which of course it could do if other countries are debasing their currencies at the same rate - if you are on a sinking ship it’s small comfort to know that the other ships around you are sinking too. Instead, we will be able to tell what is happening to it by its performance measured in gold.

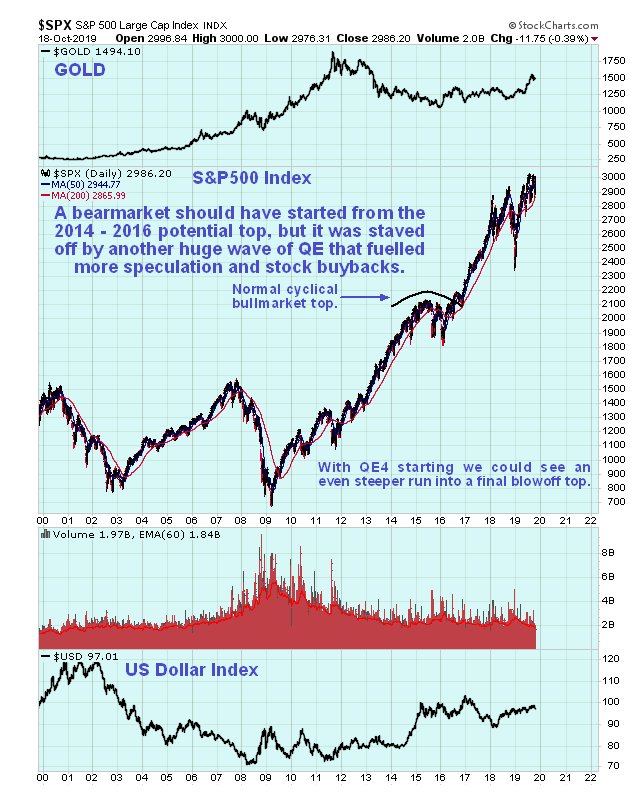

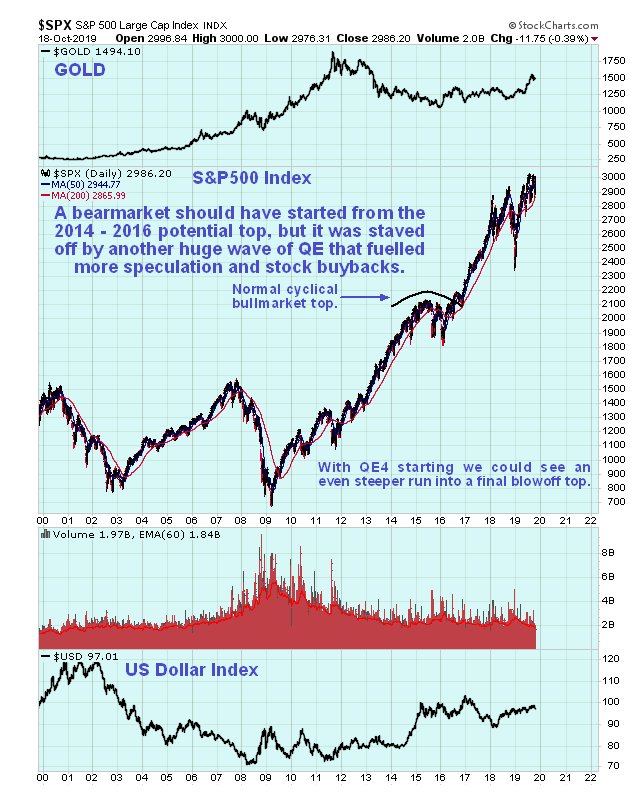

Gold has been subject to ridicule again in recent years because it has underperformed the stockmarket, with the old “barbarous relic” jibe making a reappearance, so here it is worth reminding ourselves that

gold has still outperformed the stockmarket by a factor of about 2.5 to 1 since the start of the new millennium, as we can see on the latest 20-year chart for gold against the S&P500 index.

On the following 20-year chart for the S&P500 index, we see that it tried to go into a normal, cyclical bearmarket when a potential top formed from 2014 – 2016, but this would be bearmarket was averted by the Fed intervening with another big dose of QE, that drove the stockmarket higher again, largely as a result of stock buybacks made possible not just by Fed largesse but by extremely low interest rates as well…

Given what the Fed has been doing to the money supply in recent years, it is remarkable that the dollar has held up as well as it has, but that is only because, taking a leaf out of the Fed’s copybook, other countries and trading blocs like the European Union, as been subjecting their currencies to even more abuse. Nevertheless, the pattern forming in the dollar does not look positive. It is suspected that a giant Broadening Top is completing in the dollar index, and it appears to be struggling beneath the resistance level shown on our 20-year chart for the index…

On the 2-year chart for the dollar index we can see that the slow, ponderous uptrend has continued for over a year, making it more likely that a reversal to the downside will occur soon. However, this channel is at least parallel, so it would be wise not to bank on it breaking down until it does. Watch what happens when it arrives at the lower boundary of this channel. A point worth making here is that, even though the dollar has dropped back quite steeply in recent days, gold has barely picked up. This is thought to be because the dollar and gold are now perceived as safe havens, and if QE4 promotes a risk on environment again as looks likely, they will be safe havens that are not in demand for a while.

Does the advent of QE4 mean that a market crash has been forestalled? Probably, but not necessarily. The ballooning of debt and derivatives has of course created a situation which is dangerously unstable, one in which the complete collapse of a key company like Deutsche Bank, which has a gargantuan derivative book, could implode the system, so clearly the way to avoid a meltdown is to firefight any such situation the moment it presents a problem – this is what happened in the repo market a few weeks back when it locked up threatening a liquidity crisis, an event which is thought to have brought about the early launch of QE4, that has not been labeled as such as they are trying to keep it low key.

An important point to make here is that for the elites it presumably makes more sense for the markets to crash during the Fall of next year rather than this year. The reason is that a crash before the Presidential election would inflict the maximum damage on Trump, who has made a buoyant stockmarket a major plank of his Presidency.

So, if they go at it pumping money again with QE4, they could keep the stockmarket elevated

provided that they are able to firefight any liquidity issues arising from the increasingly extreme instability. If not and things get out of control, markets will crash anyway. Action late last week suggests that, for a while at least, we are going back to risk on mode, which could see the stockmarket make new highs and safe haven assets, which both the dollar and gold are now, drop back, and we see that both the dollar and gold dropped back late last week. Gold’s chart has been weakening with a potential intermediate top forming and its latest COTs are by normal standards bearish, with the Commercials now holdings heavy short positions, which usually means trouble. Any significant reaction from here will be viewed as presenting a great opportunity to build positions across the sector, because QE4 will eventually cut the legs from under the dollar, leading to hyperinflation.

Posted at 5.20 pm EDT on 13th October 19. Charts with accompanying text added on 19th October.