Since

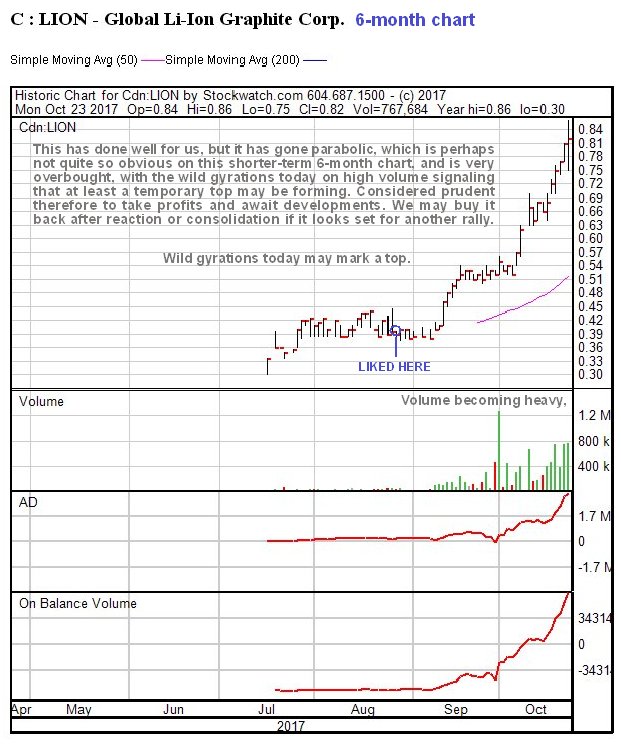

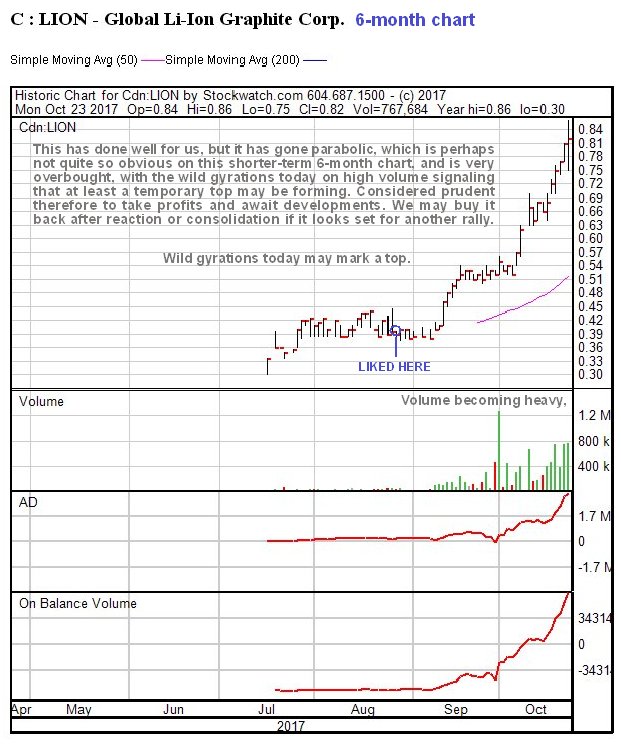

we went for Global Li-ion towards the end of August it has done very well for us, more than doubling, but it has been kept under closer observation in recent days, as it has gone parabolic on increasing volume, with the consequent risk of it burning out and reversing, at least temporarily. Today it is gyrating around wildly on big volume, which is likely to result in a bearish candle on its chart by the end of the day – perhaps a “Hanging Man” or a “Spinning Top” and of course if that happens it could soon react back quite substantially.

It is therefore considered prudent to TAKE PROFITS IMMEDIATELY, OR AT LEAST BEFORE THE CLOSE TODAY. We may consider buying it back on a reaction or consolidation if it looks like it is going up again. Global Li-ion now trades on hopelessly light volumes on the US OTC market where for the time being it should be avoided.

Global Li-Ion Graphite website

Global Li-Ion Graphite Corp, LION.CSX, GGBGF on OTC, trading at C$0.84, $0.67 at 12.50 pm EDT on 23rd October 17.

Posted at 1.05 pm EDT on 23rd October 17.