Copper is at an interesting juncture. On its latest 8-month chart we can see that within the next few weeks it will be forced to break out of a Symmetrical Triangle pattern that is now rapidly closing up. Although it could break in either direction, the rather positive Accumulation line and rising 200-day moving average suggest a higher probability that it will break out upside. However, we cannot grasp the big picture using only an 8-month chart, so now we will zoom out and see what it looks like on a longer-term chart.

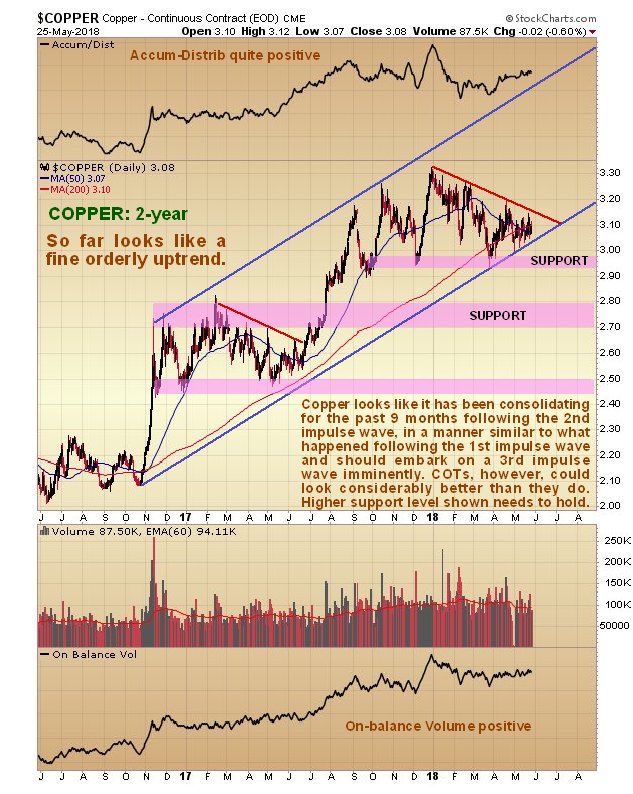

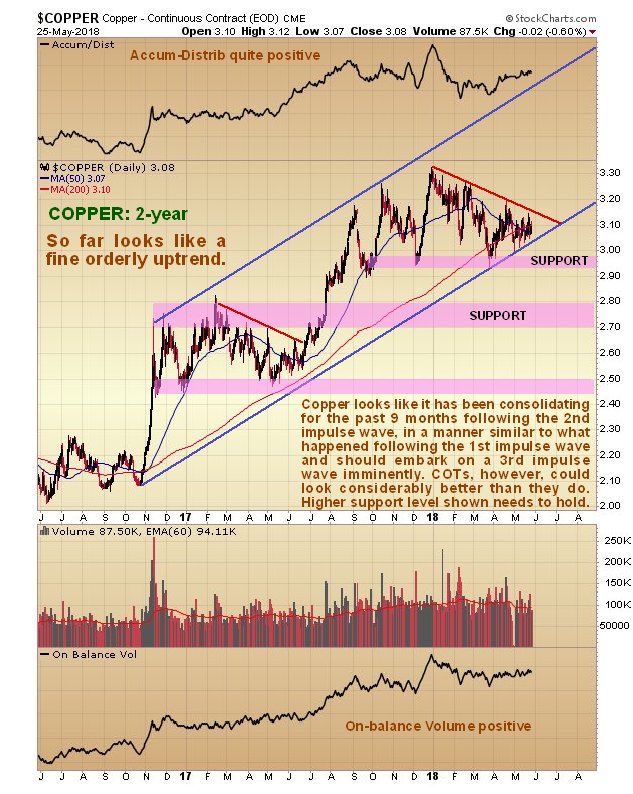

On the 2-year chart all becomes clear – copper is advancing within a well-defined parallel bullmarket uptrend channel, and we can see that the sideways pattern that has built out over the past 9 months since early last September looks like a consolidation following the upleg in the middle of last year, that should be followed by another upleg imminently. However we are also aware that there is some risk that it is a top because of the Dome shape of the pattern, and the rather unsupportive COT, so whilst we are expecting another upleg to develop, we cannot rule out a downside break and thus we can say that the higher support level shown on the chart needs to hold to maintain the bullish outlook.

The long-term 10-year chart shows that the current bullmarket in copper started late in 2016 with a sizeable upleg. While a third upleg is now expected to develop, we can see that copper will encounter a considerable degree of resistance on the way up, and since this exists across a broad band, no specific resistance levels are drawn on the chart. Volume indicators are strong overall which increase the likelihood of another upleg developing.

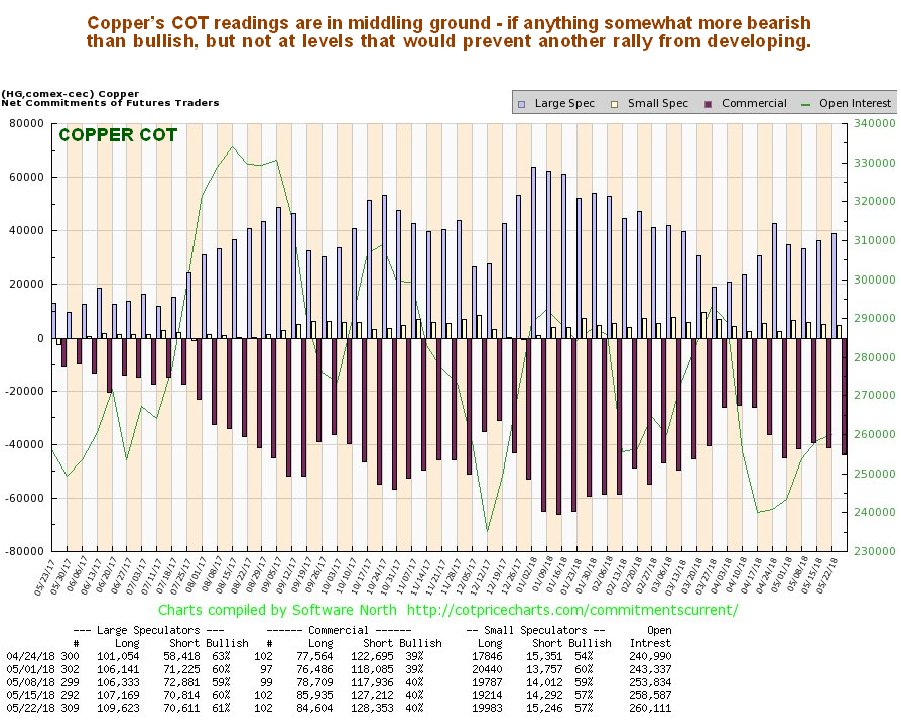

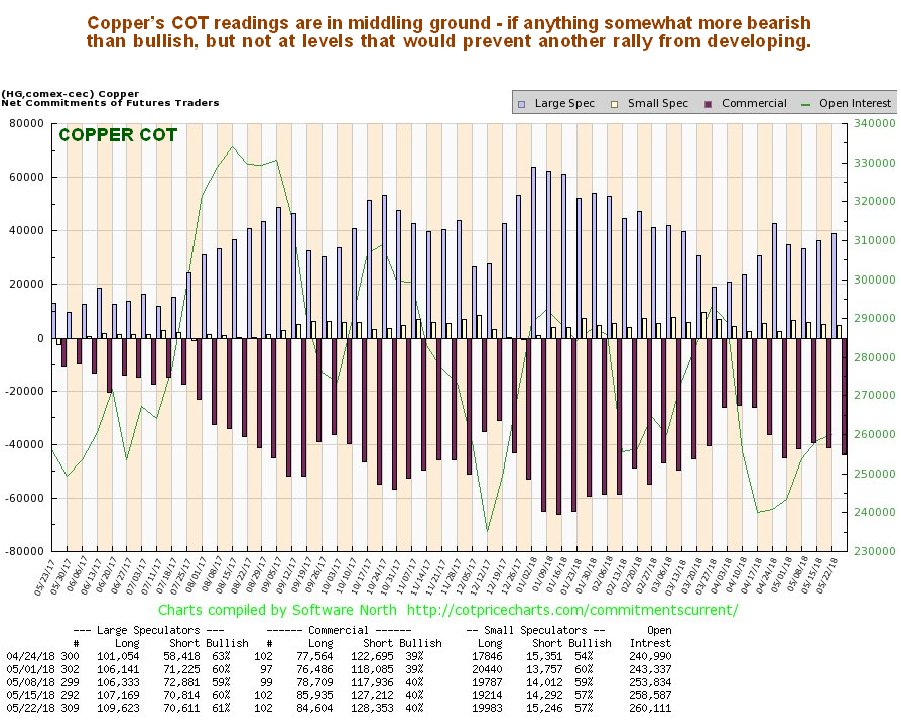

Finally we can see that latest COT readings are not very encouraging, with rather high Commercial short and Large Spec long positions. However, although they are higher than we would like to see, they are not at levels that preclude another rally developing, especially as there is nothing to stop them rising to clear new high readings for the year.

Click on chart to popup a larger, clearer version.

Our conclusion then is that copper is more likely to break out into a third upleg than it is to break down, although we are not blind to that possibility. We will now proceed to examine the charts of a range of copper stocks that look like they are poised to advance, and this being the case, increase the probability that copper will break to the upside soon.

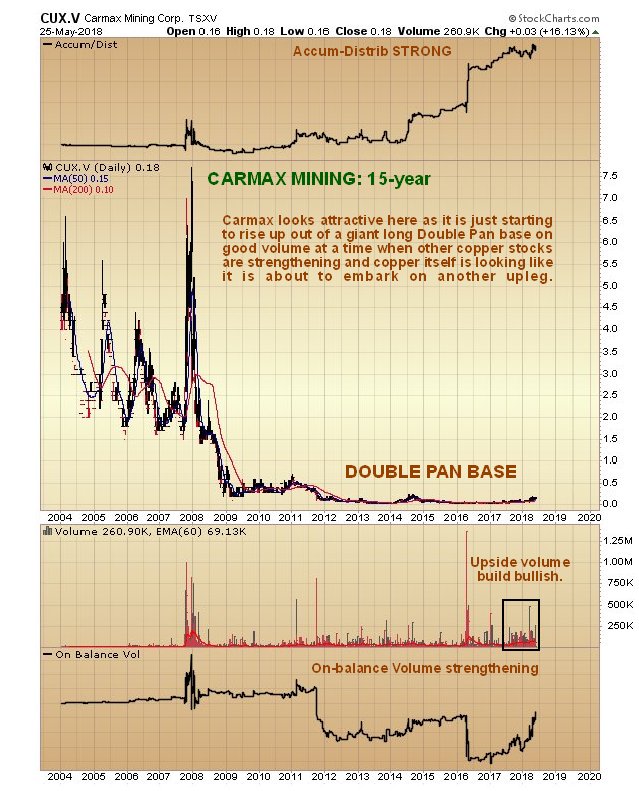

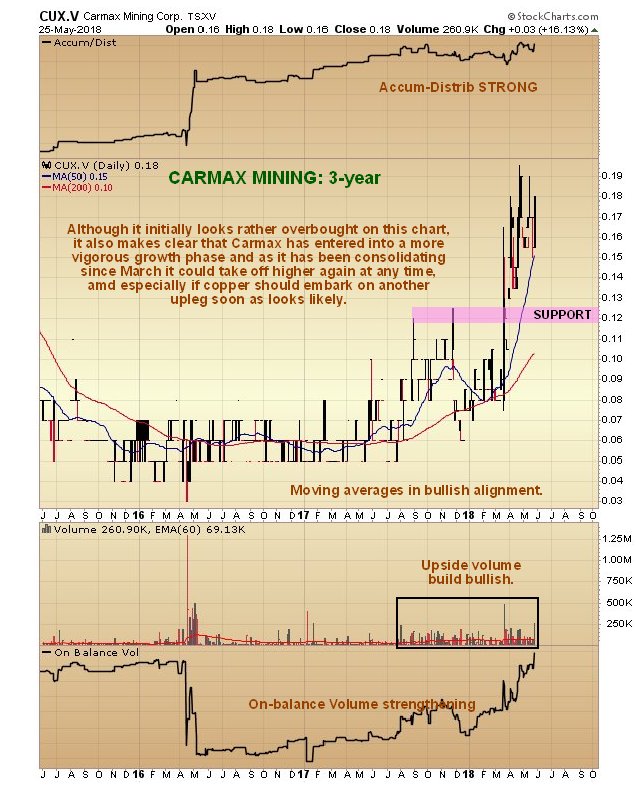

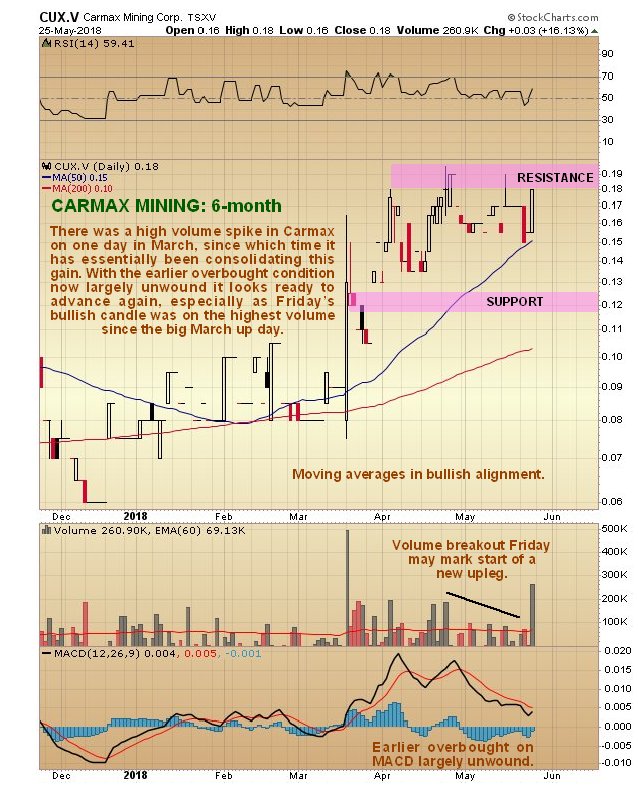

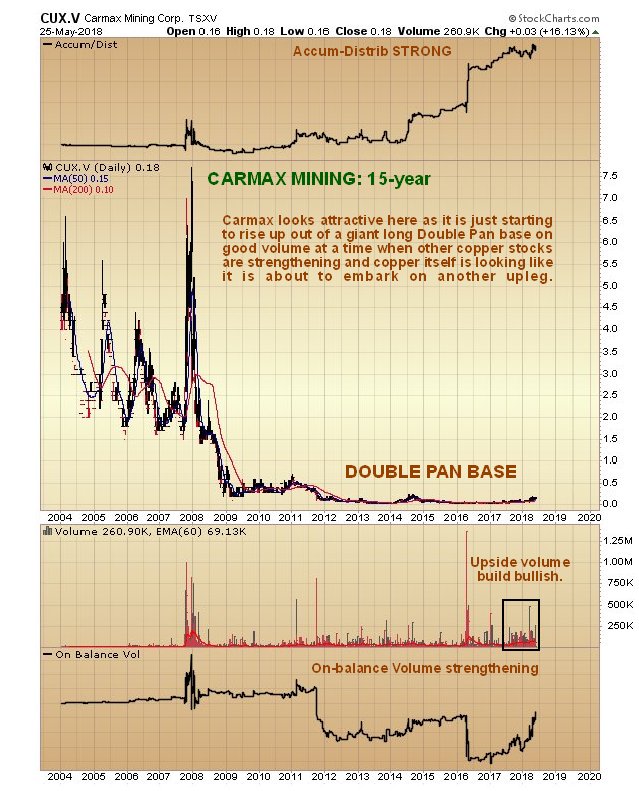

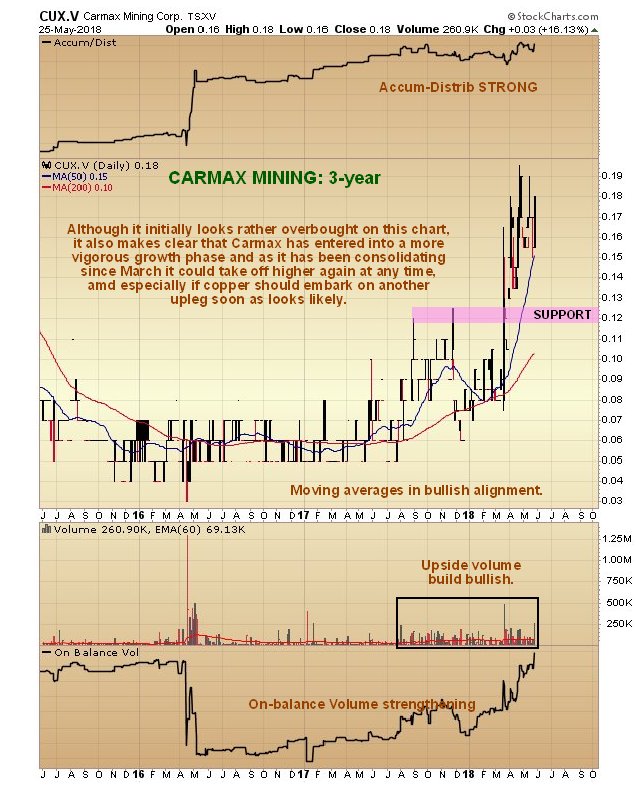

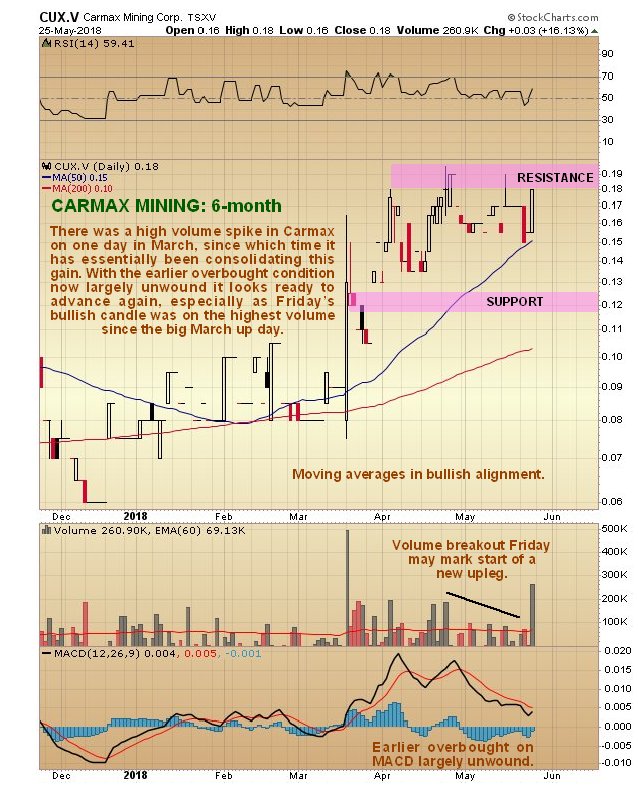

Carmax Mining Corp. CUX.V, CAXPF on OTC, C$0.18, $0.12

Carmax Mining website

Kutcho Copper Corp. KC.V, KCCFF on OTC, C$0.59, $0.426

Kutcho Copper website

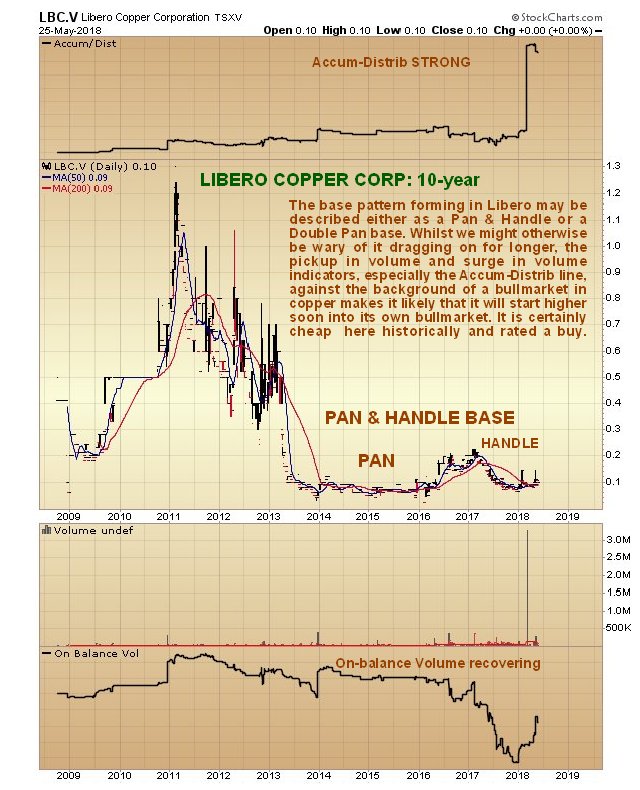

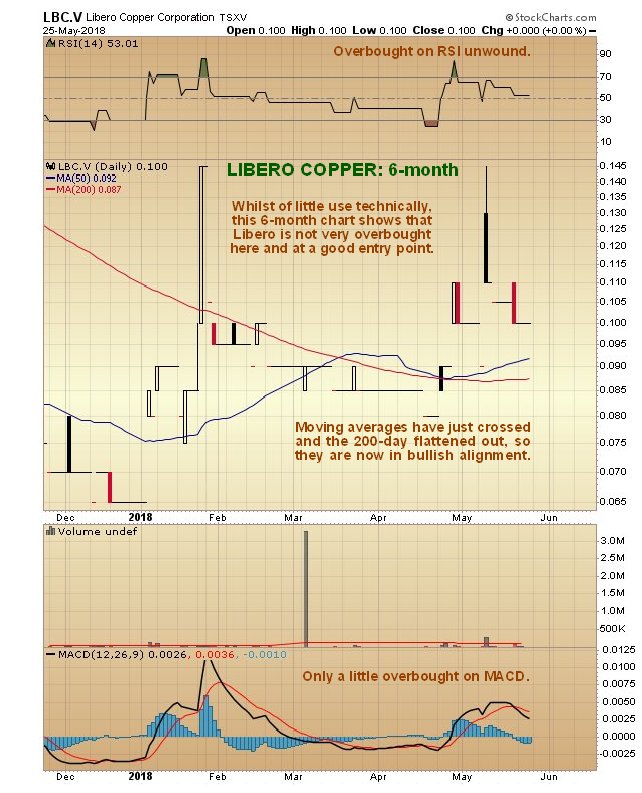

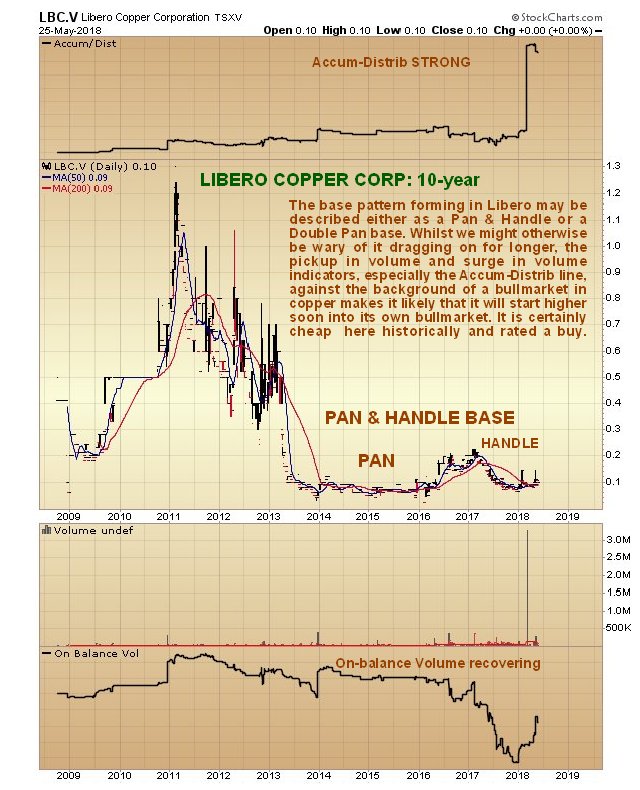

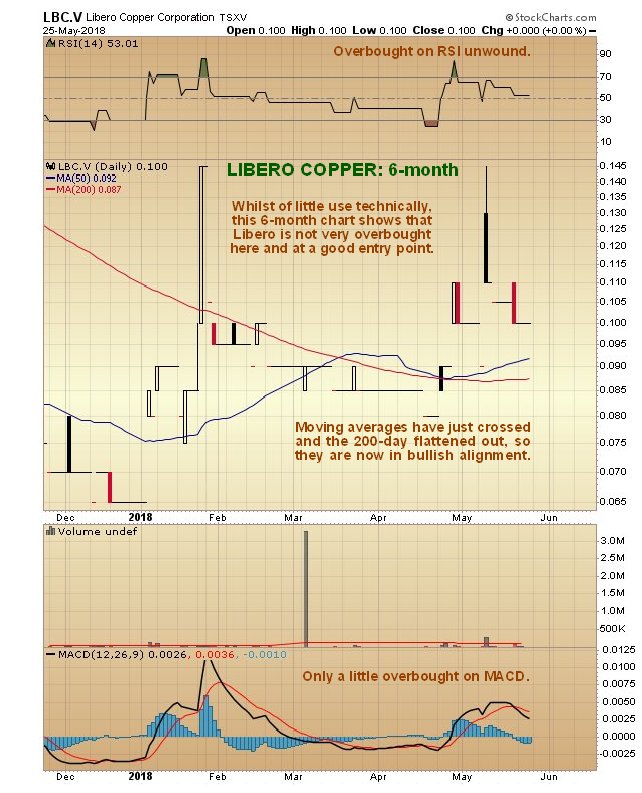

Libero Copper Corp. LBC.V, C$0.10

Libero Copper website

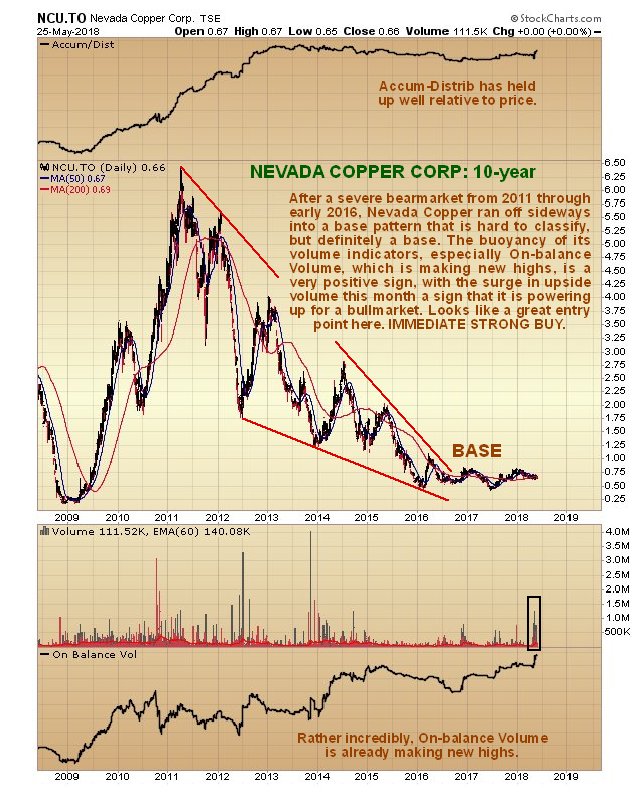

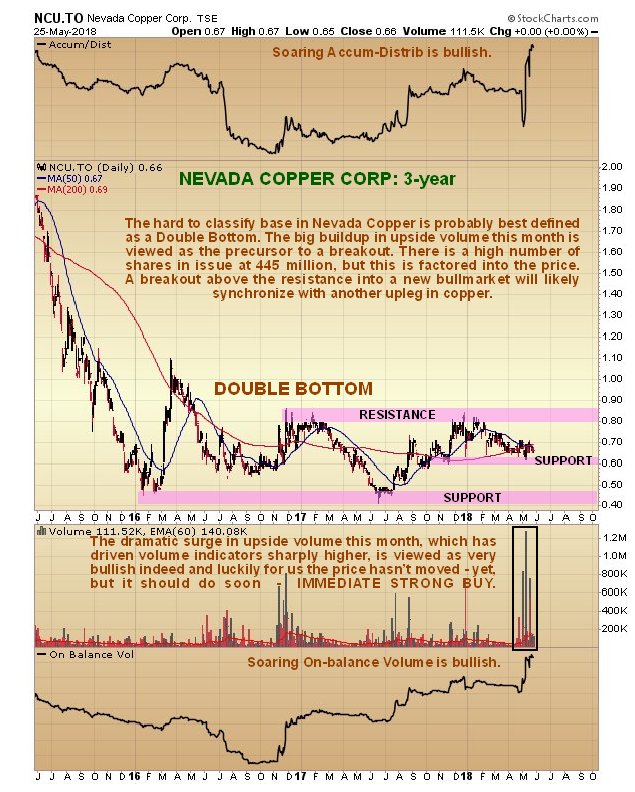

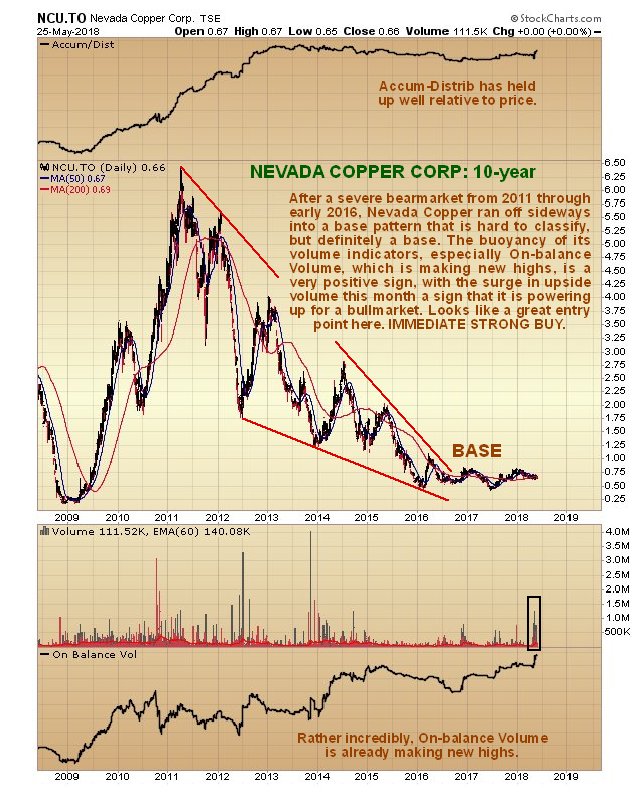

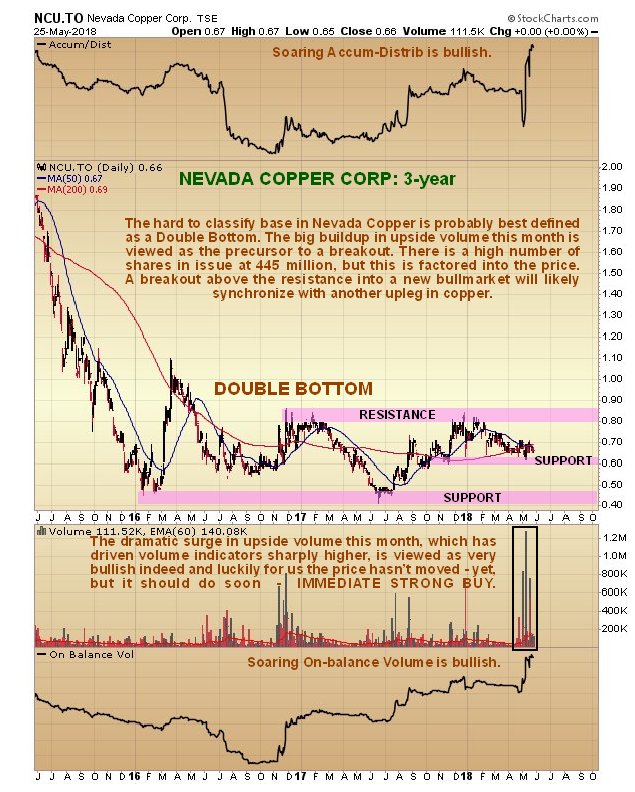

Nevada Copper Corp. NCU.TSX, NEVDF on OTC, C$0.66, $0.514

Nevada Copper website

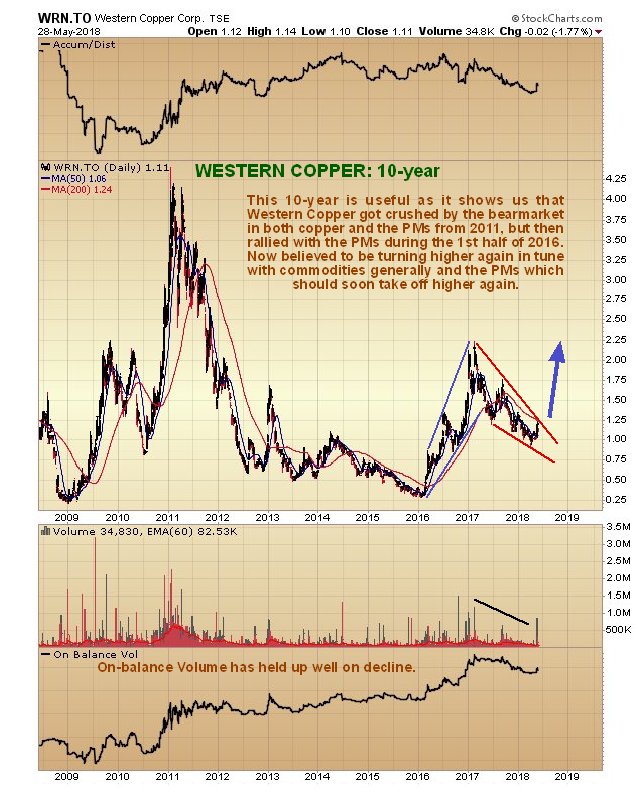

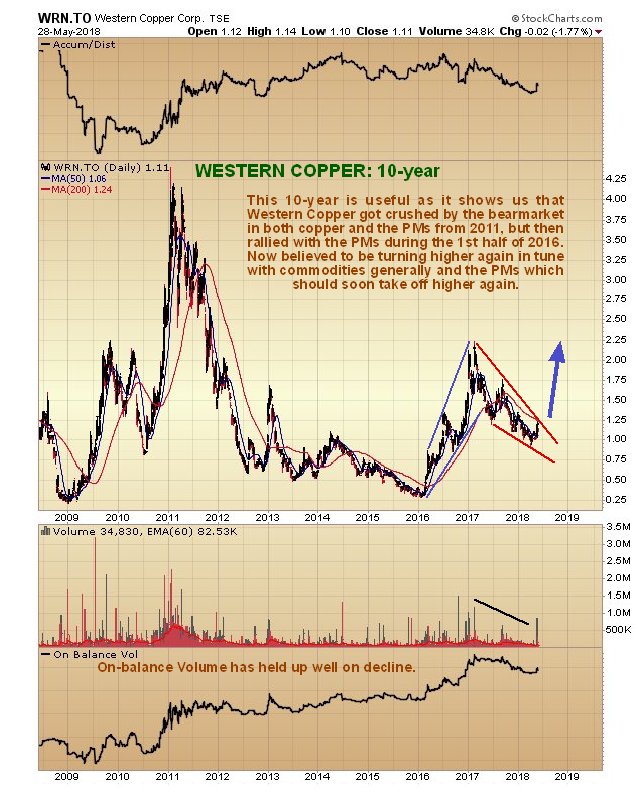

Western Copper Corp. WRN.TO, WRN on NYSE, C$1.11, $0.87

Western Copper website

The number of shares in issue for the stocks listed above is as follows: Carmax 73.8 million, Kutcho 47.7 million, Libero 44.2 million. Nevada Copper has a hefty 445 million, although this is probably largely factored into the price. Western Copper has 96.6 million. Libero is very thinly traded and probably best avoided, or bought with a “stink bid” for this reason. Asked to choose just one from this list, Western Copper would probably be the best, as it is a big solid company, and the stock has just broken out of a base pattern on strong volume and reacted back to a favorable entry point.

All prices are for close of trading on Friday 25th May with the exception of Western Copper which was added on the 29th.

End of update.

Posted as a combined copper update and copper stocks review at 2.15 pm EDT on 29th May 18.