We were on to Kerr basing when

we last looked at it back in February but were a little early in thinking that it might be able to soon break out above its falling 200-day moving average. In the event it dropped back to mark out the 2nd low of a Double Bottom base pattern, that we can see to advantage on its 1-year chart, with its technical condition improving all the while. Important positive technical points to note on this chart are that it did not make a new low when it dropped back late in March, upside volume has been heavy since mid-January which is a sign of a bottom forming that involves a lot of rotation of stock from weak to strong hands which is obviously bullish, and the fact that most of it is upside volume is revealed by the strong rise in the Accumulation line. The positive volume indications provide convincing evidence that this supposed Double Bottom base pattern is genuine.

Even though the 200-day moving average is still falling, the alignment of moving averages is steadily becoming more bullish, with an increasingly tight bunching of price and moving averages such as commonly precedes a breakout, and it is clear that both the 50-day and 200-day will soon start to flatten out as they are digging into the base area, which will quickly turn the picture positive.

The 2-year chart enables us to see the origins of the persistent and stubborn downtrend back in September of 2017 when it was priced at over C$0.40 and also that it has already broken out of this downtrend when it rallied out of the 1st low of the Double Bottom in February. This makes it clear that it is in position to begin a new bullmarket phase.

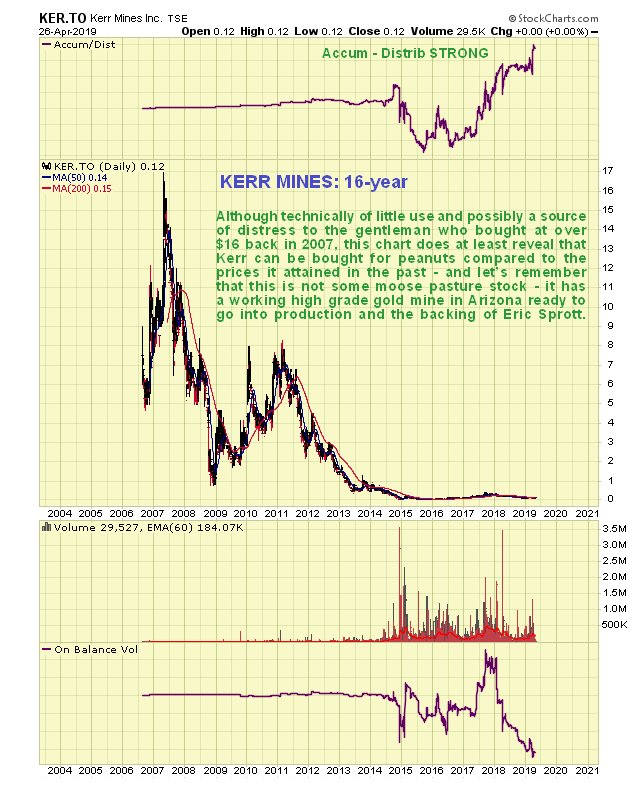

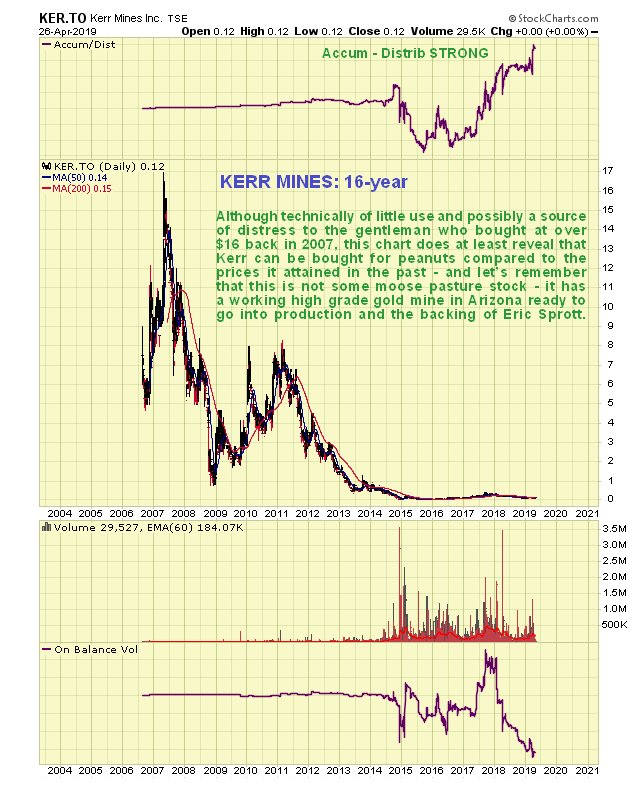

Finally we will take a quick look at the long-term 12-year chart, which, although technically almost useless, reveals that Kerr is selling for peanuts now compared to the sort of prices it commanded as recently as 2011, which is a good point to make clear that this is not some “moose pasture” stock, but the stock of a company which has an established ready to work high grade gold mine in Arizona, which is known to have better infrastructure than the Yukon, and furthermore it has the backing of Eric Sprott. Let’s now take a tour of the company’s Copperstone Gold Mine so you can see for yourself that this is for real.

The conclusion is that since Kerr mines is still very close to the lows of a Double Bottom base pattern that has formed at a very depressed level, it is a strong buy here and has the potential for very substantial percentage gains, especially if gold gets moving soon and breaks above $1400 into a major new bullmarket as expected.

Kerr Mines website

https://kerrmines.com/

Kerr Mines Inc, KER.TSX, KERMF on OTC, closed at C$0.12, $0.086 on 26th April 19.

Posted at 9.05 pm EDT on 28th April 19.