Isodiol is not a cannabis stock – it manufactures a wide range of health products using CBDs extracted from non-gmo hemp. However, although it is not a cannabis company, investors may group it with cannabis stocks, because the charts show that it moves with them, for similar reasons.

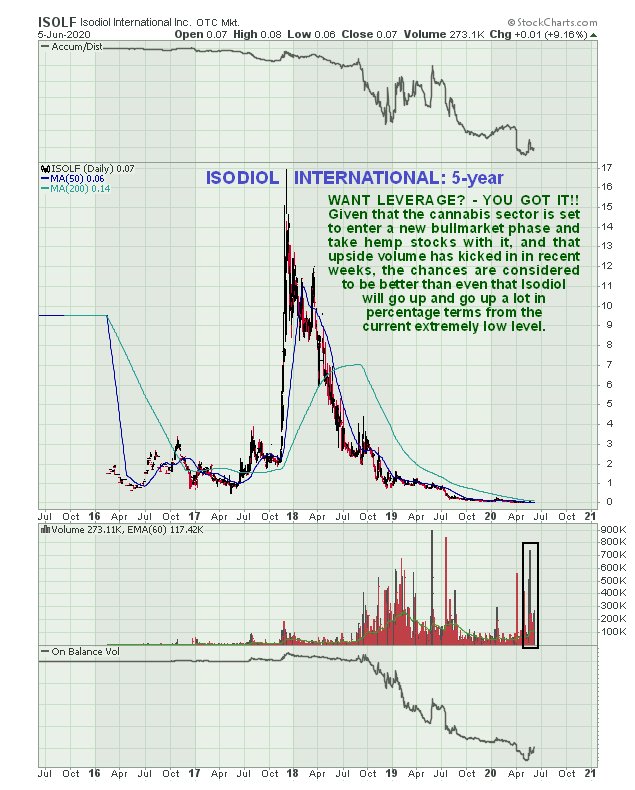

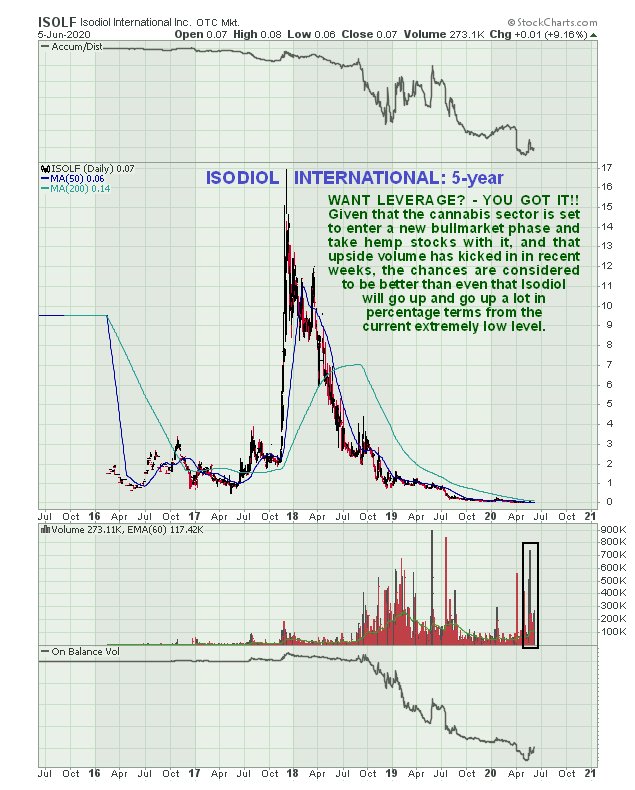

On its 5-year chart we can see that it rocketed higher in tandem with cannabis stocks late in 2017, before reversing into a savage bearmarket that saw it drop to bottom at an extremely low price in the Spring of this year. Quite obviously, since it won’t go lower than zero (unlike interest rates), it has hit bottom, and the recent volume pattern indicates that it is unlikely to go bust. Before leaving this chart, potentially bullish factors to observe are the 200-day moving average closing on the price and a marked buildup in upside volume in recent weeks, both of which we can see much more clearly on the 1-year chart.

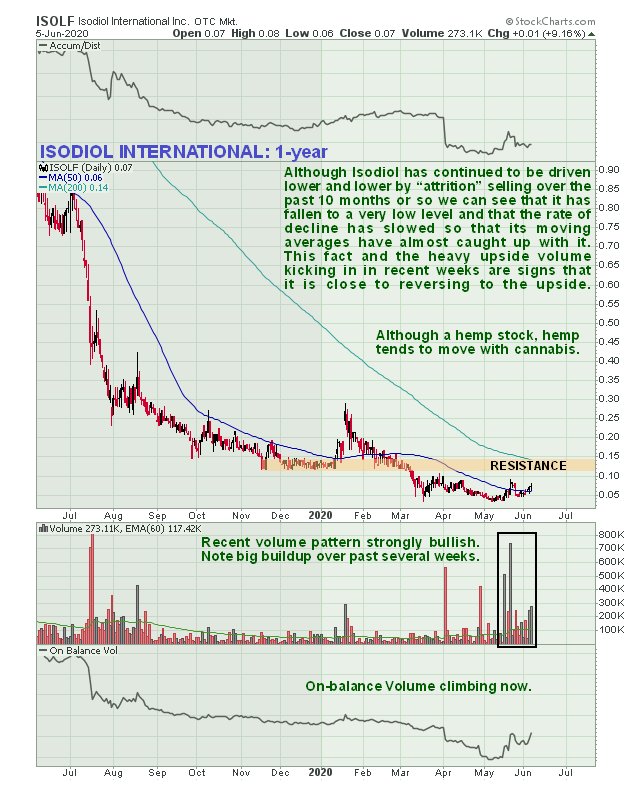

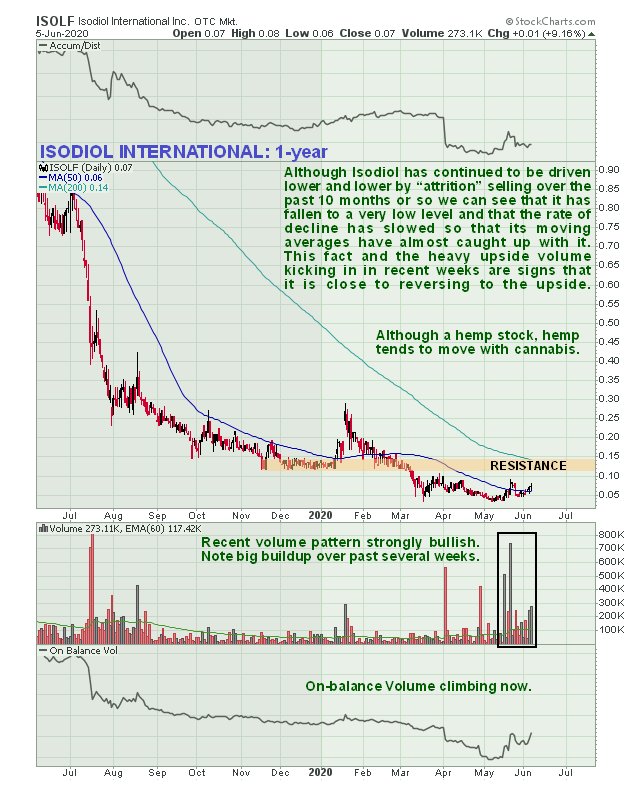

Zooming in via the 1-year chart allows us to view the latter part of the severe bearmarket in detail. On this chart we can see how it has been driven lower and lower over the past 10 months or so by persistent attrition selling against a background of adverse conditions across the sector. However this relentless selling has driven the price down to such a low level that bears have at last been exhausted and the rate of decline has slowed, so that its moving averages have almost caught up with it – have in the case of the 50-day – and this intensifying bunching of the price and moving averages with time is creating the conditions for a trend reversal. It is thus most interesting to observe the heavy upside volume kicking in in recent weeks that is driving the On-balance Volume line higher. This is a sure sign of Smart Money taking positions ahead of an upside breakout, which fits with the extremely bullish pattern that we are seeing on cannabis sector flagship stock Aurora Cannabis, which looks about ready for another big upleg. So this looks like an excellent point to put in an appearance and buy the stock.

We can see recent action in more detail still on the latest 6-month chart. Points to observe on this chart are that it made a low in March, when the broad stockmarket hit bottom, and then dropped back last month to form a Double Bottom with that low, since which time it has picked up again but on heavy volume which at this juncture is bullish, and is viewed as a sign that it is getting ready to take out the important resistance near to its 200-day moving average.

While this is obviously a cheap speculative stock, it should be clear that if it turns higher from here – and the indications that we have just considered suggest a better than even probability that it will – it has the potential to make very big percentage gains from the current abysmally low level, especially if the sector should take off strongly higher as looks likely, and it is therefore rated a strong speculative buy. There are reasonable 58 million shares in issue.

Isodiol International website

Isodiol International Inc. ISOLF on OTC, ISOL on CNQ, closed at $0.07, C$0.08 on 5th June 20.

Posted at 9.30 am EDT on 6th June 20.