The first thing to state about Kontrol Energy Corp is that it is not some oil or gas stocks, it is an energy efficiency company whose products are used primarily in what are called Smart buildings to drastically reduce energy costs and emissions. The reason that we are looking at it here is because it looks strong and ready to make another upleg within a fine uptrend which may well be triggered by

this morning’s news that the company has completed its acquisition of New Found Air.

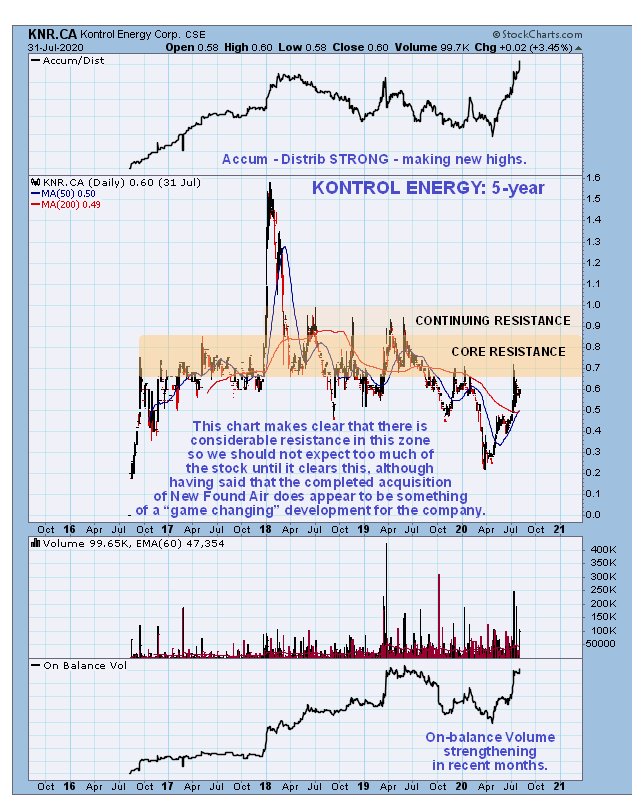

On its latest 6-month chart we can see that Kontrol Energy is in a fine uptrend that looks set to continue, especially as we have just had a bullish moving average cross. A continuation of the uptrend is made more likely by the strongly positive volume pattern with big upside volume that is already driving the Accumulation line to new highs, even though the price is currently consolidating. Right now a bull Pennant appears to be completing that should lead to another upleg very soon, and today’s news may well trigger it.

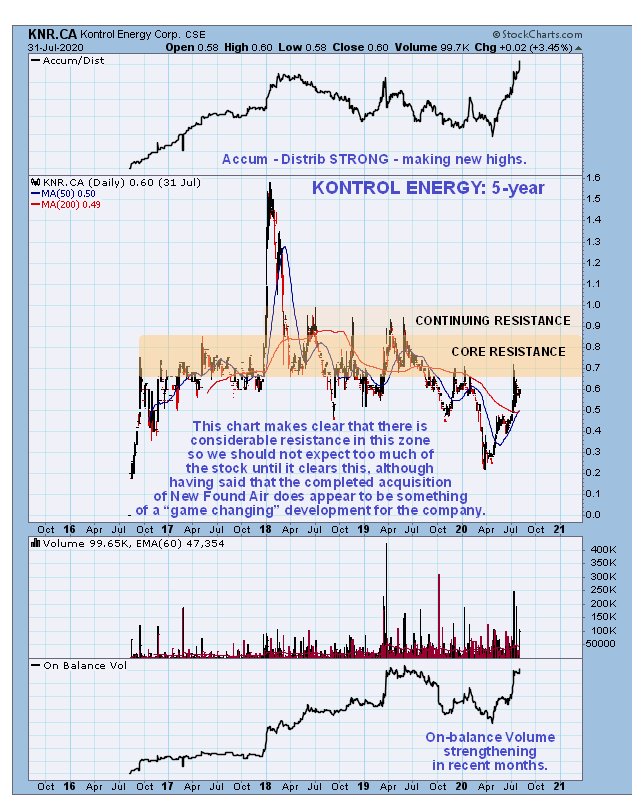

It is important to look at the long-term 5-year chart as it reveals that there is considerable resistance in this area and up to about C$0.85, so it is probably best not to expect more than a measured advance until it gets above this level, although we should also take note that there is further resistance, if not so strong, up to about C$1.00. That said, the completed acquisition of New Found Air looks like something of a “game changer” for the company, particularly as the company appears to now be in possession of a technology that can detect Covid-19 in buildings, although I do not know the details about this.

The conclusion is that Kontrol Energy looks like an immediate buy here for an imminent move up towards the top of the uptrend channel shown on our 6-month chart and a continuing bullmarket beyond that.

Kontrol Energy Corp. website

Kontrol Energy Corp., KNR.CA, KNRLF on OTC, closed at C$0.60, $0.43 on 31st July 20.

Posted at 9.20 am EDT on 4th August 20.