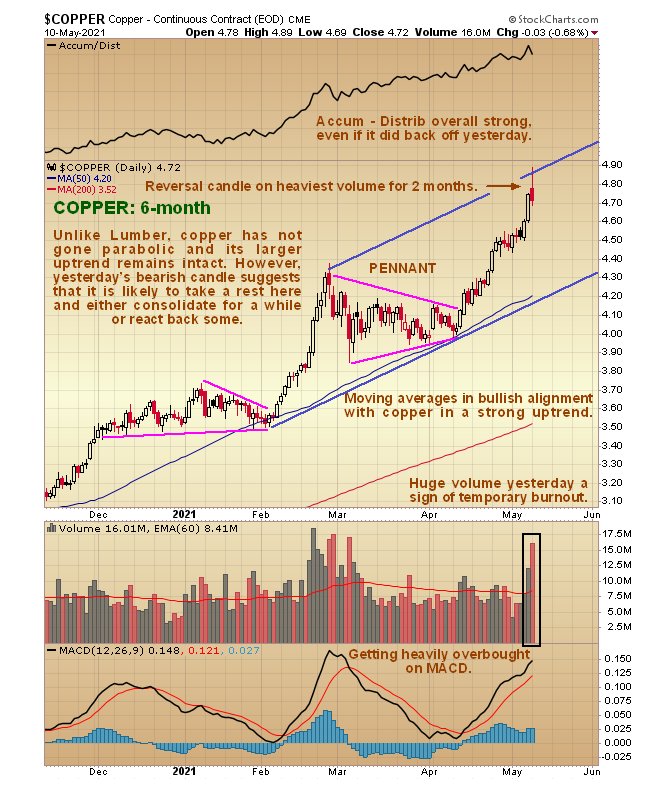

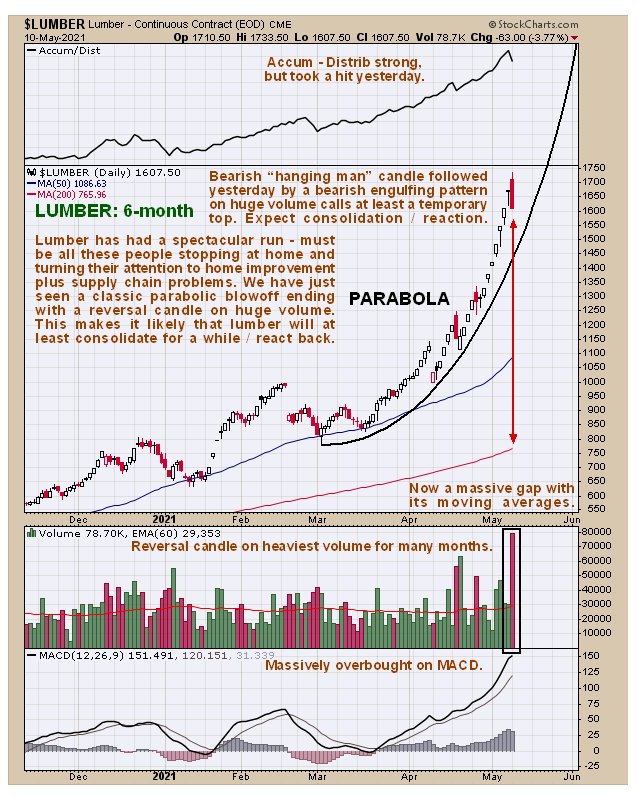

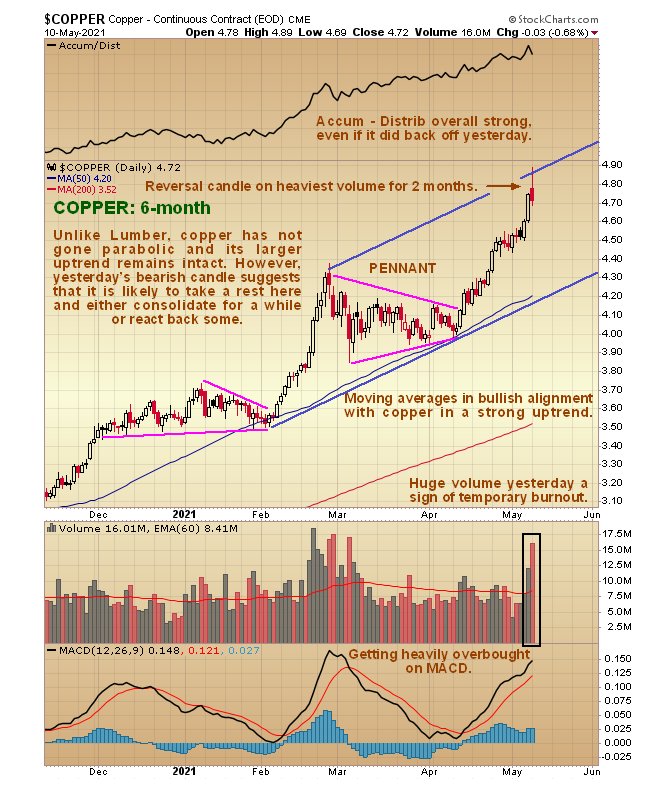

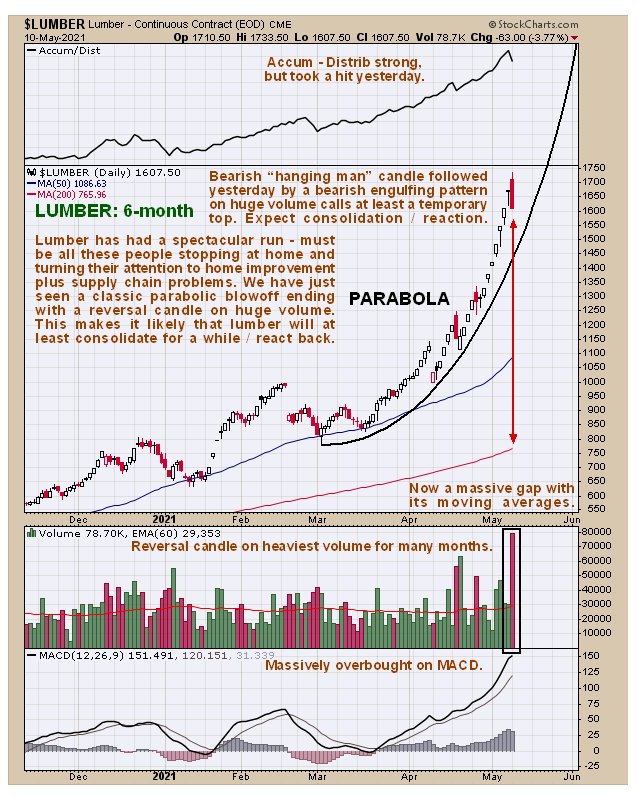

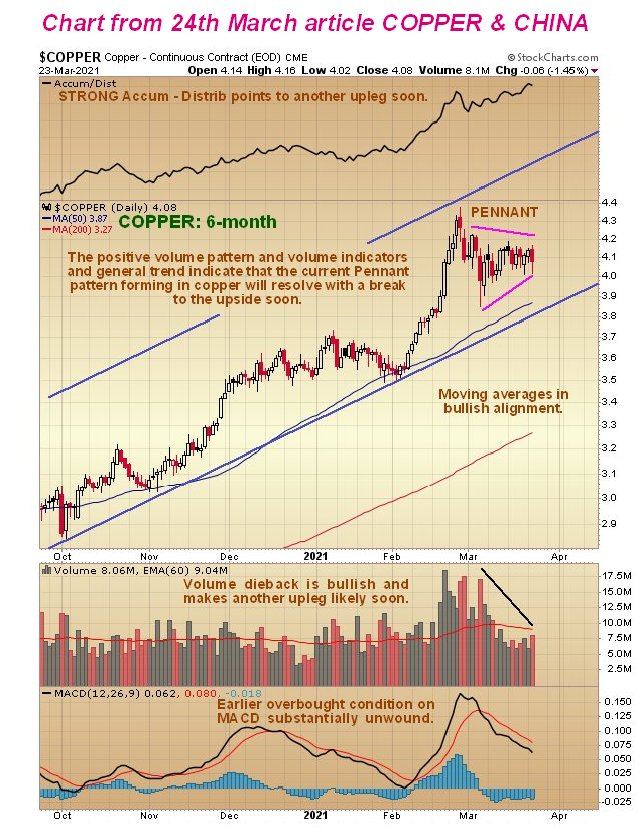

Both copper and lumber put in clear reversal candles on heavy volume yesterday. We haven’t looked at lumber before but we are taking a look at it here because it has gone parabolic and become so “hot” and its reversal day yesterday was quite spectacular. The big difference between copper and lumber here is that the reversal yesterday in copper probably marked the end of an intermediate uptrend within an ongoing orderly larger uptrend that looks set to continue, whereas lumber’s reversal marks the probable blowoff top of a spectacular vertical ramp…

So, copper is expected to consolidate, probably for some weeks or even a month or more, and perhaps react back some across its uptrend channel before its advance resumes, whereas there is a bigger chance that lumber is “done”, at least for the foreseeable future.

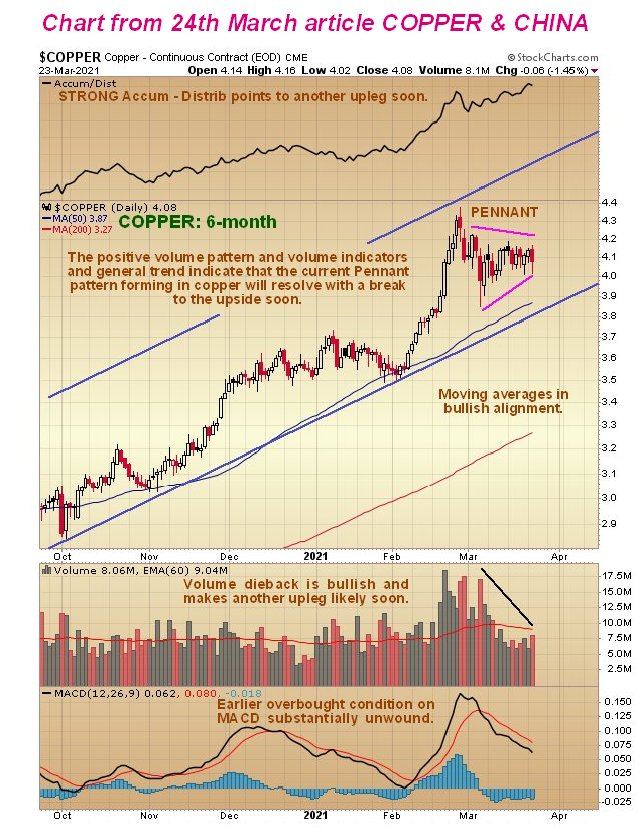

This last rally in copper was predicted on the site in the article Copper and China posted on the 24th March, with the 6-month chart for copper from that article is reproduced below…

End of update.

Posted at 6.50 am EDT on 11th May 21.