With all the endless money creation going on and continual Fed intervention, calling any kind of top in this market is a hazardous game, for as we figured out long ago, the stock market now has no connection with the economy and looks only to easy money from the Fed to sustain it.

Nevertheless, even with a bull market that seems to go on forever, there are times when corrections or shakeouts occur, as happened in July. We expected the recovery that followed early this month to probably top out and reverse at about 5450 on the S&P500, but it didn’t, it blew right through it, again probably due to Fed largesse. The purpose of this update is to point out that we are at a juncture where another reversal to the downside could occur, particularly as another potential “island top” has appeared involving another large gap that appeared on the chart about two weeks ago. We can see this on the 6-month chart for the S&P500 Index below and how, so far at least, the latest rally has not been confirmed by a relatively weaker Accumulation line. The market is also overbought after this run, although not so much as in mid-July. So there is the potential for a Double Top to form here, especially as we are at the end of the month, a good time for a change of trend. The correct disposition here is thought to be to be prepared for a drop but remain aware that a break above the resistance shown will lead to an advance to the vicinity of the top rail of the channel shown.

The Dow Jones Industrials look more toppy for the intermediate-term with this index nearer to the top of a more distinct uptrend channel as shown on its 6-month chart…

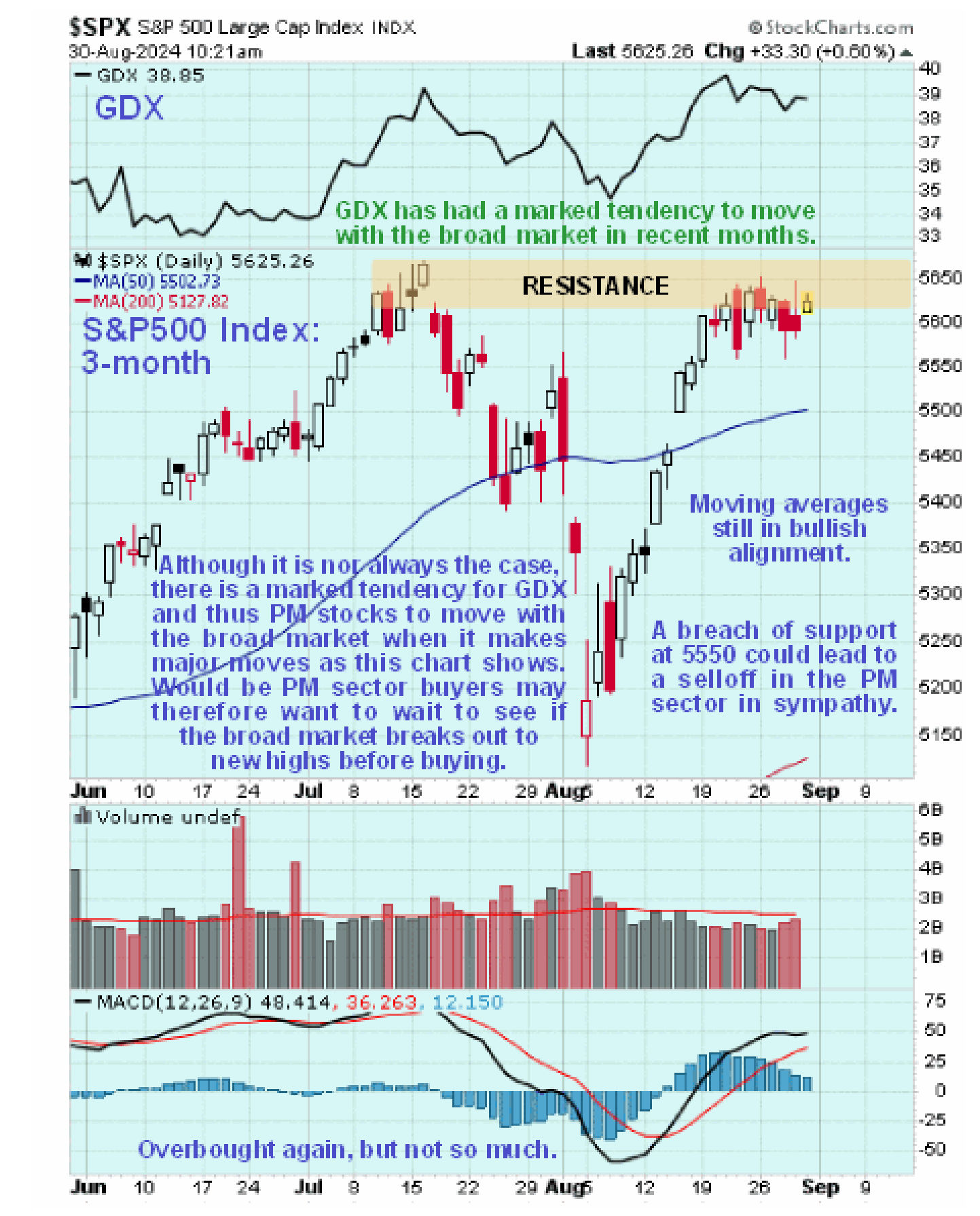

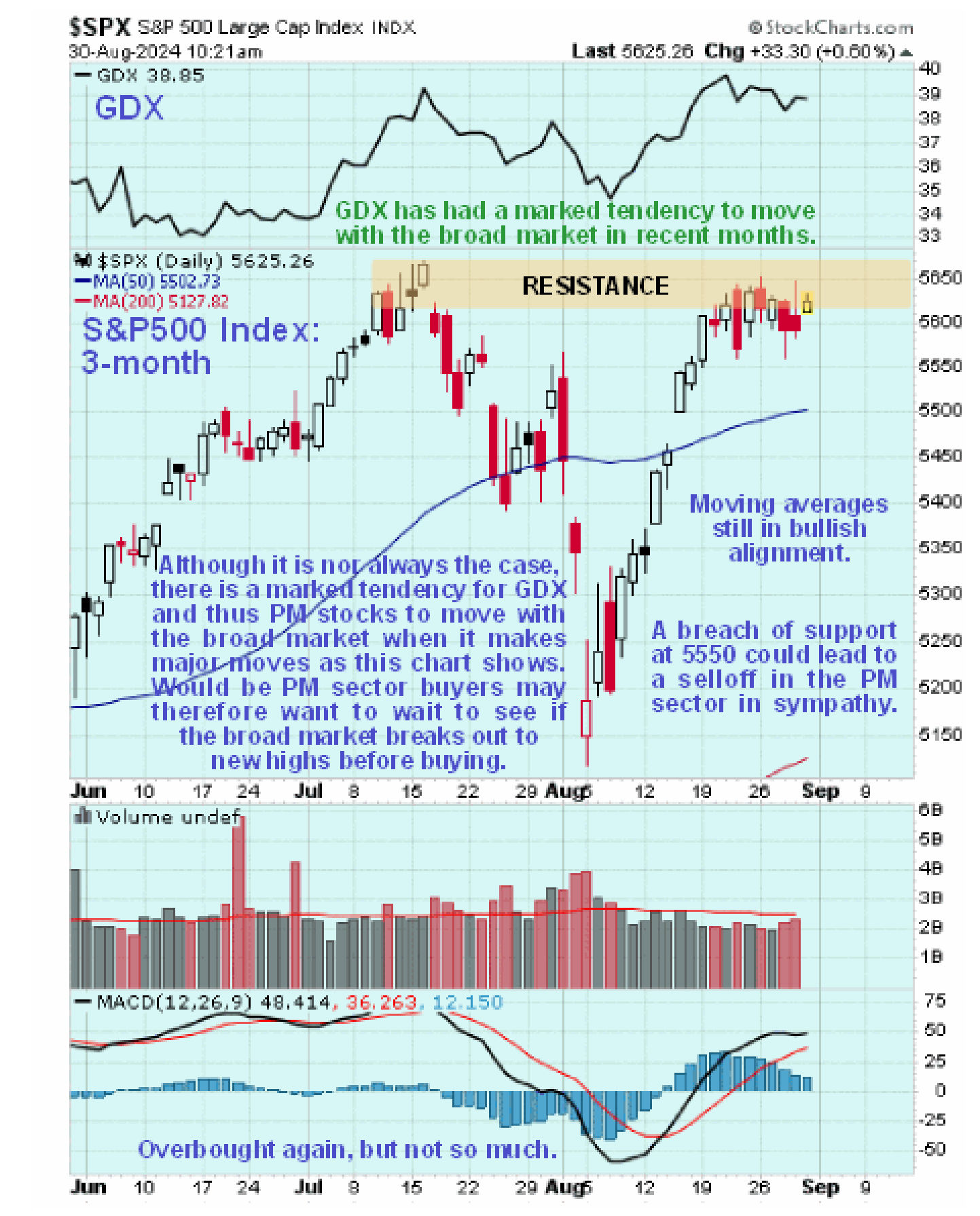

The 3-month chart for the S&P500 index is included below as it has GDX added at the top of it and it reveals that the PM sector has moved rather slavishly with the broad market in recent months, although this is by no means always the case. The takeaway from this is that if the broad market drops away soon, it is likely to take the PM sector with it…

An example of a Precious Metals stock that could drop back on a broad market decline over the short to medium-term is the big silver stock Coeur Mining which is close to the boundary of a “Distribution Dome” that could force it back to the support in the vicinity of the rising 200-day moving average which is expected to be a good point to buy or add to positions and this turns out to be the case with many PM stocks.

End of update.

Posted at 11.40 am EDT on 30th August 24.