After striving to up the “gravitas” of the site by covering a range of larger gold and silver stocks in the recent past, like an attendee at an AA meeting reaching for the bottle I find myself slipping back into recommending a penny stock again but after reading this I am confident that many of you will forgive this relapse and understand the reasons for it.

A good point to start with this is to present a brief bulleted list of some big reasons to like Nevada Sunrise and want to own its stock, which are…

- The CEO is Warren Stanyer and he has been buying shares.

- The CEO is a geo, recently acquired gold project, past-producer of 60,000 oz gold in 2 years, mine is in a county of Nevada with dozens of antimony deposits (any discovery of this would moon shot the stock).

- Underpinning its value is their Gemini Lithium project in Nevada which is the 4th largest resource in USA (Trump set to stimulate work on critical metal projects).

- The CEO has said the company is looking for JV with a major.

- Company owns hard to acquire $3M water rights (market cap of company only $2M).

- History of multi-bagging 15x in 2020 and 6x in 2022 (presume this refers to the CEO).

Nevada Surise is primarily a copper and lithium exploration stock and is also exploring for gold and antimony.

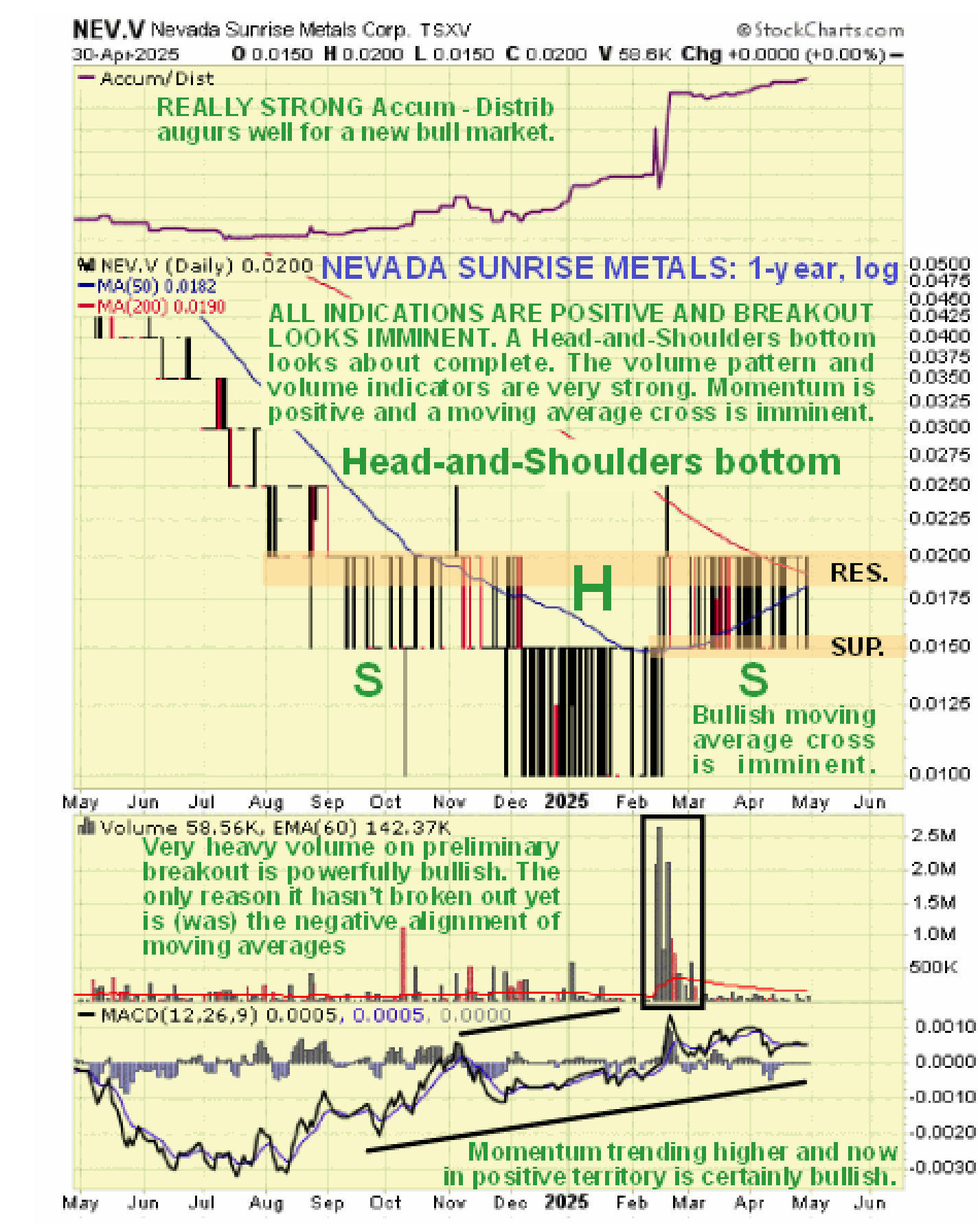

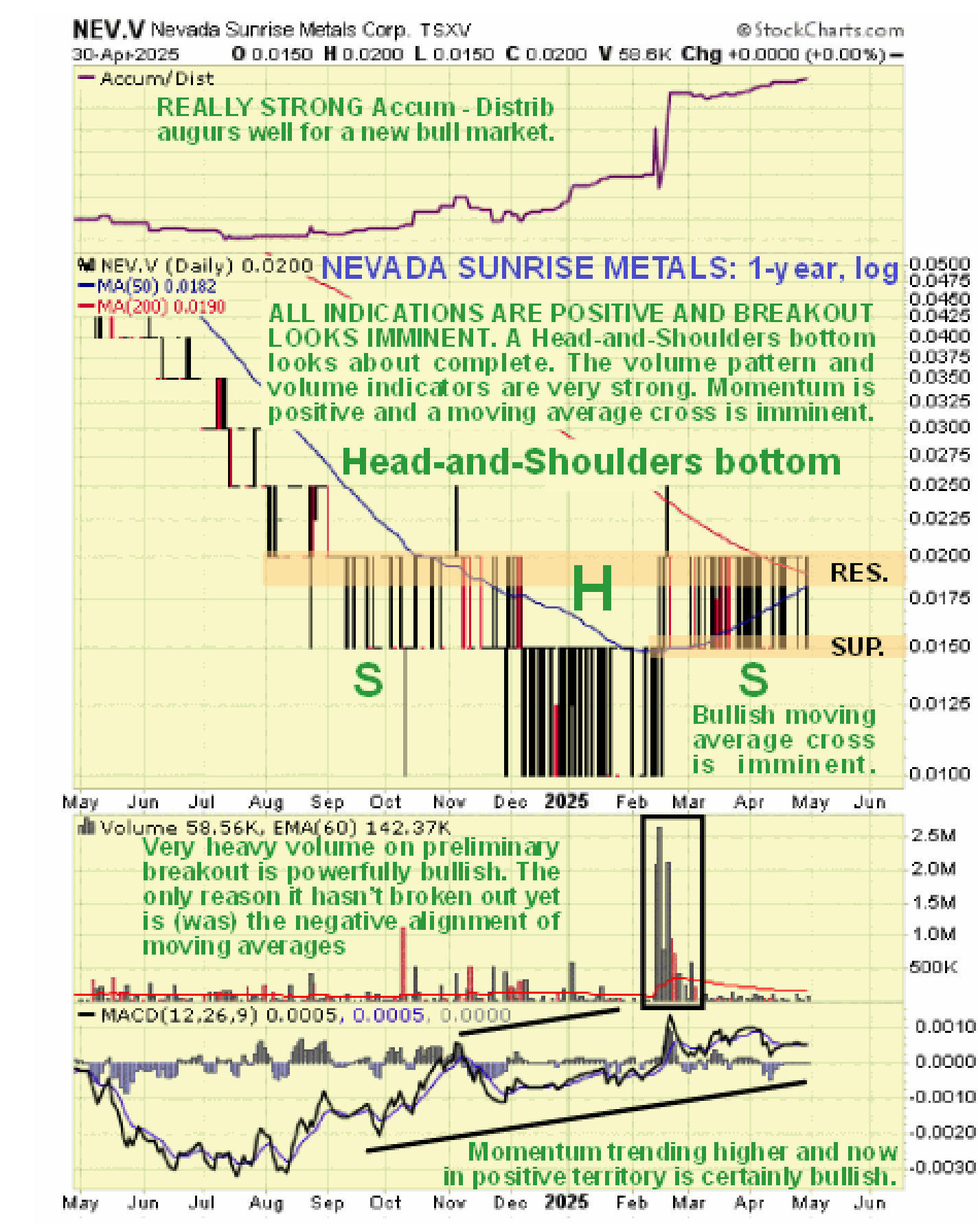

Now we come to the charts which are extraordinarily bullish, and not only that, we appear to be very close to or even on the verge of a breakout into a new bull market which, as it will start from a very low level, will result in big percentage gains in short order.

Starting with an 8-year arithmetic chart we see that Nevada Sunrise is currently trading at the miserly price of just 2 cents at what looks like a long-term cyclical low after a long and brutal bear market from its mid-2022 highs when it briefly touched C$0.40, which means that it is now at just one-twentieth of its price at that high. This is a good time to reflect on the old saying that “It’s darkest before the dawn” which is especially the case as we plan to be the early birds who reap the full benefit of the Nevada Sunrise.

Now we will shift to look at the bear market from early 2023 on a 3-year log chart which captures the bear market within a long orderly parallel downtrend which it only fell out of during the 2nd half of last year with a final capitulative selloff and on this chart we can just make out the base pattern of recent months that started to form as far back as last August – September. What is truly remarkable on this chart is the high volume rally in February to complete the right side of the Head of a Head-and-Shoulders bottom which drove the Accumulation line steeply higher so that it even made new all-time highs which is extraordinary given the still low price. Because of the net sideways movement of the stock for many months now, we can see that it is already very close to breaking out of the long downtrend and it wouldn’t take much for it to accomplish this.

The 1-year log chart enables us to see the completing Head-and-Shoulders bottom in much more detail and in particular how the strong rally on big volume in February didn’t succeed in breaking the price out because of the unfavorable alignment of moving averages at that time – it slammed into a still quite steeply falling 200-day m.a. which is why it has since bided its time consolidating and forming the Right Shoulder of the Head-and-Shoulders bottom. That big move up on huge volume is therefore classed as a “preliminary breakout” that has paved the way for the sustained breakout move to follow. Now, however, the situation has vastly improved as indicated by the imminent cross of the moving averages and the steadily improving momentum with the MACD indicator now trending higher into positive territory. In short, everything is in place for a decisive breakout into a major new bull market to occur soon.

In conclusion, Nevada Sunrise is rated an exceptionally strong buy for all time horizons.

Nevada Sunrise website

Nevada Sunrise Metals Corp., NEV.V, NVSGF on OTC, closed at C$0.02, $0.014 on 30th April 25.

Posted at 10.20 pm EDT on 30th April 25.