Further to

yesterday’s update on palladium in which it was deduced that it is about to start another big upleg, the logical next step is to find a suitable vehicle or vehicles to trade the expected gains in palladium. Although Sibayne-Stillwater (SBSW) is the one big palladium producer in the US, its chart has nowhere near the promise of the subject of this article, the Sprott Physical Platinum and Palladium Trust – and the platinum element in it is no problem as the platinum price looks set to advance in tandem with palladium.

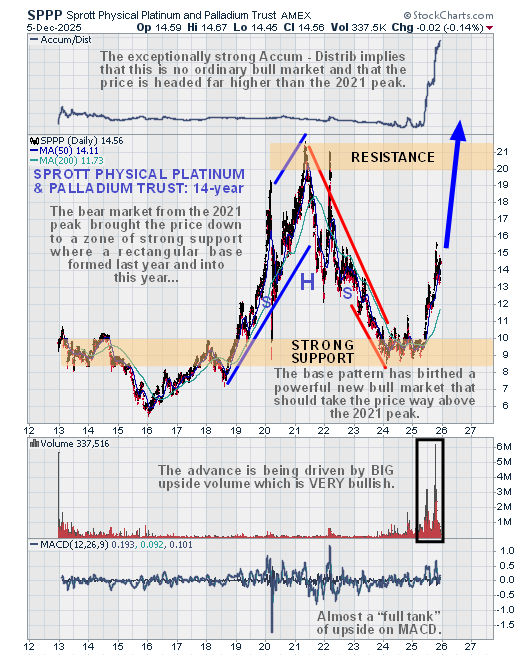

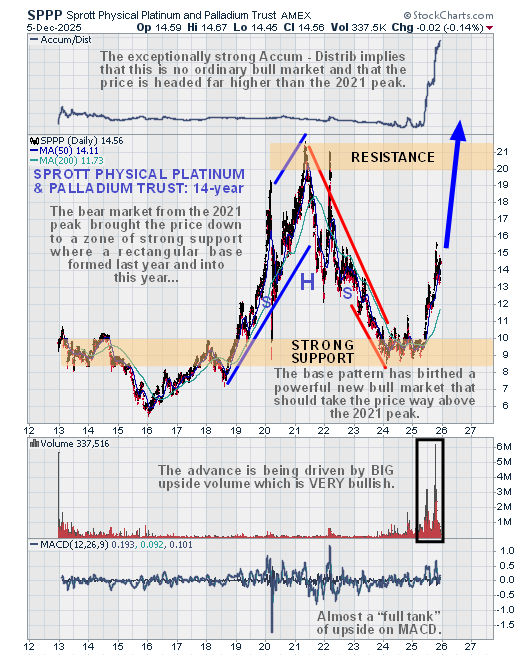

We’ll start with the 14-year chart for the Sprott Physical Platinum and Palladium Trust, hereafter mostly referred to by its code SPPP for brevity, which shows the entire price history of the Trust. We can see almost instantly that a powerful bull market is already underway. A giant Head-and-Shoulders top formed between late 2019 and early 2023 that led to the price breaking lower and heading down into the zone of strong support shown, although by the time it broke down from the tall Head-and-Shoulders top it had done most of the bear market from the 2021 peak. Upon arriving at the zone of strong support, a tight rectangular base pattern formed during 2024 and into this year that birthed the current strong bull market. What is striking on this chart is the strong upside volume driving the new bull market that has caused the Accumulation line to skyrocket. This is very bullish indeed and implies that SPPP is headed much higher than its 2021 peak at about $21.50.

Zooming in much closer by means of a 9-month chart enables us to examine the new bull market in its entirety in detail from when it began in April of this year. As we can easily see, a fine steady and strong uptrend has become established which has so far consisted of two uplegs followed by two normal reactions back to the lower boundary of the uptrend with the 3rd upleg that is still in its early stages having just begun towards the end of last month. Both the volume pattern and Accumulation line are exceptionally strong. This chart allows us to easily project a minimum upside target for the current advance which is the upper boundary of the channel at about $18 and given the aforementioned strength of this advance, it could even accelerate out the top of this channel with the result that it becomes steeper.

Lastly, a 3-month chart is useful as it shows recent action in detail. On this chart we see how the price already broke out of the corrective downtrend late last month with a gap move (breakaway gaps do not need to be filled) that has been followed by a fine small Flag that has formed on diminishing volume which is expected to lead to renewed advance imminently.

The conclusion must be that Sprott Physical Platinum and Palladium Trust is an immediate strong buy for all timeframes.

Sprott Physical Platinum and Palladium Trust webpage.

Sprott Physical Platinum and Palladium Trust, SPPP on AMEX, SPP.TSX, closed at $14.56, C$20.17 on 5th December 25.

Posted at 5.10 am EST on 7th December 25.