If I was the owner or CEO of a Canadian marijuana company, I would send a box of chocolates and a bunch of flowers to Jeff Sessions , the Attorney General of the US, with a note reading “Dear Jeff, I believe I can safely speak for the entire Canadian marijuana industry when I thank you and the Federal Government for holding back the US marijuana industry, so that we here in Canada can advance freely to become the global leaders in the field – these flowers and chocolates are but a small token of our appreciation”.

Actually, we took our eye off the ball a bit with the marijuana sector. Having got bored with it when it went into a lengthy correction after various US States voted on legalization last year, at the time of the US elections, we turned our attention to more active areas, like Biotech and Medical stocks, pending the mighty bullmarket in the Precious Metals sector, which by and large worked out, but as a result we have missed out on the early stages of the next phase of the marijuana sector bullmarket, which has already gotten going in the favored Canadian market. There are promising Canadian stocks that haven’t really started moving yet, however, and Revive Therapeutics is one of them.

Before going further I would like to point out that when I think of the Marijuana industry I don’t think of stupid students getting stoned and staring into space and bursting into uncontrolled laughter and then going and causing traffic accidents, and maybe jumping off the roof and trying to fly because they suddenly think they are a bird. I think of the silent majority of normal everyday citizens who are seeking more natural and effective medicines and tonics to stay healthy or treat ailments, and the senior market for marijuana based medicines and treatments is truly vast, and only just starting to be tapped – and the Canadian companies which are growing rapidly are the leaders in the field.

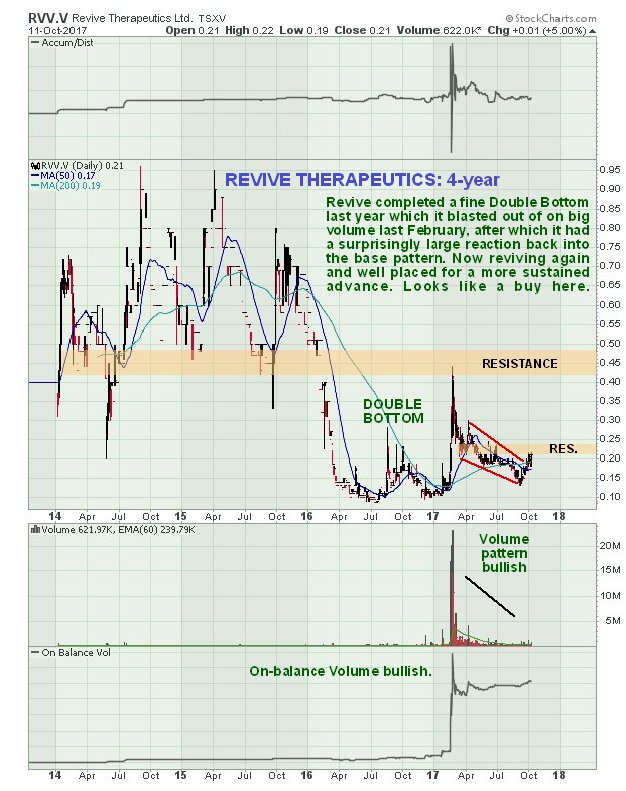

On its 1-year chart we can see that, perhaps surprisingly, Revive didn’t partake in the big sector ramp into last November, but instead spiked dramatically on huge volume in February of this year. After the spike it reacted back hard, and then went into a long downtrend that ended early in September with it losing all of the spike gains. Since hitting bottom it has recovered to break out of the downtrend, with momentum improving, and is now looking a lot better. However, it continues to be restrained by unfavorably aligned moving averages (whose alignment is rapidly improving) and the band of significant resistance not far above the price shown on its 1-year chart below. Volume has been very light in recent months, a positive sign as it shows a lack of public interest, which is normally the time when Smart Money quietly accumulates. This looks like a good time to buy this stock which could really “light up” when it breaks above the resistance level.

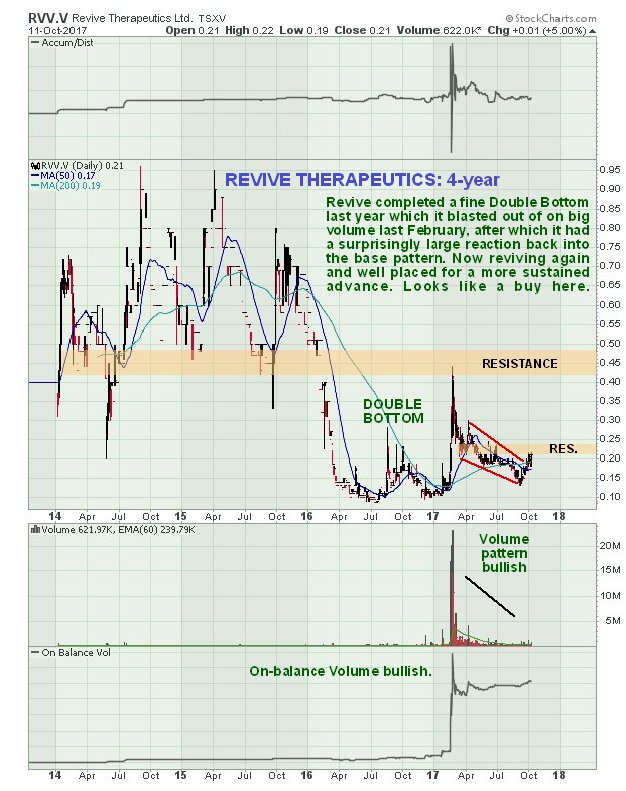

The 4-year is very interesting as it shows that the spike back in February marked the breakout from a fine low Double Bottom. The extent to which it has reacted back following this high volume breakout is surprising, as it has given back almost all of the gains, but we are not complaining because it gives us a second chance to buy it at a good price ahead of an expected advance that this time round should prove more sustainable because the entire sector is now starting to forge ahead again.

Conclusion: Revive looks attractive here, and is rated a buy anywhere below the resistance level shown on the 1-year chart. If it reacts back it shouldn’t be by much.

Conclusion: Revive looks attractive here, and is rated a buy anywhere below the resistance level shown on the 1-year chart. If it reacts back it shouldn’t be by much. The point for a stop is just below C$0.18. The stock trades is very light volumes on the US OTC and it is therefore much better to buy it on the Canadian market. There are a modest 36 million shares in issue.

Revive Therapeutics

website

Revive Therapeutics Ltd RVV.V, RVVTF on OTC, closed at C$0.21, $0.15 on 11th October 17.

Posted at 7.55 am EDT on 12th October 17.