We

“threw our hat in the ring” at the wrong time with this one, but

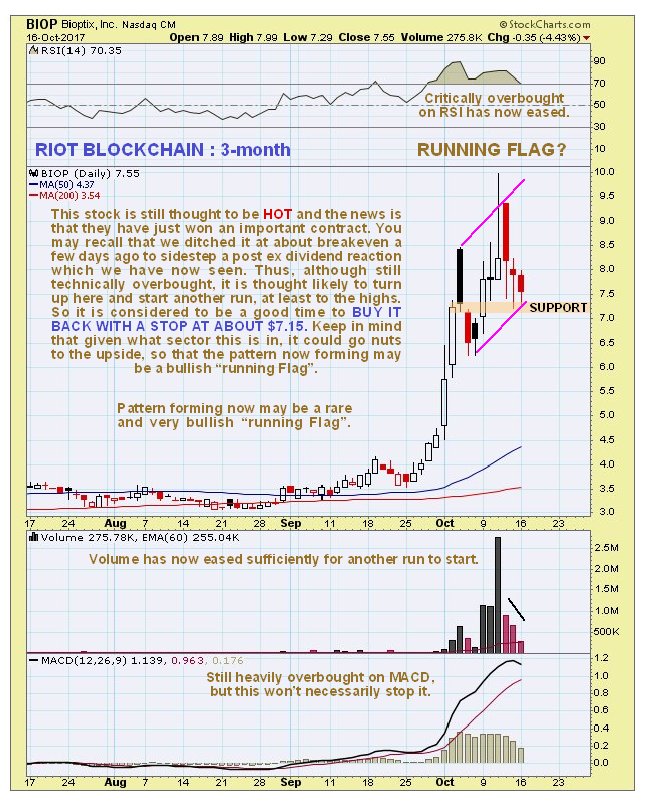

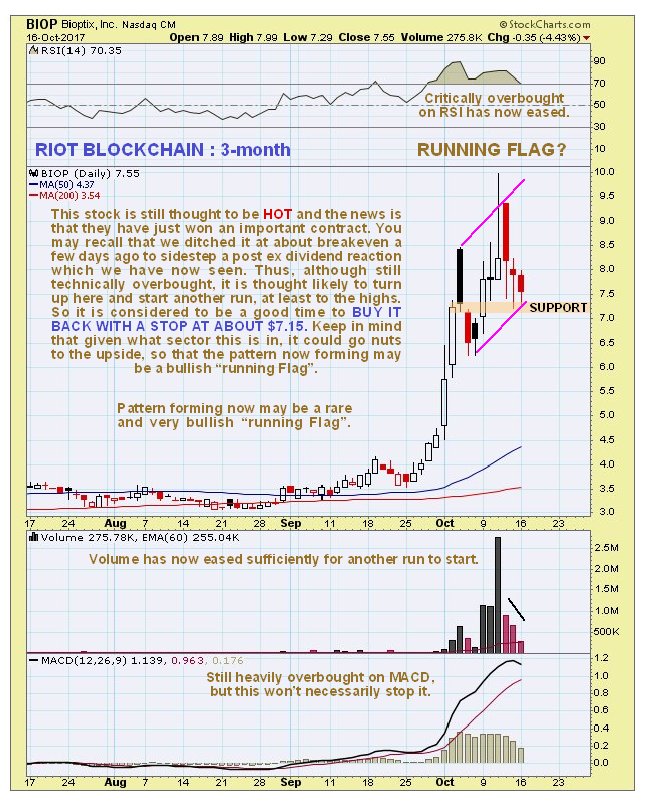

managed to escape relatively unscathed before the post ex-dividend reaction of the past few days set in. However, this stock is still thought to be HOT in one of the hottest sectors there is – blockchain technology. When we look at the latest 3-month chart we can see that it has still “only” risen from an approx. $4.00 peak in mid-September to the current $7.55 which is nothing considering the business that this company is in. Thus it is interesting to observe how volume has dropped back in a satisfactory manner as the price has reacted back in recent days, with the long-tailed candles of recent days just above the support level shown increasing the chances that it is about to reverse to the upside again. These factors taken together suggest that a rare and very bullish “running Flag” may be forming bounded by the pink trendlines shown on the chart, which is a type of Flag that is upwardly skewed into the direction of the prevailing trend, implying that the trend is so strong that it won’t even react properly. If this really is the case then we can expect another powerful rally soon, and at the least it should make it back to the recent highs, which would result in a good percentage gain from here.

Conclusion: Riot Blockchain is rated a buy again here for another advance which could be really big. Due to the proximity of support, risk can be minimized by placing a stop at about $7.15 beneath the intraday lows of recent days. MINIMUM target is the recent highs at $10.00.

Conclusion: Riot Blockchain is rated a buy again here for another advance which could be really big. Due to the proximity of support, risk can be minimized by placing a stop at about $7.15 beneath the intraday lows of recent days. MINIMUM target is the recent highs at $10.00.

Riot Blockchain

website

Riot Blockchain BIOP on NASDAQ CM, closed at $7.55 on 15th October 17.

Posted at 5.45 am EDT on 17th October 17.