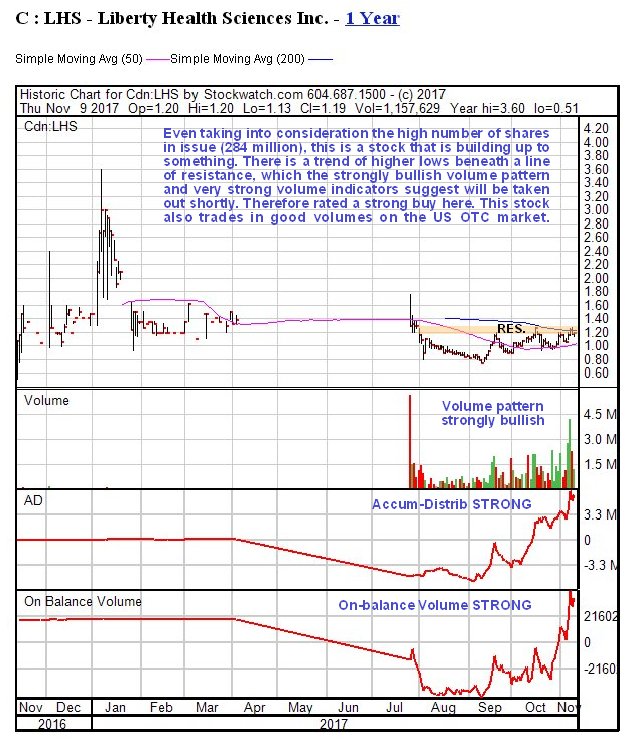

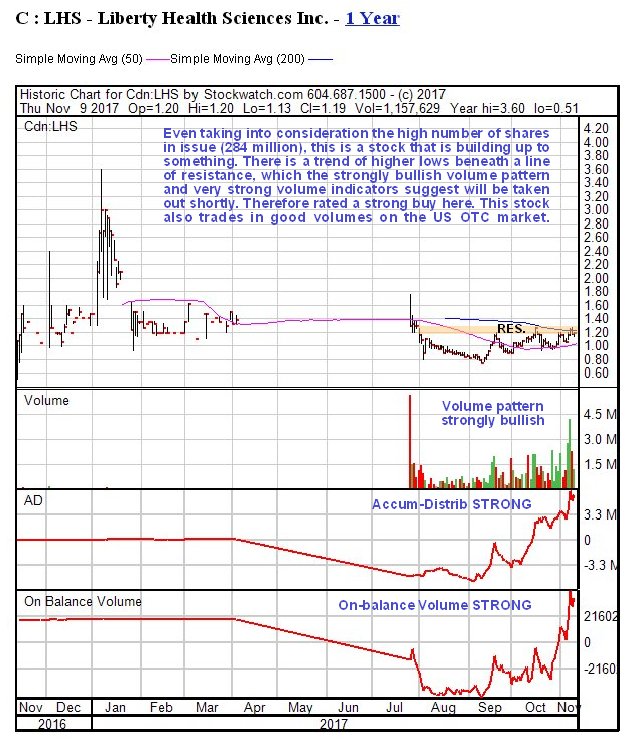

Although the large number of shares in issue is a drag factor for this stock, sometimes it is justified by the scale of a company’s operations, and while it is not known for sure if this is the case here, what is clear on the charts is that this stock is getting ready to break out upside to appreciate sufficiently over the medium-term to justify tasking a position in it here. We

first looked at Liberty about a month ago when it was at C$1.11 and the technical condition of the stock has since continued to strengthen.

On its 1-year chart we can see that after starting trading again in July, Liberty drifted lower before recovering and then tracking sideways / up within a narrowing range beneath a resistance level at about C$1.20 – C$1.25, with moving averages swinging into bullish alignment. All the while upside volume has been building, driving volume indicators steeply higher, so that technically the situation is like a pressure cooker – this thing is going to blow in a positive way, with a breakout to the upside that should result in good percentage gains in fairly short order, despite the high number of shares in issue.

Liberty Health Sciences is accordingly rated an immediate strong buy, and anyone holding should of course stay long. Stops at personal discretion as there is a broad range of support beneath the current price.

Liberty Health Sciences is accordingly rated an immediate strong buy, and anyone holding should of course stay long. Stops at personal discretion as there is a broad range of support beneath the current price. Liberty trades in good volumes on the US OTC market, where, as ever, limit orders should be employed.

Liberty Health Sciences

website

Liberty Health Sciences, LHS.CSX, LHSIF on OTC, closed at C$1.19, $0.93 on 9th November 17.