After missing the spectacular rocket move in Riot Blockchain (RIOT), due to being stopped out, I, and maybe you too, felt like

the lady at Hong Kong airport who missed her flight, but after picking myself up from the floor I consoled myself with the thought that “there’s always another train leaving the station” and recovered what I could of the smashed furniture and ornaments around me, but then couldn’t stop brooding about it – that wasn’t just any old train it was a big shiny beautiful powerful train, like The Flying Scotsman, of the sort that you only see once in a blue moon – and

we actually had a seat on it and got off not long before it left the station.

I at last started to feel better when we caught the massive ballistic runup in Marathon Patent on Friday, which we had positioned ourselves for well in advance, but only started to feel really cheerful again when a powerful and well-connected associate brought Analytix Insight Inc. to my attention this weekend, which is another Blockchain that is still cheap and has one of the most bullish looking charts I have ever seen.

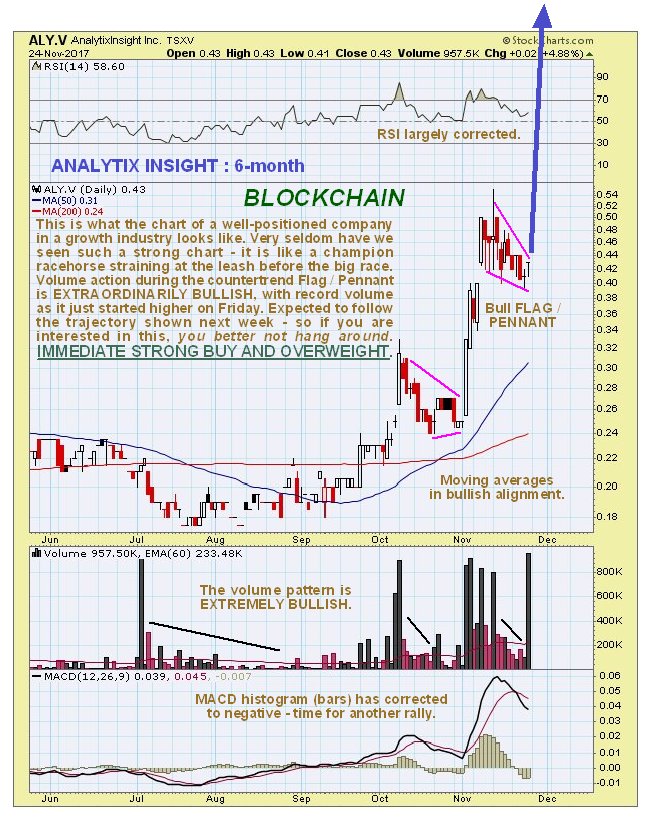

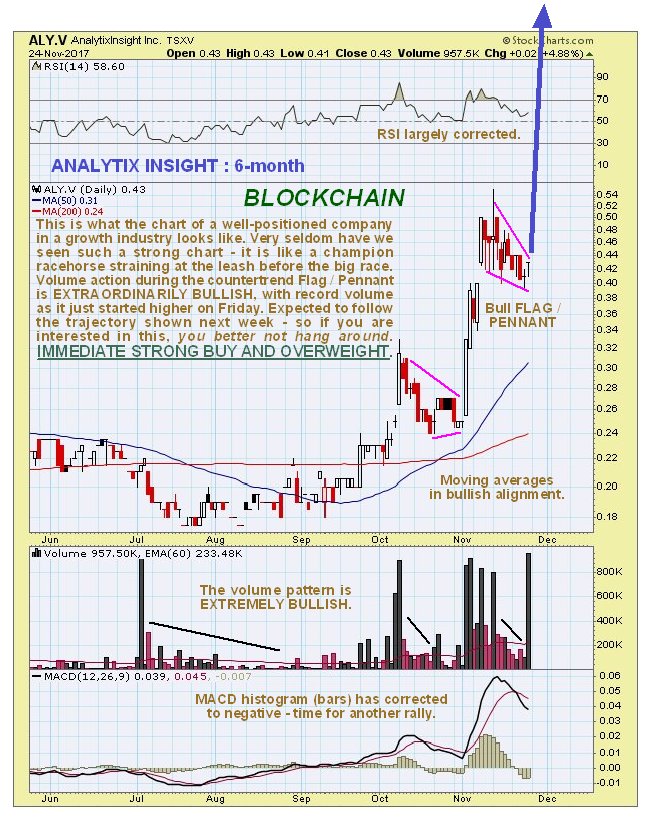

We can see what is going on in this stock to advantage on its latest 6-month chart. Here we see that it started to break out on heavy volume early in October, and then consolidated within a Pennant on dwindling volume before making another upleg early this month, this time a bigger and more dramatic one, again on heavy volume, since which time it has settled into another countertrend Pennant, accompanied by an exceptionally bullish volume pattern, with volume dying right back as the price eased back within the Pennant, but quickly exploding to record levels on Friday as it started to pick up again. This is the strongest signal possible that another big run is about to begin. A breakout from the Pennant leading to another steep upleg as shown on the chart is therefore believed to be imminent, so those of you who are interested should go for it first thing on Monday morning, and it is worth chasing it if it opens up, provided that it doesn’t gap up huge of course.

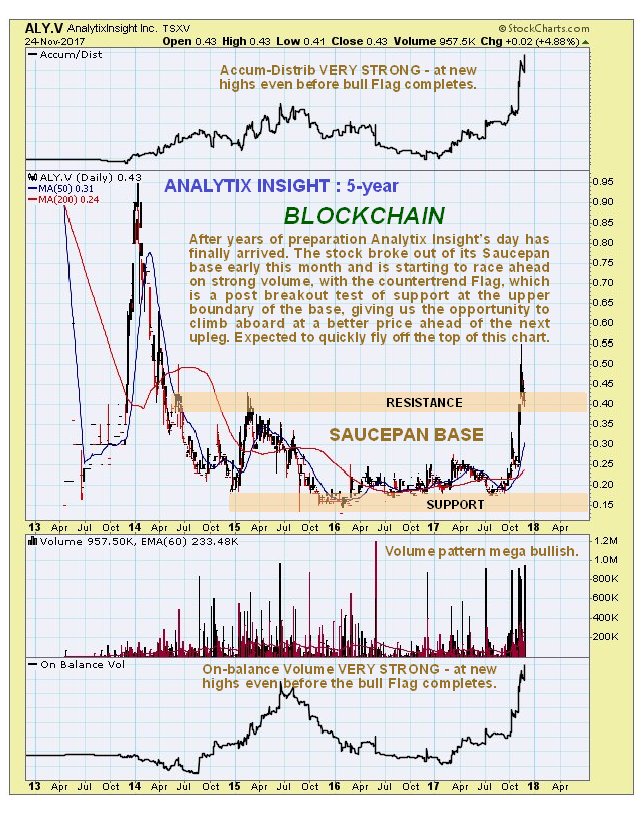

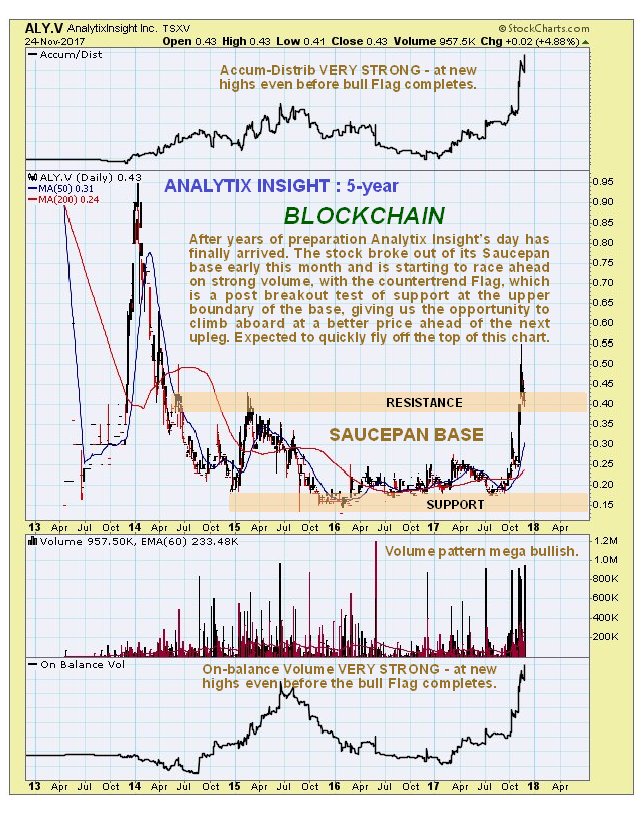

The long-term 5-year chart shows that Analytix has been building up to these “glory days” for a long time, having marked out a large base pattern from as far back as mid-2014, with the part of it from mid-2015 being a Saucepan base. The upper limit of this base pattern is the early 2015 peak at about C$0.43, which means that it only broke clear out of this base pattern with the sharp rally early this month, and also means that the countertrend reaction back within the Pennant of the past 2 weeks or so is a classic post-breakout reaction back to test what is now support at the upper boundary of the base pattern. Quite clearly, a 3-year plus base pattern is hardly likely to be followed by a bullmarket lasting just one week -

NO – THIS IS GOING TO BE BIG, ESPECIALLY GIVEN THAT IT IS A BLOCKCHAIN, AND A CHEAP ONE AT THAT, AND GIVEN THAT ITS VOLUME PATTERN IS EXCEPTIONALLY BULLISH AND ITS VOLUME INDICATORS ARE AT NEW HIGHS AND GOING THROUGH THE ROOF, EVEN AS IT REACTS BACK WITHIN THE PENNANT.

Conclusion: Analytix Insight is rated an immediate strong buy at the open on Monday, ideally on the Canadian market as it is still thinly traded on the US OTC market, although this appears to be changing fast.

Conclusion: Analytix Insight is rated an immediate strong buy at the open on Monday, ideally on the Canadian market as it is still thinly traded on the US OTC market, although this appears to be changing fast. Whilst the number of shares in issue at 64 million is much higher than Riot Blockchain, the stock is much lower priced.

Analytix Insight

website

Analytix Insight Inc, ALY.V, ATIXF on OTC, closed at C$0.43, $0.34 on 24th November 17.

Posted at 8.30 am EST on 26th November 17.