South32 has the distinction of owning the giant

Cannington Mine, the world’s largest and lowest cost producer of both lead and silver, which is good to know, since we are of the opinion that silver is at a very low price and is an extremely good value investment here. The company is also a very big producer of other base metals, but as far as is known has not yet discovered any

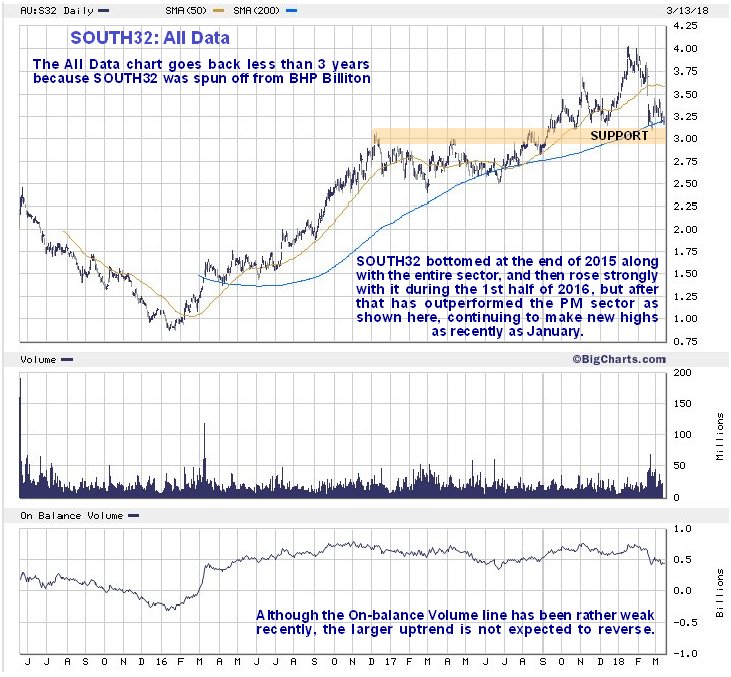

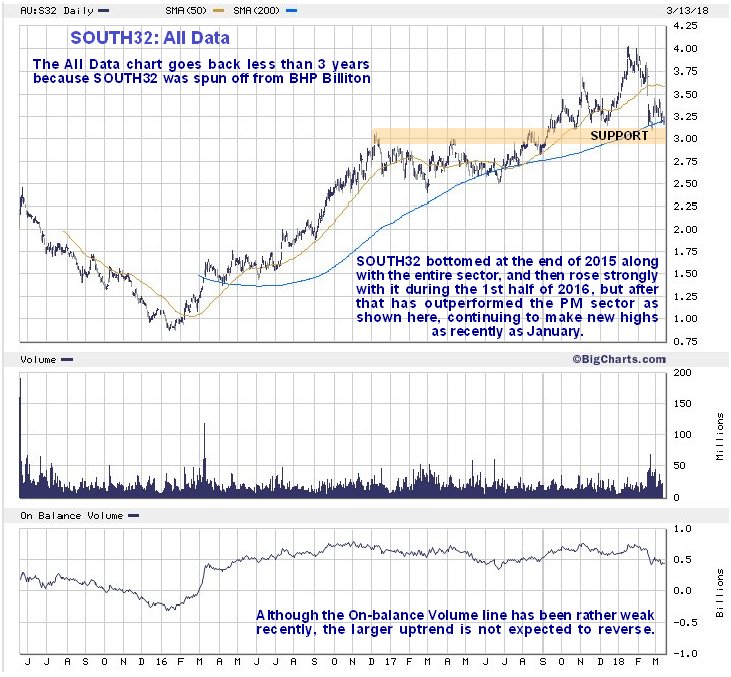

unobtanium. The stock charts only go back about 3 years because the company was spun off from BHP Billiton several years ago.

On the all data chart which goes back to mid-2015 we can see that after being spun off, South32 continued to drop in a severe downtrend in sympathy with a weak sector, until it hit bottom in January 2016. It then reversed into a strong uptrend, again in sympathy with a now strong sector, but while the sector advance stopped and reversed in August 2016, South32 carried on to higher levels until December 2016, and then ran off into a long consolidation pattern that ended with an upside breakout the following September. This quite strong upleg continued until January and last month it reacted back to its rising 200-day moving average and to a point not far above the support level shown, where it is suspected to be forming an intermediate base pattern, because the rising 200-day moving average is an indication that the trend is still up, and this factor is thought to override the rather weak On-balance Volume line in the recent past, especially because of the now positive outlook for gold and particularly silver.

The following chart is the same all data chart as the one above, but with the Market Vectors Gold Miners ETF, GDX, overlayed, so that the performance of South32 can be compared with the performance of the PM sector as a whole. As we can see, it moved with it until the Summer of 2016, but after that South32 outperformed significantly, which is all the more impressive given the drab performance of silver over the past year or two.

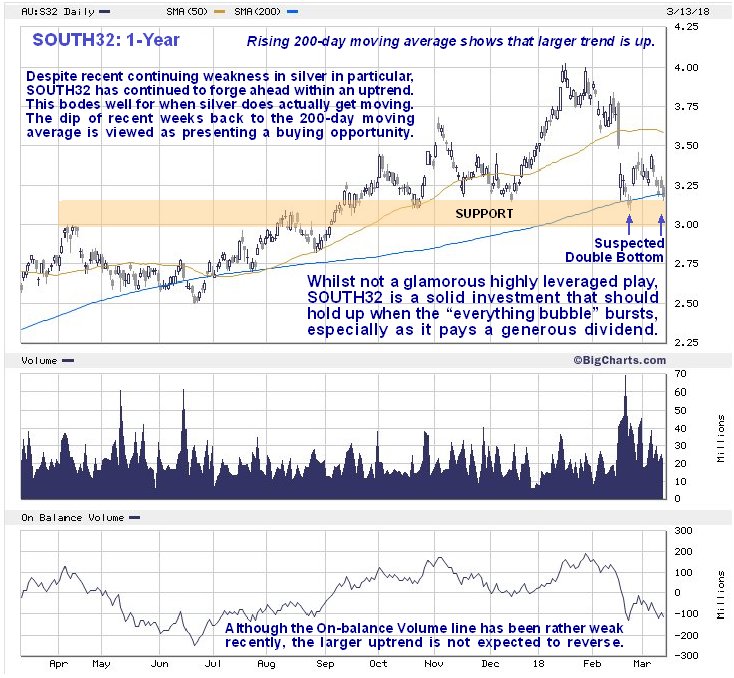

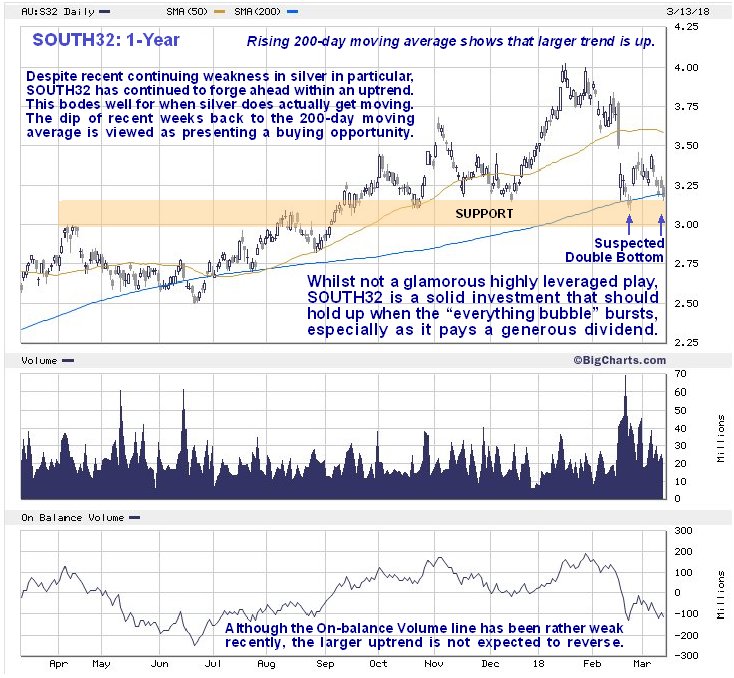

On the 1-year chart we can see recent action in rather more detail, in particular how the reaction back from the January high has presented a better entry point. The still rising 200-day moving average and proximity of strong support indicate a high probability that it will turn up from this area, and it is currently believed to be making a small Double Bottom with its late January low, that will lead to another upleg.

The number of shares in issue is a daunting 5.2 billion, but that doesn’t seem to have slowed it down, probably because it is a mining company whose output of silver and base metals is on a truly gigantic scale.

A preliminary search for the company’s website turned up what I at first thought was a social or welfare club. When you enter it you find yourself on a website that is wonderfully politically correct, and for example it is easier to find information on the company’s anti-slavery policy than it is to find information on production and the company appears to be almost apologizing for mining as in “Look, we have to make these big holes in the ground, so that you can have metals for your cars, Iphones and washing machines etc” – it’s enough to make an old school miner cringe – wonder what

Crocodile Dundee would have to say about it? It’s nice though to see attractive lady miners in clean hard hats, although we know that in reality they would look more like all-in wrestlers. Speaking of political correctness, some of you may remember that Sweden used to be a wonderful country, charming and civilized – not any more – thanks to the politically correct policy of letting in hordes of immigrants unchecked and then treating them as more important than the locals, the country has been culturally and socially ruined – watch this astounding, if somewhat “in your face” video report on it

HOW SWEDEN IS COMMITTING SUICIDE THROUGH POLITICAL CORRECTNESS.

Back to South32, while the company’s website may portray it is as a social club and a fun place to work, the underlying reality is that they “produce the goods” and in vast quantities, and in a world in which many companies produce nothing of any substance, it represents a solid investment at a time when commodities look set to move to the forefront and become one of the best performing sectors.

South32 is thus rated as a solid investment here for the future, that is at a good entry point after its recent dip. The company’s stock also trades on the London Stock Exchange in big volumes and the Johannesburg Stock Exchange.

South32

website

South32 Ltd, S32.ASX, S32.LSS, closed at A$3.18 on 13th March 18, trading at 181.10 at 2.53 pm GMT on 13th March 18.

Stay tuned – for upcoming reports on neighboring South31 and South33.

Posted at 2.10 am AEST, 10.10 am EST on 13th March 18.