In this morning’s update entitled

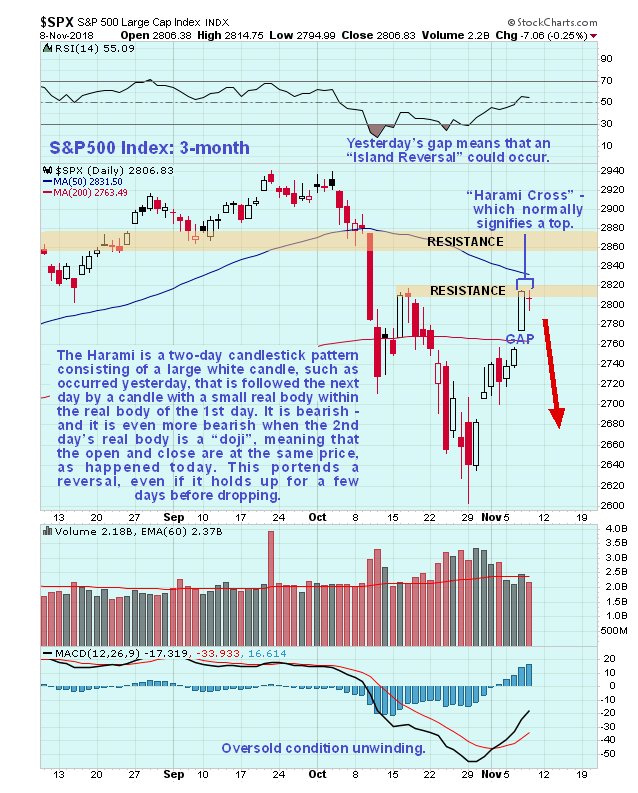

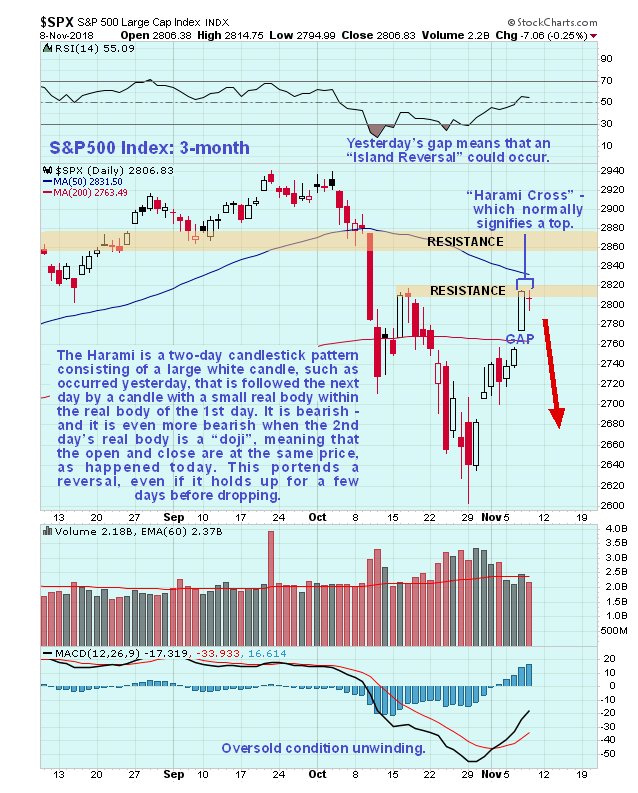

Post US Election Commentary, we looked at the latest S&P500 index chart and figured that, after yesterday’s big up day, it might creep higher between the 2 resistance levels shown on its chart for tonight’s close below and form a top area before dropping away, a process that could take from a few days to a week or two. Now, however, after today’s action, it looks more likely that it could drop back sooner, or even immediately, because a bearish “Harami“ pattern completed on the chart today (with a similar pattern appearing at the same time in other major US indices). The bearish Harami is where a big white candle, as occurred yesterday is followed by a small candle whose real body (trading between open and close of the day) is entirely within the real body of the 1st candle, as was the case today, and it is even more bearish if the 2nd candle’s real body is a “doji”, meaning that the open and close were at the same price, as was also the case today, which makes it a “Harami Cross”. Today’s action therefore indicates that the broad market is probably reversing, even if holds around current levels for a few days before dropping. This is why, emboldened by seeing this, we decided to go for Apple Puts again in the late trade, having sold an earlier tranche of November expiry Puts for a big profit before the sharp bounce of the past couple of days.

Let’s now quickly review Apple’s latest 3-month chart, which, it has to be said, looks awful. A few days back it crashed the support in the $211 - $213 zone as we had expected on the release of its results – results which pointed to future omissions which mean that Apple’s glory days are over. This steep drop a few days back occurred with gaps and on heavy volume, which taken together have very bearish implications. Fortunately we saw yesterday’s bounce coming and

quickly sold out our Puts for a good profit, expecting that it would bounce back to the underside of the failed support that is now resistance, which it has just done, and in so doing afford us the opportunity to roll out to later Put expiries. We were initially wary that it might rebound a little higher, on further gains in the broad market, but after today’s bearish action in the broad market it looks like it’s about done and will turn tail and drop again soon. So the coast is now believed to be clear to buy Apple Puts again.

An Email alert was sent out during the final hour of trading today, which read as follows…

“Apple Puts as Broad Market reversal pattern forming

You may recall that we offloaded our Apple Nov 210 Puts for a fat profit a few days back (they almost tripled in a week). Since then we have been waiting for an opportunity to re-enter the Put trade, rolling out to the December expiry. (Any of you who did offsetting Calls - to make it a Straddle will have to forget the Call side of it, which is about worthless now, and substract the loss on that from the Put gain).

Today, a potentially very bearish "Harami Cross" is forming in the Dow and other major stockmarket indices, which suggests that it will soon turn and drop away again, so it looks like a good time to do the Apple Puts again. Apple's chart is still awful, with heavy downside volume and gaps, and it looks set to get clobbered soon, and with it just having bounced up to resistance at the underside of its recent top, this looks like the time t o scarf up Puts again. A series considered suitable is the December $200's now at $2.78. An article backing up this Email update with charts will be posted later, after the close, but since time is clearly of the essence for those of you who are interested, this Email is being sent out without delay. As ever, a risky trade of this nature is only suitable for experienced saubscribers of a more sporting disposition.

Apple last price $207.76, Apple December $200 Puts last price $2.78.”

Apple rose a little by the close, with the result that the Dec $200 Puts ending up closing at $2.55, a little cheaper, so they will be better value in the morning for those of you who are interested, assuming Apple doesn’t open down significantly. The Put option prices at the close are shown in the following table…

Click on chart to popup a larger, clearer version.

Table courtesy of bigcharts.com

Apple Inc, AAPL on NASDAQ GS, closed at $208.20 on 8th November, with the December $200 Puts closing at $2.55 ask.

End of update.

Posted at 8.22 pm EST on 8th November 18.