You might recall that in the PRECIOUS METALS SECTOR update posted on Sunday that we were looking for the Precious Metals sector to get whacked back and it started yesterday with GDX being beaten down 7% - hardly surprising given what happened to the market as a whole – but gold held up, even making new highs in the early trade as we can see on its latest 6-month chart below. However, with sentiment at positive extremes for gold in recent weeks, it now looks set to follow PM stocks down, and it already started down overnight.

Gold is way overbought relative to its 200-day moving average and could take quite a hit from here. It is thought likely that it will drop back either to the black line shown on the chart, or lower to the support level – a move of sufficient magnitude to present us with an opportunity, even taking into account last night’s drop.

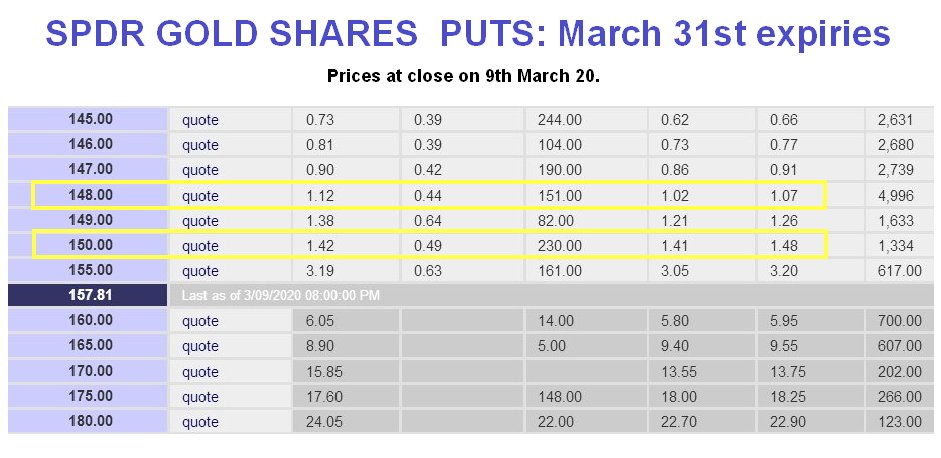

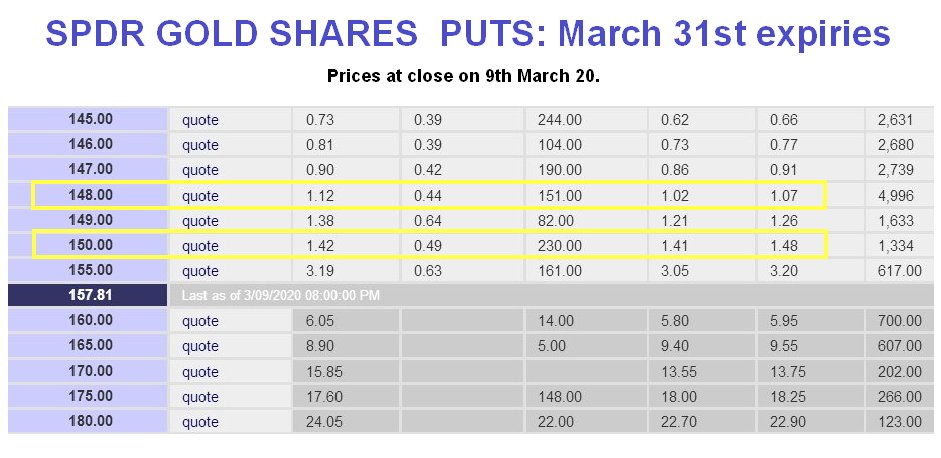

One way to exploit this opportunity is by means of Puts in gold proxy SPDR Gold Shares Puts options. As we would expect its chart looks very similar to gold itself, with the differences being that its Accumulation line has been extremely weak in the recent past and it has more a more definite Double Top. If you are interested, I would suggest the March 31st expiring $148’s or $150’s. This provides enough time and although it is considered unlikely that GLD will drop below the black line currently just above $147, an approach to the line would ramp the prices of these options. GLD options are quite liquid with good spreads.

20.jpg" border=0 align="" hspace=5 width=600 >

Table showing the Puts expiring on March 31st…

Table courtesy of www.bigcharts.com

Table courtesy of www.bigcharts.com

The 3-month chart for GDX shows how PM stocks got whacked back yesterday as expected, suggesting that gold will follow suit.

SPDR Gold Shares

website

SPDR Gold Shares, GLD, closed at $157.81 on 9th March 20.

Posted at 6.35 am EDT on 10th March 20.