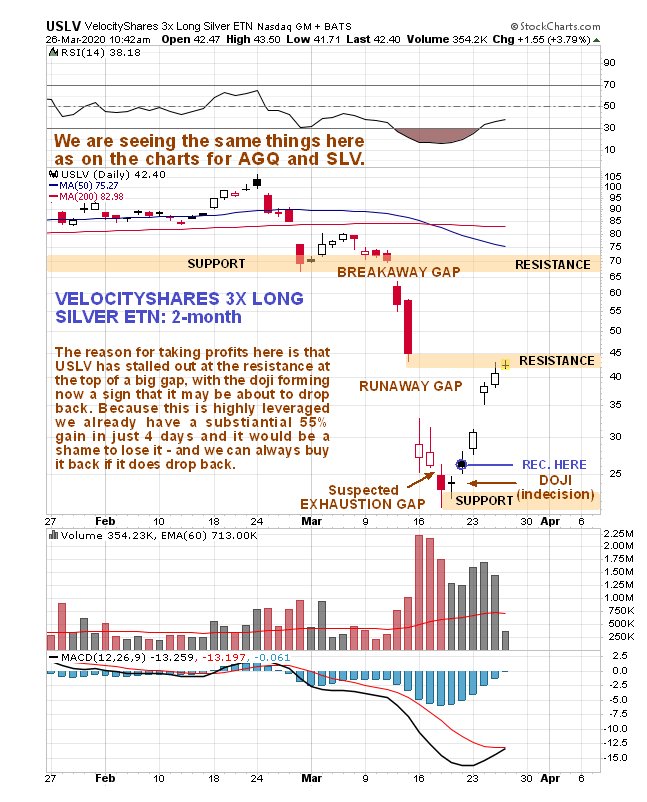

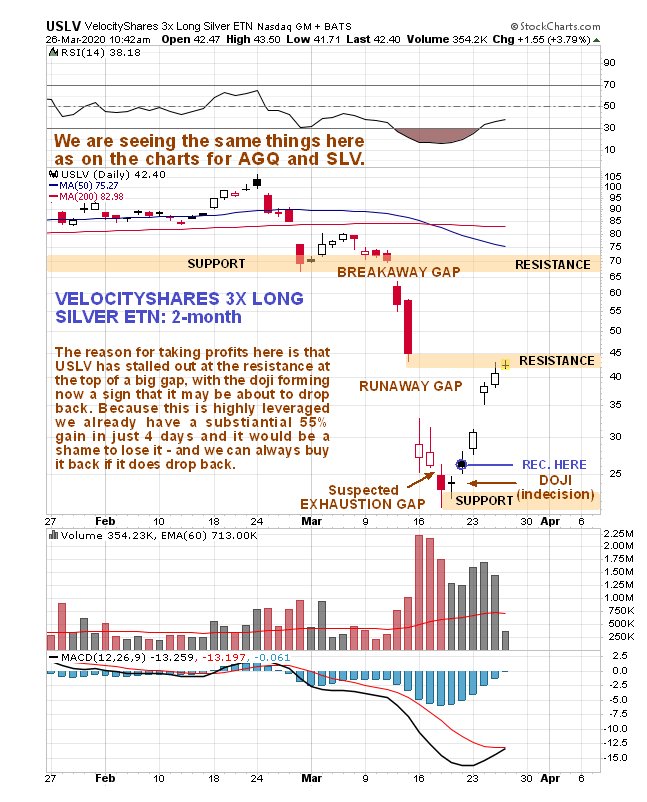

The action in USLV this morning suggests that it may be on the point of reversing to the downside as the rally off recent lows has slowed as it has arrived at the resistance at the top of a large gap, and at this point a bearish looking “doji star” candle appears to be forming. It might not look like much on the chart, but we have a good profit in this, as it is so leveraged and we have a gain of 55% in 4 days from we bought it, which we don’t want to give back to Mr Market. Keep in mind that the overall tenor of this chart is still negative, with the price still below bearishly aligned moving averages.

Selling this here does not mean that we no longer believe that silver is undervalued and due a massive rally before much longer. We do, but this could return to recent lows before that happens, so we will be looking to buy it back on a dip.

It is now considered to be time to TAKE PROFITS IN AGQ AND SLV, for the same reasons, and in any SLV Calls you may still have.

USLV

webpage

VelocityShares 3X Long Silver ETN, USLV, trading at $43.15 at 10.30 am EDT on 26th March 20.

Posted at 10.35 am EDT on 26th March 20.