Resverlogix was

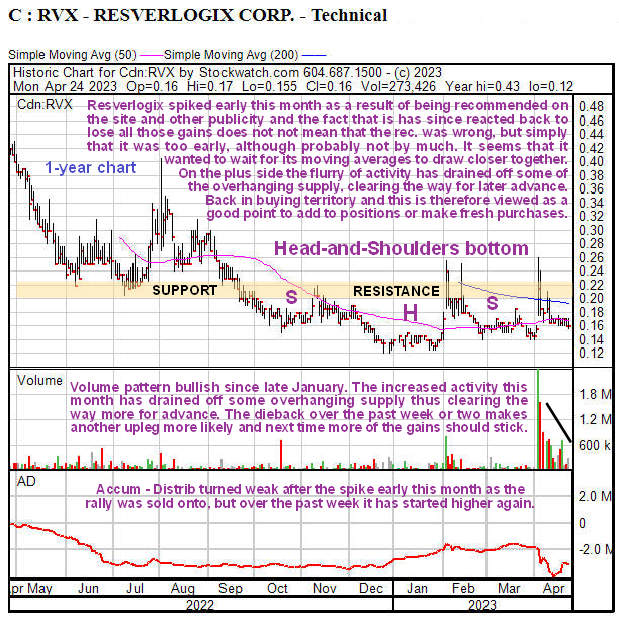

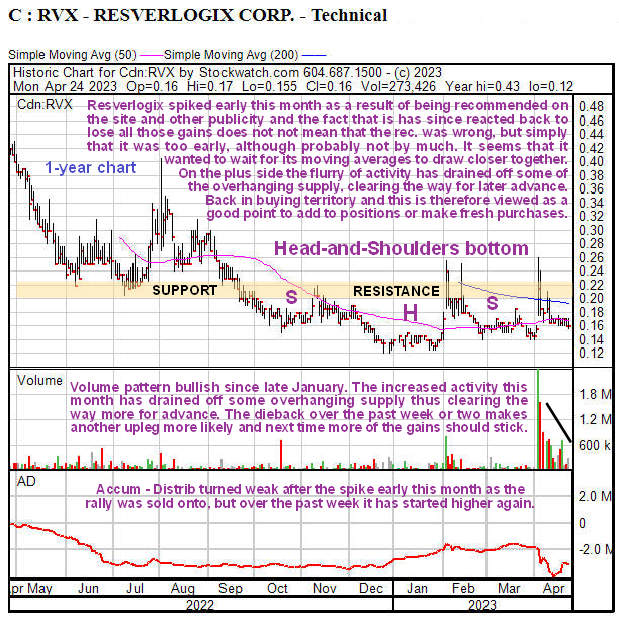

recommended on the site early this month on the 4th but after a brief spike it turned into a “damp squib” quickly losing all the gains and then ran off sideways on dwindling volume as we can see on its latest 1-year chart below. However, the case for owning the stock remains the same. Technically, all that happened was that the stock was not yet ready to advance with the 200-day moving average still dropping, but it is now closing on the price and the 50-day and this, coupled with the fact that the recent flurry of activity has drained off some overhanging supply, is believed to have set it up for another upleg soon, especially as volume is now light – and this time more of the gains should stick.

We therefore stay long and this is a good time to buy or add to positions.

We therefore stay long and this is a good time to buy or add to positions.

Resverlogix Corp.

website

Resverlogix Corp., RVX.CSX, RVXCF on OTC, closed at C$0.16, $0.118 on 24th April 23.

Posted at 8.55 am EDT on 25th April 23.