Volatus Aerospace is an interesting aerospace and drone company that offers a variety of different services including drone and fixed wing monitoring and surveillance, drone nesting stations, drone purchase and drone training plus other services. More importantly from our point of view its stock looks ready to turn up and begin a bull market after a long bear market from its inception at the start of 2022.

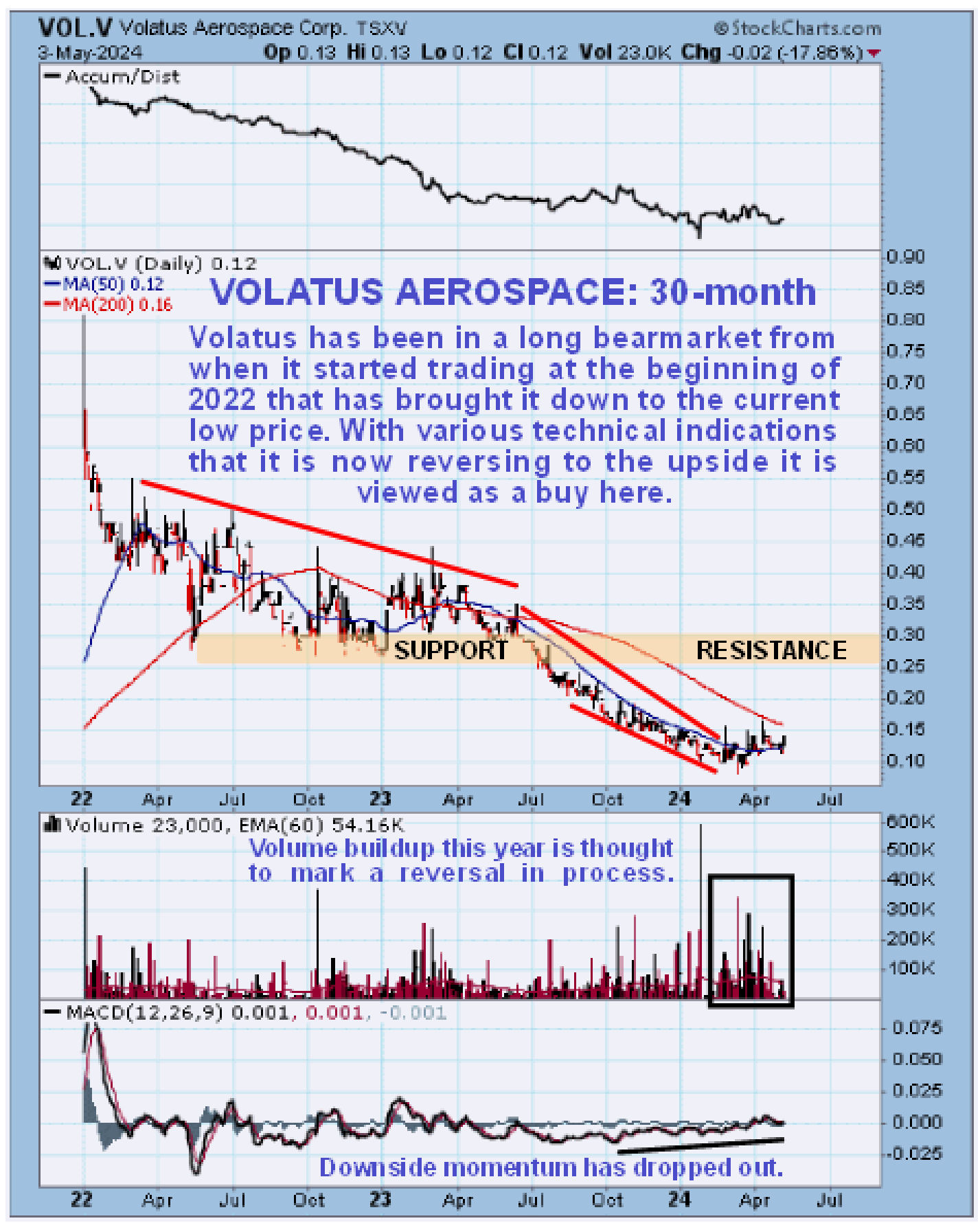

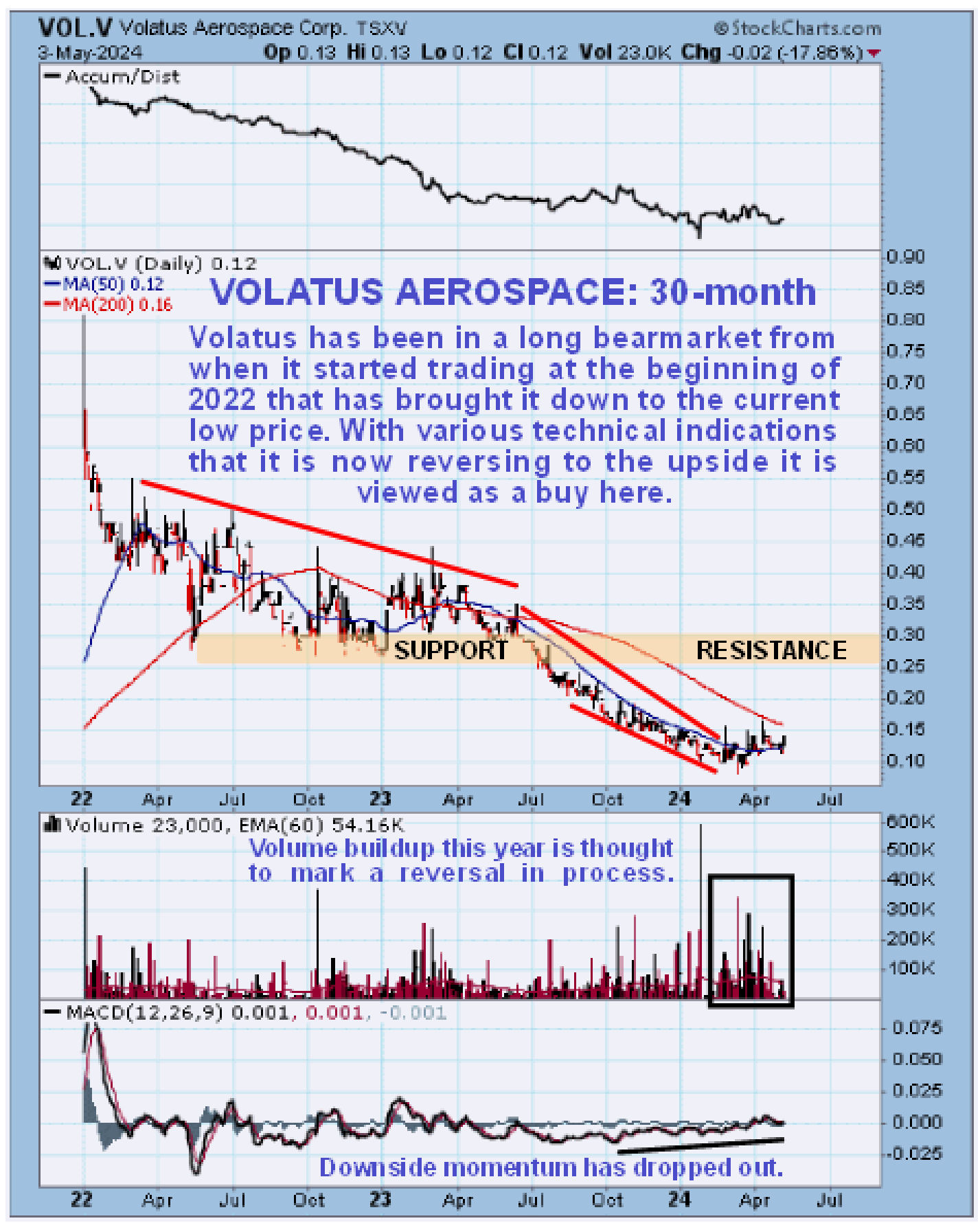

On the 30-month chart we can see that the long bearmarket in Volatus, that went on for well over 2 years from when it started trading at the beginning of 2022, erased 90% of its value from its high point at the outset to the low it touched this March. Whilst we cannot be entirely sure that the bear market is over, despite the recent low and current low price, due to the fact that it is still below a falling 200-day moving average, there are various technical indications, especially in the recent price / volume pattern, that it is over and that a new bull market is about to begin. A positive background factor for the company that is worth pointing out here is that the market for drones and drone services is very buoyant at this time.

Looking now at the 6-month chart we can see why a breakout into a new bull market looks likely soon – the price is in the late stages of what is believed to be a Head-and-Shoulders bottom that has been developing beneath a band of resistance roughly in the 15 – 16 cent zone. The volume pattern has been increasingly positive since late March even if, up to now, it has had little effect on the Accumulation line with downside momentum (MACD) steadily dropping out since last October and moving averages are converging in a manner that frequently leads to a breakout. With the price now close to or at the Right Shoulder low after Friday’s drop, this looks like a good point to buy the stock.

In a recent article

Drone Co’s Services Extend with Federal Approval it was detailed that Volatus Aerospace's authorization from the Federal Aviation Administration will let it attain revenues from the sale, charter, or operational support of agricultural drones, as well as recurring revenues from its operation, management, and maintenance, according to an Echelon Capital Markets report and also that Echelon Capital Markets maintains a Speculative Buy rating on Volatus Aerospace Corp. with a target price of CA$0.68 which is well above the current price.

Volatus Aerospace is therfore rated a strong buy here for all timeframes. Buyers should note that the price may “hang around” in this general area for up to a few weeks waiting for the moving averages to draw closer together, and if so the stock may be accumulated on down days. It is understood that management and insiders own 63% of the stock.

Volatus Aerospace

website.

Volatus Aerospace Corp., VOL.V, VLTTF on OTC, closed at C$0.115, $0.083 on 3rd May 24.

Posted at 12.30 pm EDT on 5th May 24.