This article is a follow on from the article on platinum posted earlier. The reason is that Generation Mining is on course to be a producer of not just platinum, but copper, palladium and significant quantities of silver too. It is progressing the Marathon Project, recognized as one of North America’s few fully permitted and construction-ready critical mineral developments. It describes itself as “shovel ready" which is good to know as it means that the company has been granted all of the necessary permits and has funding organised – it has a streaming agreement with Wheaton Precious Metals.

For reasons of space and time we don’t normally delve into the fundamentals much as the charts tell us most of what we want to know, but on this occasion we will to some extent, because the fundamentals of this company are compelling. For this purpose we will include some pages from the company’s

Investor Deck.

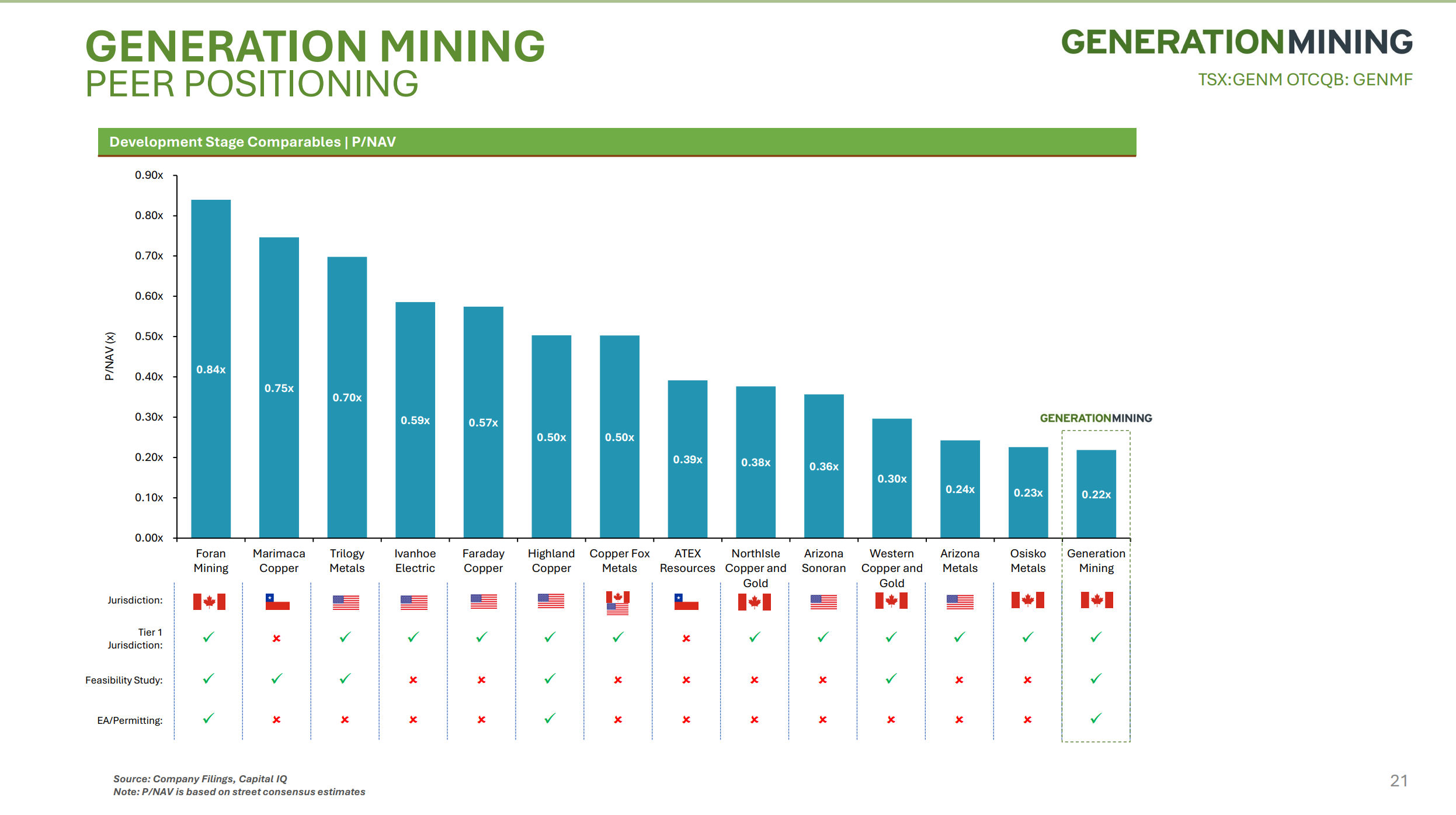

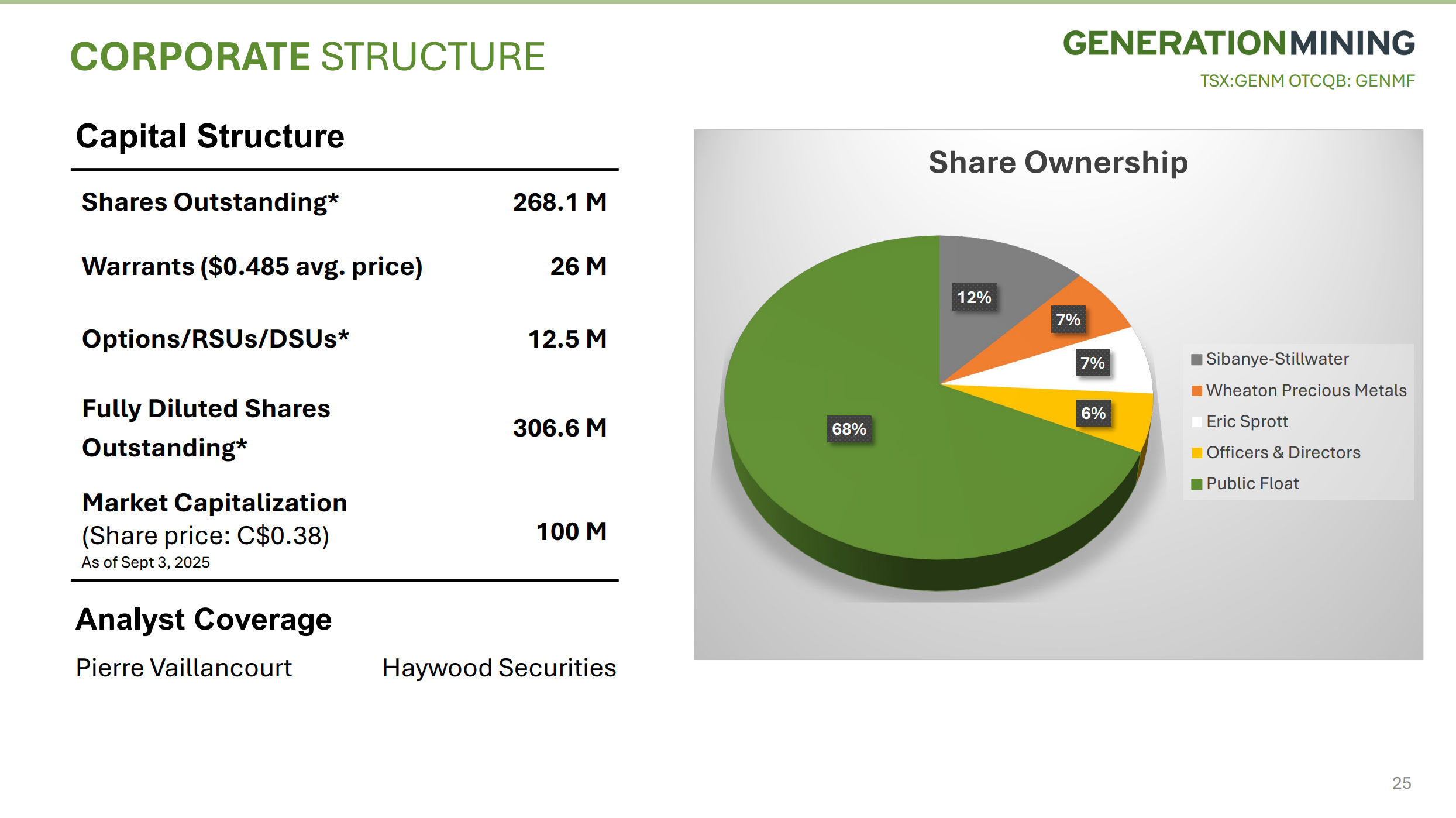

The first page shows that the company’s P / NAV (price to Net Asset Value) is the best among its peers standing at just 0.22 which means that it is way undervalued in relation to its assets…

Click on pages to pop up a larger image.

Click on pages to pop up a larger image.

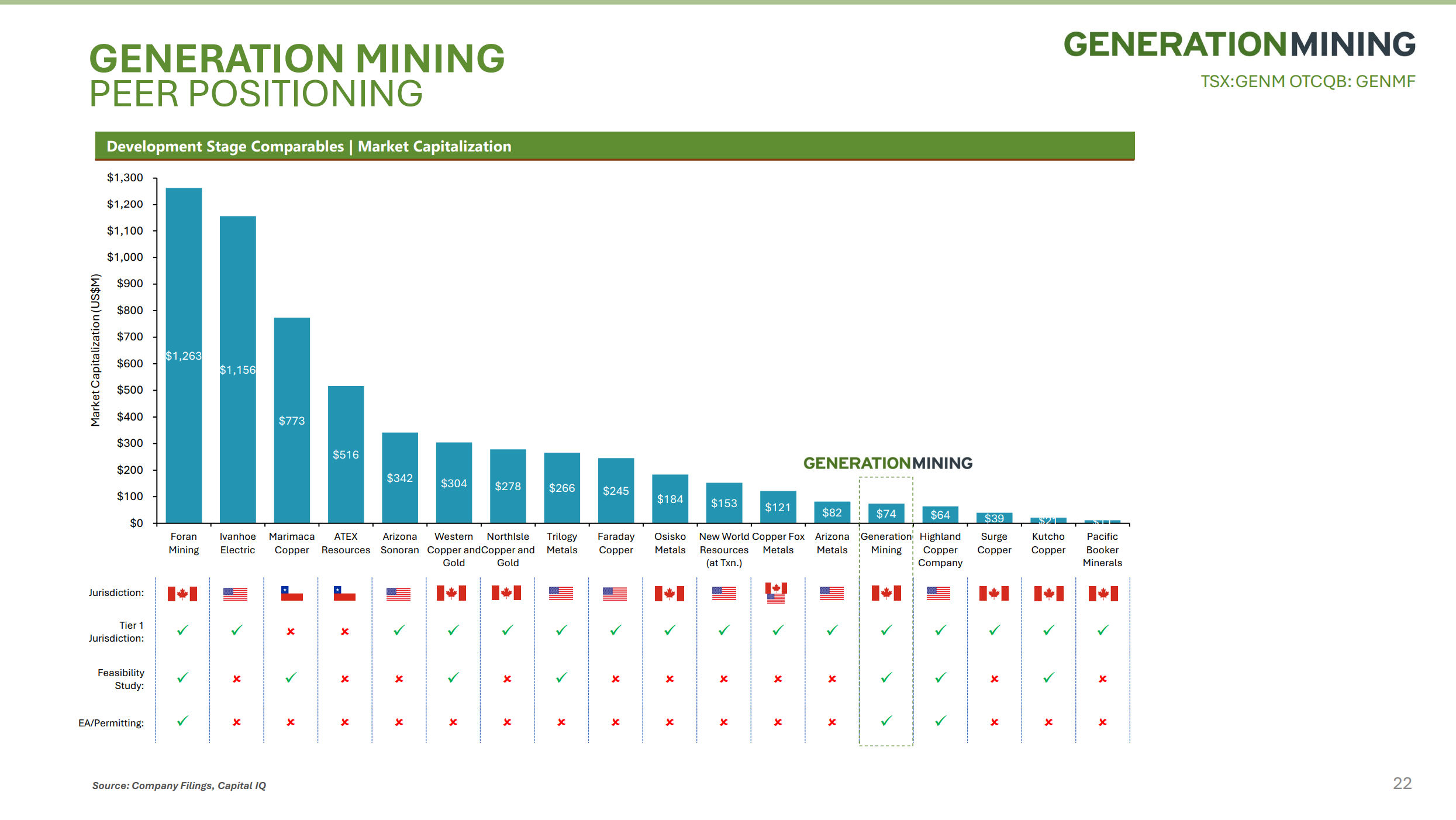

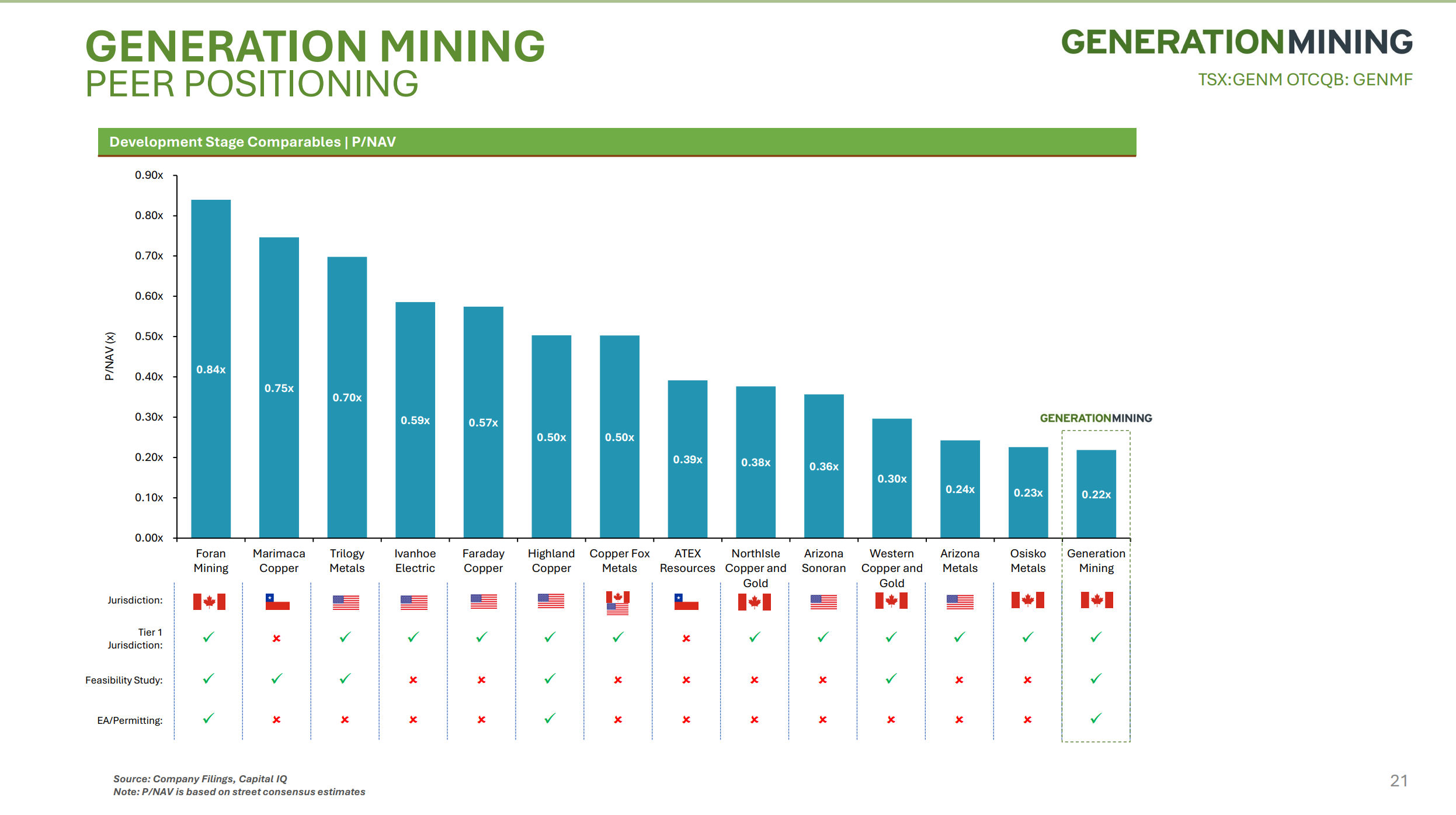

On the next page we see that its Market Capitalization is a very modest $74 million which is all the more impressive when you factor in that the company’s Marathon Project is in a Tier 1 jurisdiction, it has a completed Feasibility Study and is fully permitted…

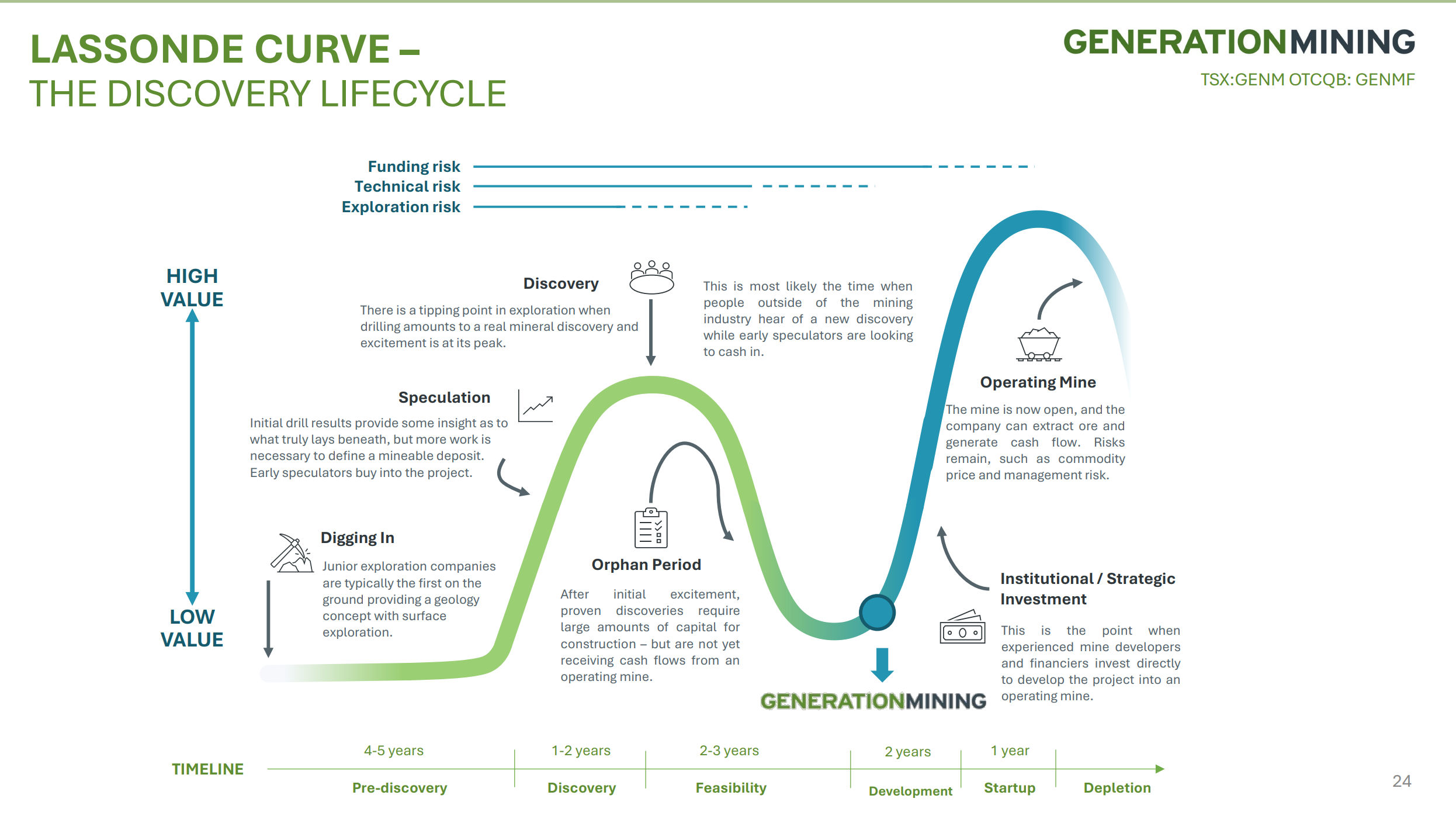

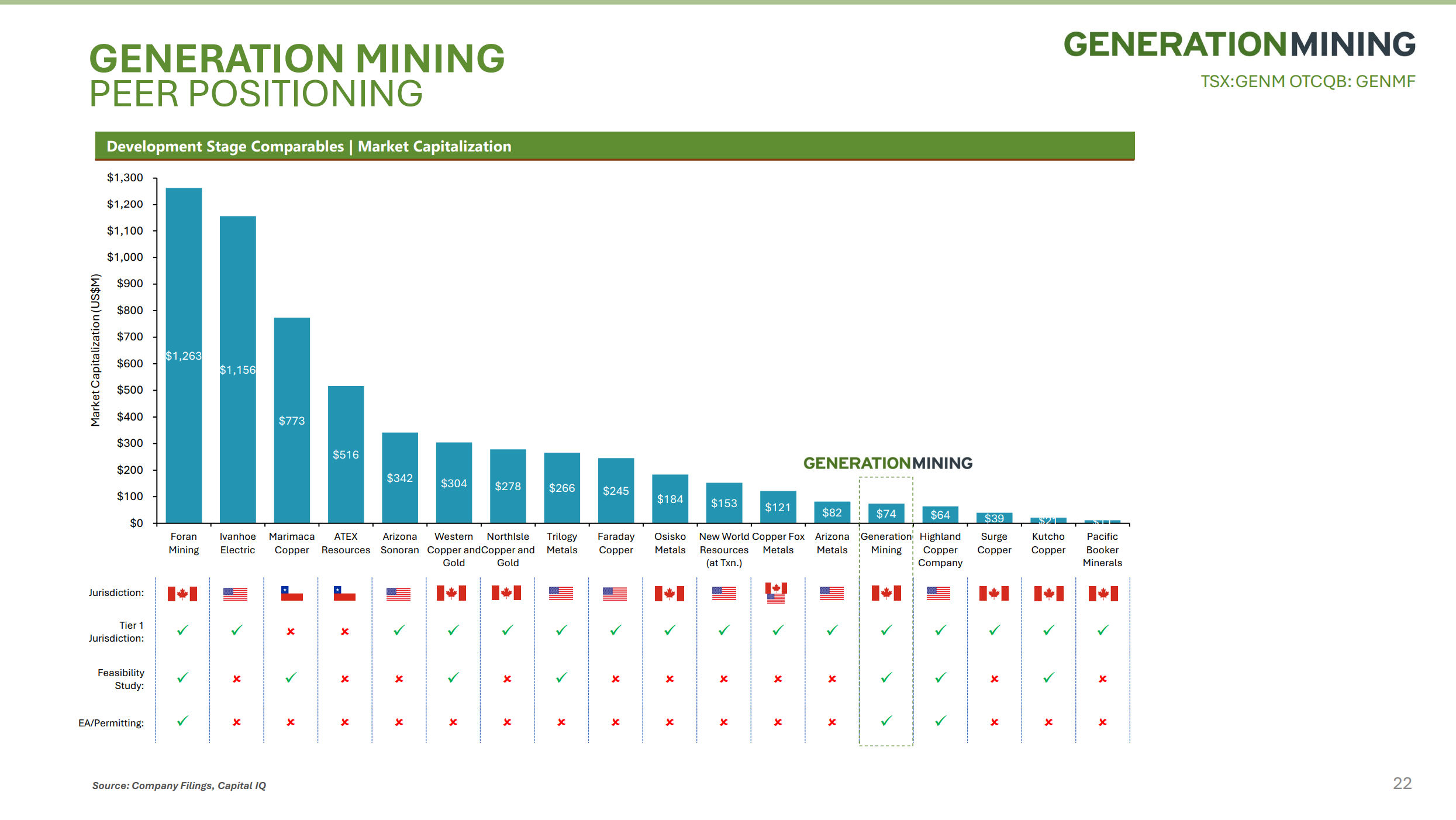

Another attractive feature is where the company’s valuation sits on the Lassonde Curve, right at the point of valuation takeoff as the company approaches production, although this is according to them so we might want to take this with “a pinch of salt”. That said, our stock charts concur with their assertion which is therefore believed to be correct…

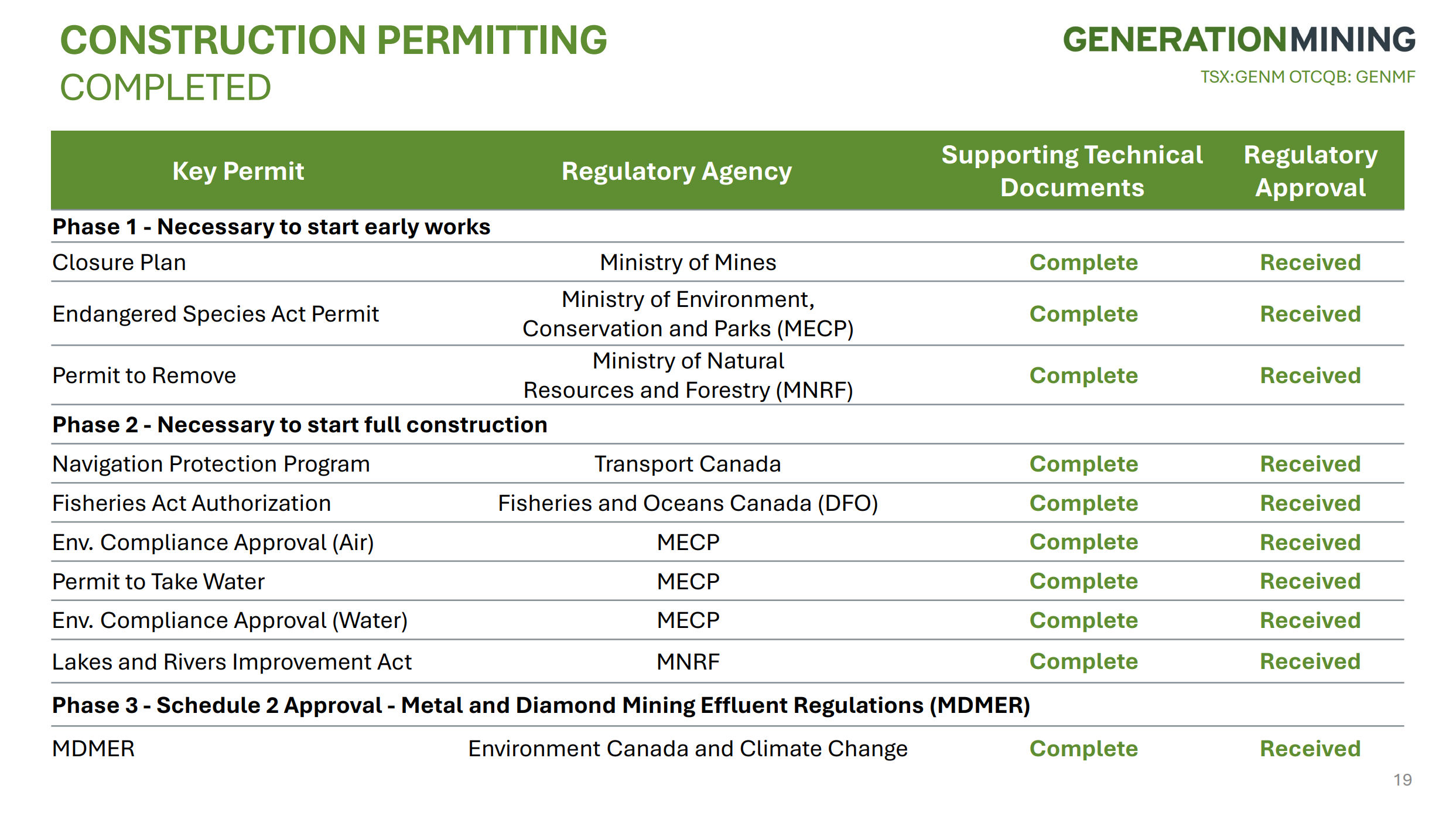

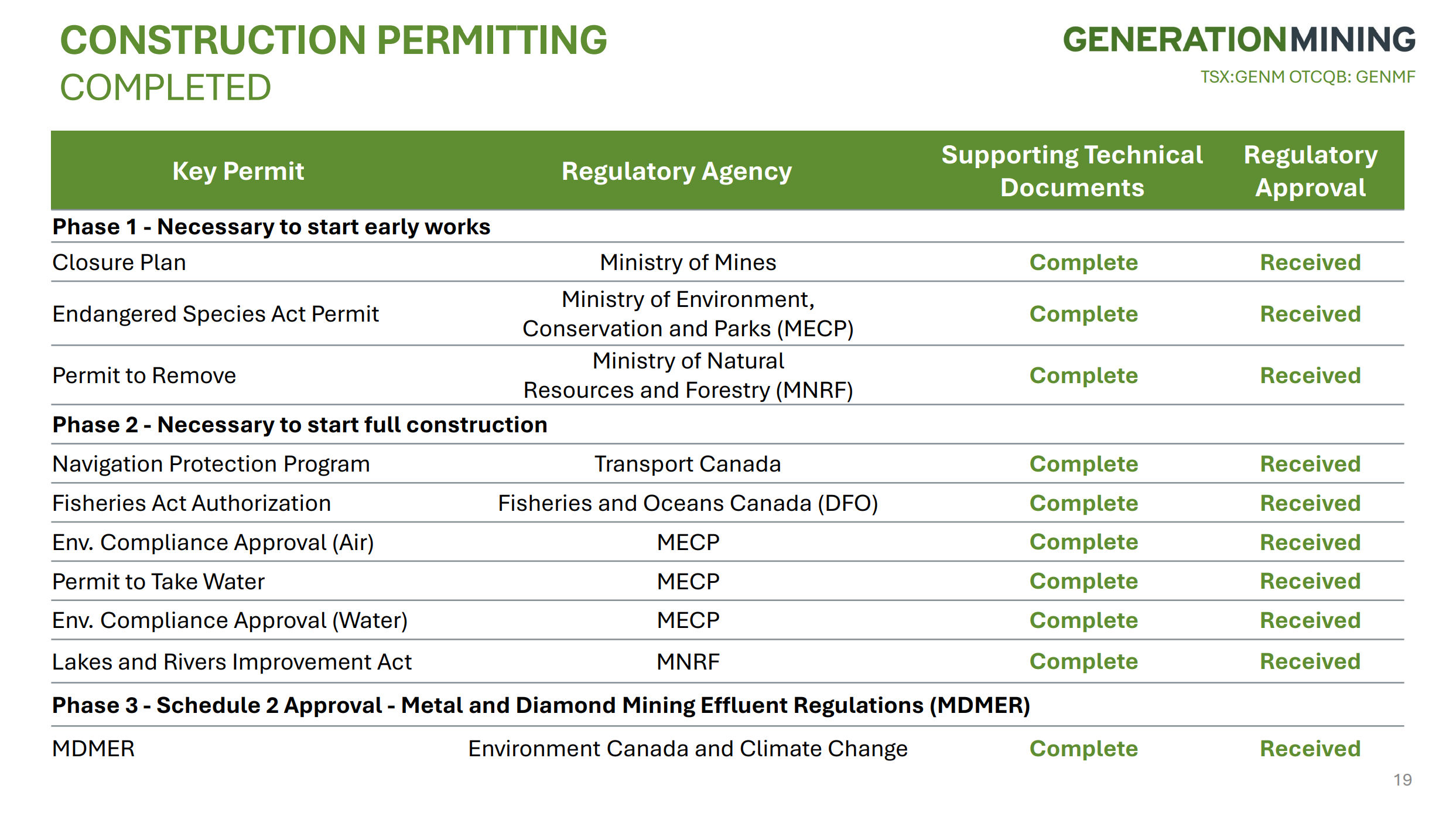

The following table couldn’t be better – all construction permitting has been completed, so the company has a big green light to move forward…

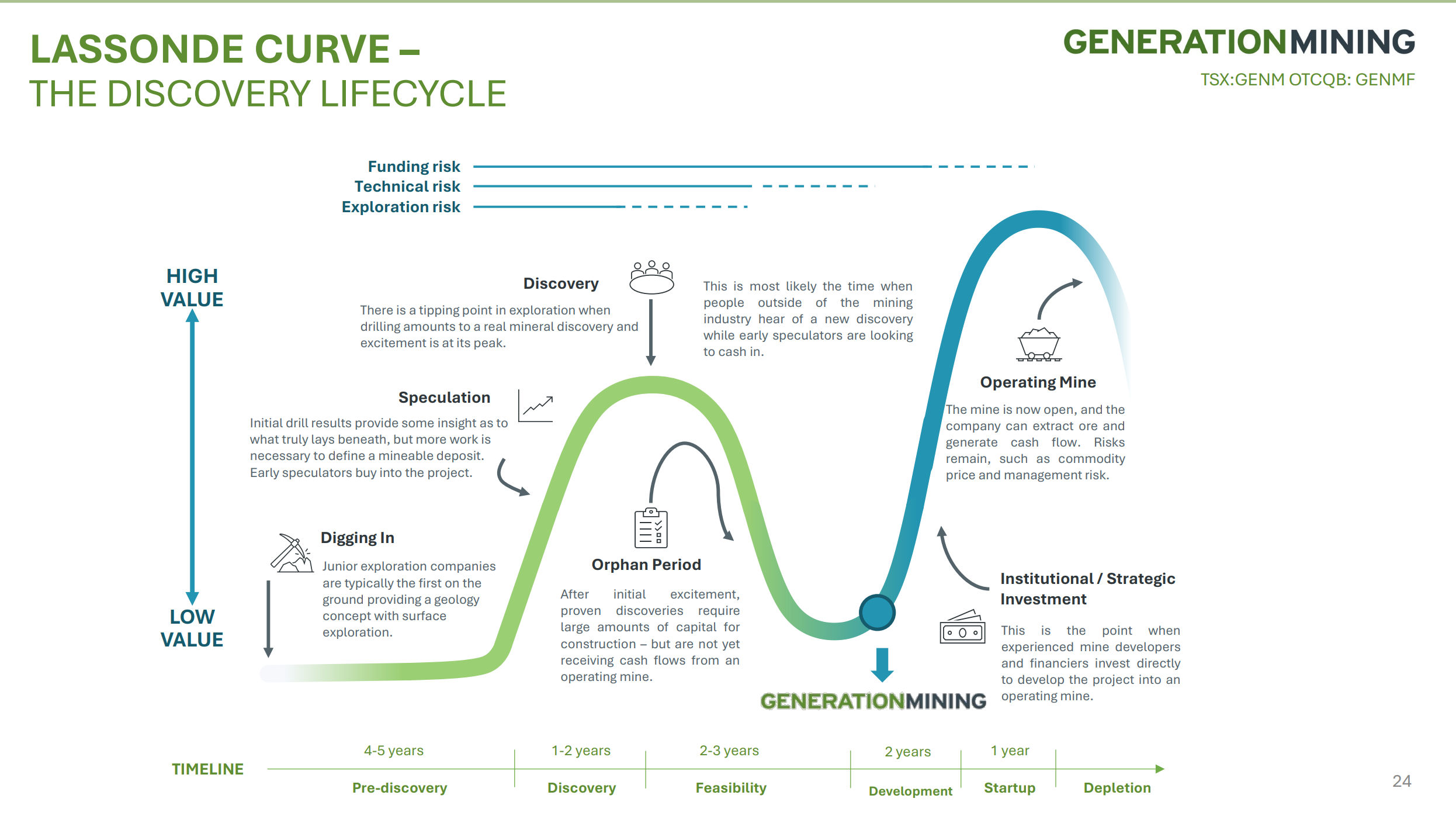

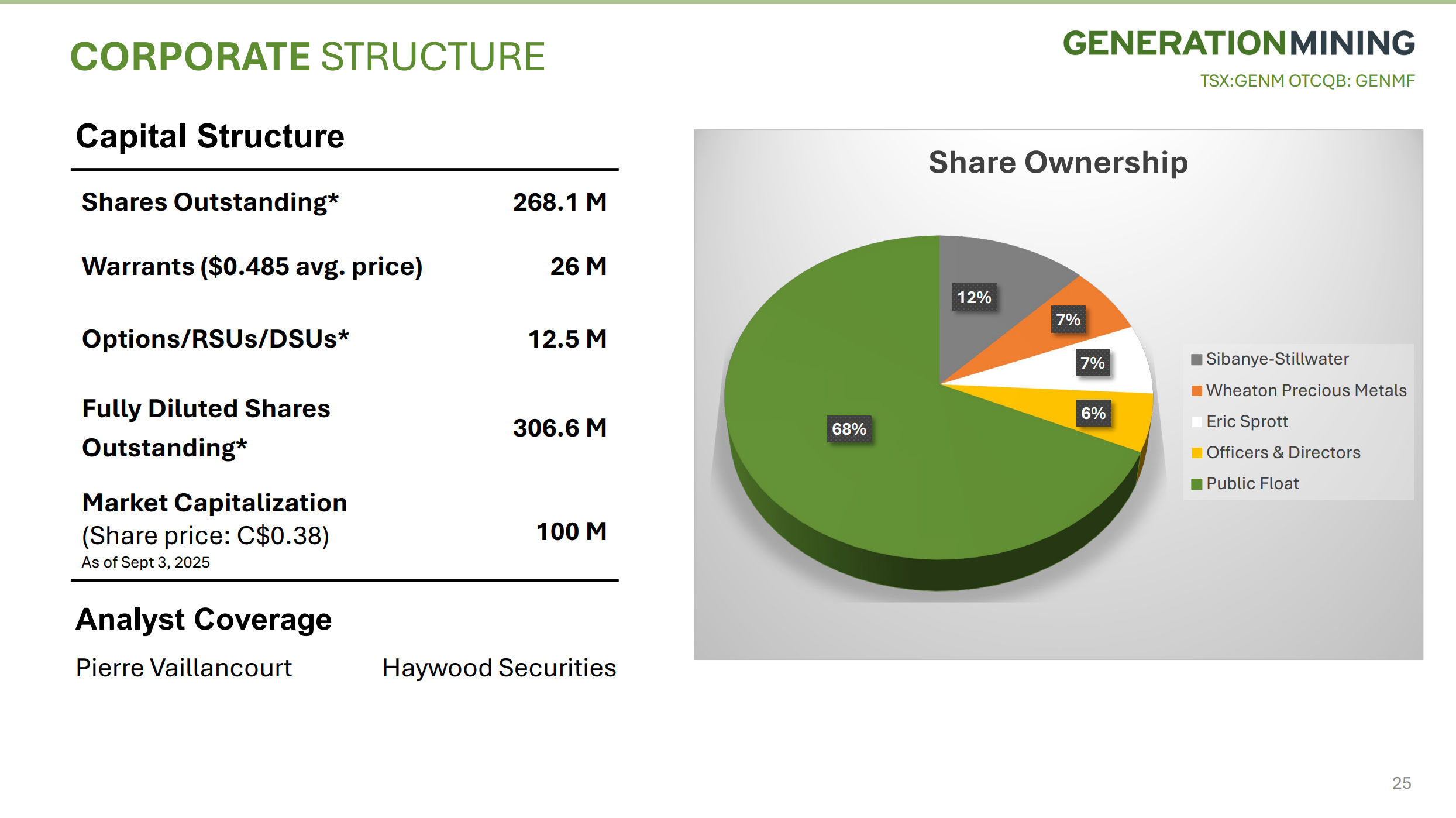

Whilst the number of shares in issue might be considered on the high side, it is not in relation to the size of the operation, and of the 268 million shares outstanding a sizable chunk are owned by Sibanye-Stillwater, Wheaton Precious Metals and Eric Sprott who is not known for investing in losers…

Now we move on to consider the charts. We only need 2 of them, an 8-year and a 1-year to see what’s going on.

Starting with the long-term 8-year chart we see that after it started trading on this market in the Spring of 2018, it went into an accelerating bull market for several years that culminated with a steep ascent into a peak in the Spring – Summer of 2021 above C$1.20. Then it tipped into a severe bear market that brought it all the way down to just C$0.10 by the time it hit bottom early this year, although it had begun a basing process beneath the resistance shown at about C$0.40 – C$0.45 as far back as mid-2023 long before it reached its final low. We can just make out that the latter part of this base pattern is a Cup & Handle that has been accompanied by increased upside volume this year that has the On-balance Volume line moving higher, which is bullish, and we will now look at this in much greater detail on a 1-year chart which shows it in all its glory.

On the 1-year chart we can see that an unusually fine, clear Cup & Handle base has formed over the past 11 months with the strong rally in May and June to complete the right side of the Cup believed to have been fuelled in large part by the steep runup in platinum during this period. After becoming extremely overbought on this move it has consolidated, marking out the Handle to complement the Cup which has allowed time for the overbought condition to unwind and for the moving averages to at least partially catch up. This Handle is now considered to have been going on for long enough and with platinum in particular looking poised to break out into another strong uptrend, the time is ripe for Generation Mining to do likewise.

Generation Mining is therefore rated an immediate strong buy for all time horizons.

Generation Mining is therefore rated an immediate strong buy for all time horizons.

Generation Mining

website

Generation Mining Ltd., GENM.TSX, GENMF on OTC, closed at C$0.375, $0.275 on 19th September 25.

Posted at 4.20 pm EDT on 20th September 25.