After the sharp drop from the middle of last month, trading in the Precious Metals sector has become relatively quiet over the past 2 weeks, with gold, silver and PM stocks trading in an increasingly narrow range. What this means is that a larger move is likely soon and the big question is what the direction of this larger move will be and if up, will it mark the start of the next major uptrend?

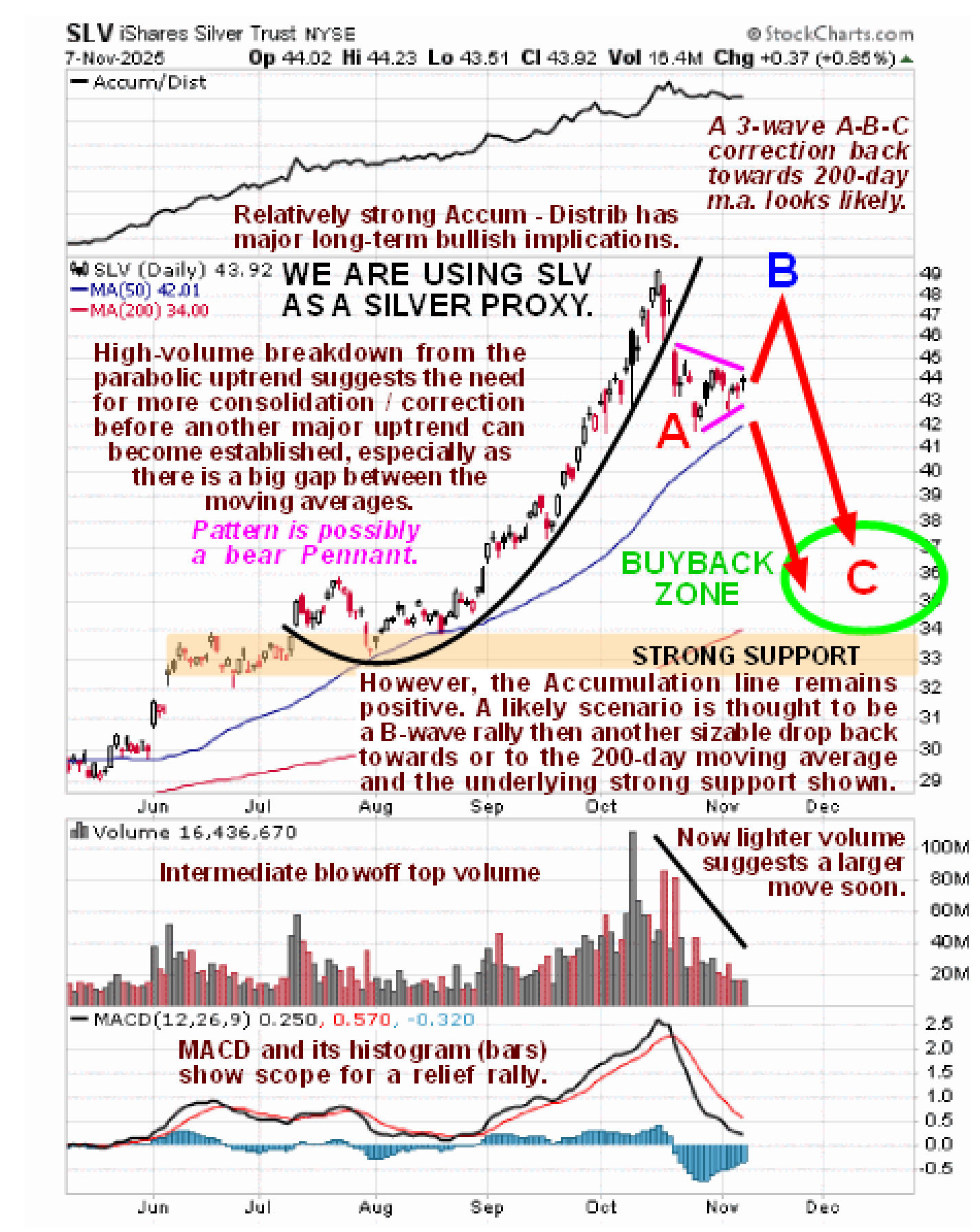

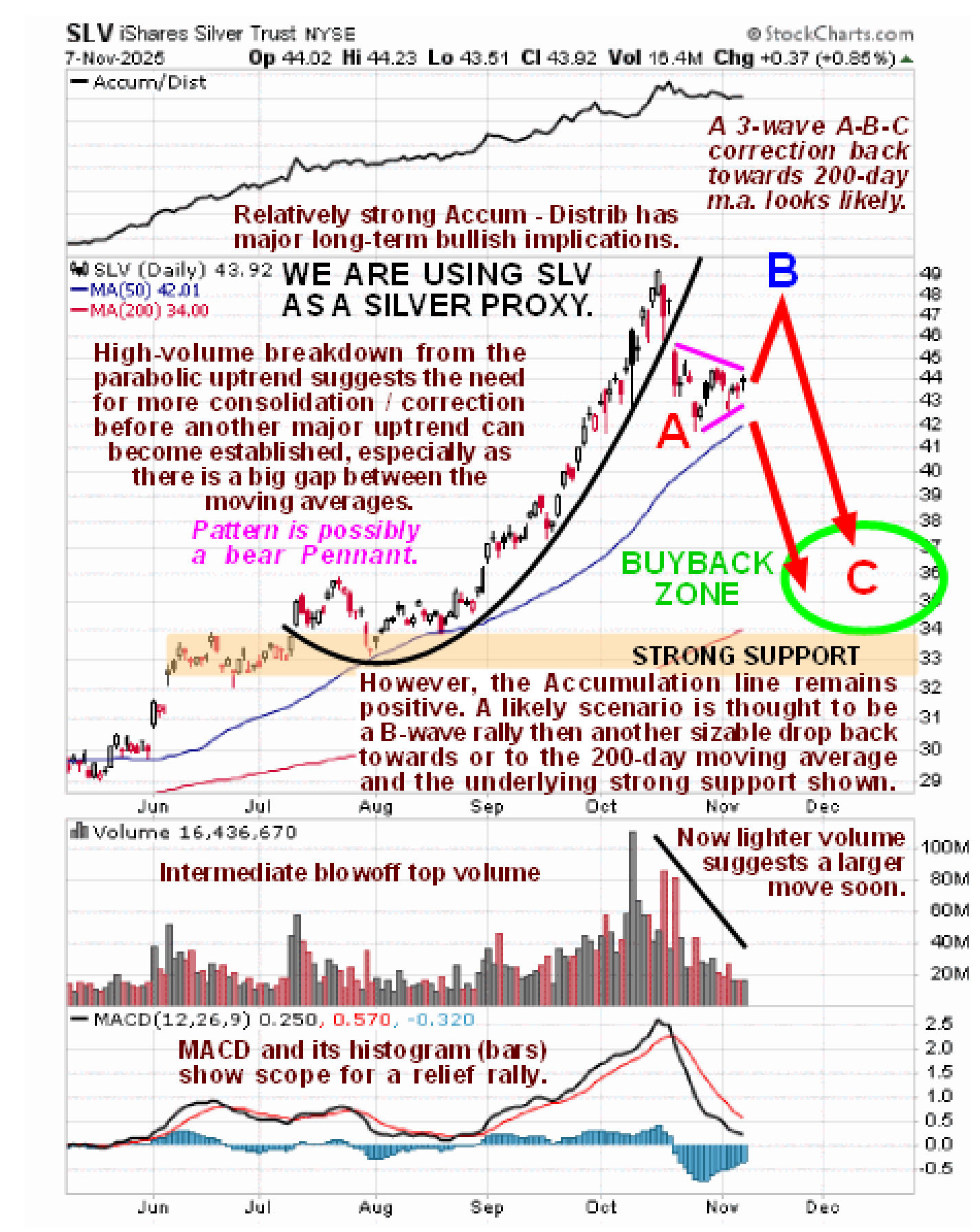

In this update we will only look at the chart for the faithful silver proxy, iShares Silver Trust, SLV, because the same reasoning applies to silver itself, to gold (and GLD) and to GDX and the Precious Metals stock índices.

We’ll start by making the point that this correction is not believed to be over yet. There are several reasons for this opinion. One is that, as we can see on the 6-month chart for SLV above, it has broken down from a steep parabolic uptrend with volume having become very heavy around the peak, indicating that this was a “blowoff top” which normally means that a quite lengthy period of consolidation / reaction is needed to rebalance sentiment – and we haven’t seen much so far. The breakdown also involved a collapse in upside momentum (MACD) implying that for now the trend is down. Another factor pointing to the need for further correction is the large gap that has opened up between the 50 and 200-day moving averages. Although moving averages are definitely in bullish alignment, which bodes well for the longer-term, the current rate of climb of the 50-day is steep and further correction will serve to moderate this rate of climb. A complicating factor in deciding what will happen next is that the Accumulation line has held up well on the correction thus far which means two things, one is that the long-term outlook remains highly favorable as we have earlier observed, but the other is that the triangular congestion pattern that has formed over the past two weeks could be a small base pattern that leads to renewed advance at least temporarily, although as pointed out above, it is thought to be too soon for a major new uptrend to begin. These deductions lead us to the conclusion that the two most probable scenarios are that we see a B-wave “sucker rally” as shown on the chart that is followed by another quite severe downleg back towards the rising 200-day moving average and the strong support not far beneath it – if this happens we will probably turn a nice little profit on the stocks we have bought over the past week or so which we might dump on the B-wave peak with an eye to buying them back again later and the other scenario is that the triangular pattern that has formed over the past two weeks is a bear Pennant, despite the Accumulation holding up, that will lead to the sector breaking sharply lower again soon.

Conclusion: further correction by the sector is expected in coming weeks and the only question is whether we first see a modest rally that fools a lot of investors into thinking that the next big upleg is beginning – it could be but for the reasons given above this is considered unlikely. If we do see the B-wave rally then we will probably take profits in the stocks we bought over the past week or so with the aim of buying them back later. If we don’t then we will hang on and aim to buy across the board / add to positions once the sector drops into the target zone shown (parallel target zones were given for GLD and GDX in the PM SECTOR CORRECTION ROADMAP article posted on the 31st.

Posted at 12.55 pm EST on 9th November 25.