Action in the stockmarket and in individual stocks that we have lined up as candidates to short looked bearish by late yesterday, following a jump occasioned by the Trump - Xi can kicking exercise at the G20 summit at the weekend, which ironically may pressure interest rates higher. Both this and the dovish noises out of the Fed about a week ago regarding the course of interest rates have been insubstantial pieces of news that triggered sharp rallies in the market largely because it was oversold and sentiment had become heavily bearish. Now, however, the market is looking vulnerable to a reversal and drop again. A severe bearmarket or crash and recession / depression are now pretty much inevitable. We have just seen a dangerous development with the yield curve inverting on the 3 to 5 year Treasuries and rates are set to rise next year regardless of what the Fed does, due to an acute shortfall in demand for Treasuries.

A word about strategy here. It has been pointed out several times that the market is still in the late stages of a topping out process, and that

the big drop or crash will not occur until the market has broken below its lows of last February – April. This being so we should be careful not to use up too much of our ammo here, and hold back much of it for “The Big One”. It’s worth doing the Puts detailed here, but you should not use up more than a modest percentage of your speculative capital at this juncture, since we plan to buy a bucketload of Puts right before the crash, and that might still be a little way off yet, although a move in this direction does seem to be imminent.

Again you are reminded that the trades set out here are only suited to the most experienced subscribers, who can handle the risks involved in trading options, which are high, and take full responsibility for their actions. Although the risks are high these trades are worth doing from time to time because the leverage is huge and the potential for gain correspondingly high – and we have to have something to keep us amused while we wait for the PM sector bottom. If you are out of your depth with this stuff, which is nothing to be ashamed of, just watch and learn, like this guy...

Cartoon from the “Yobs” series by UK cartoonist Tony Husband.

Cartoon from the “Yobs” series by UK cartoonist Tony Husband.

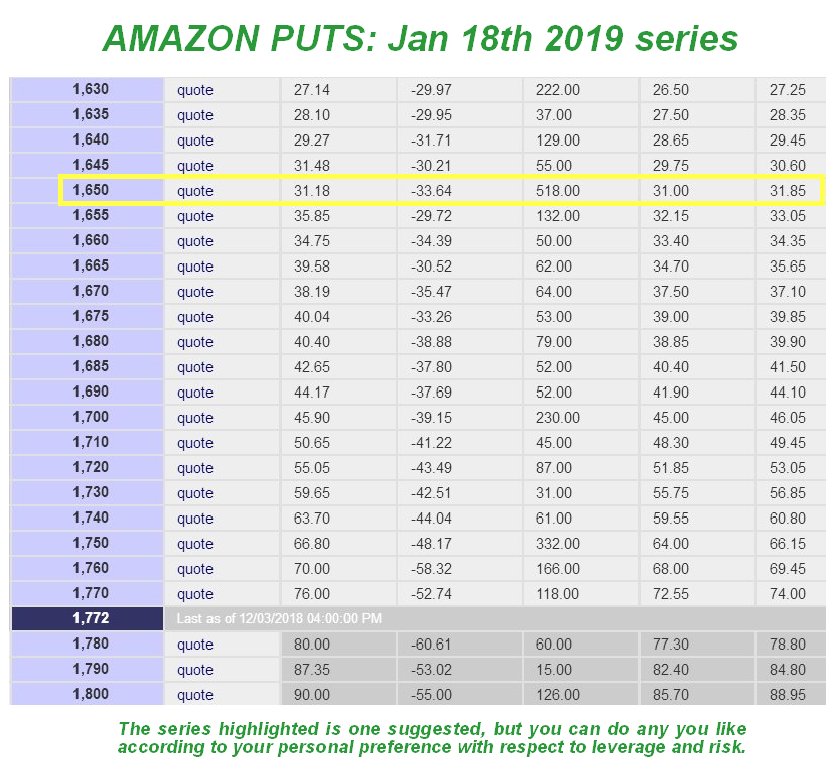

Starting with Amazon, it hopped out of its downtrend channel as we had surmised it would following the “success” of the trade war freeze at the weekend, driven higher by the rise in the broad market. However, it is looking vulnerable here now as it has risen up through a falling 50-day moving average into a zone of significant resistance, and yesterday’s bearish “hanging man” candle implies that it is about to drop back again. Thus it looks like an immediate candidate for Puts.

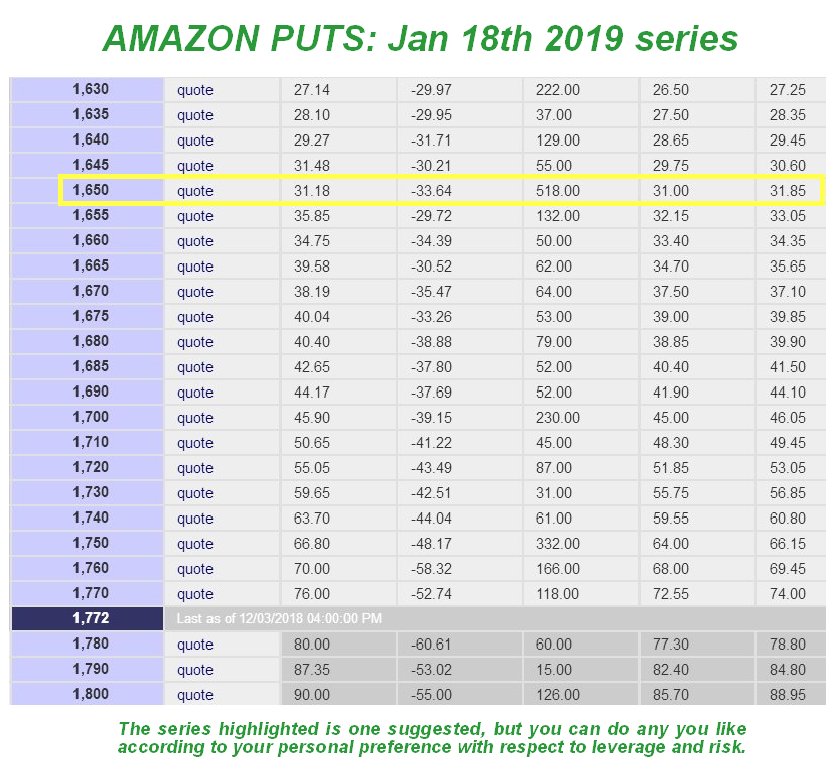

An appropriate Put series to go for here is the Jan 18th $1650 Puts (ask $31.85 last night’s close, will be marked up at open), but a wide range of series will do, depending on your preference with respect to leverage and risk.

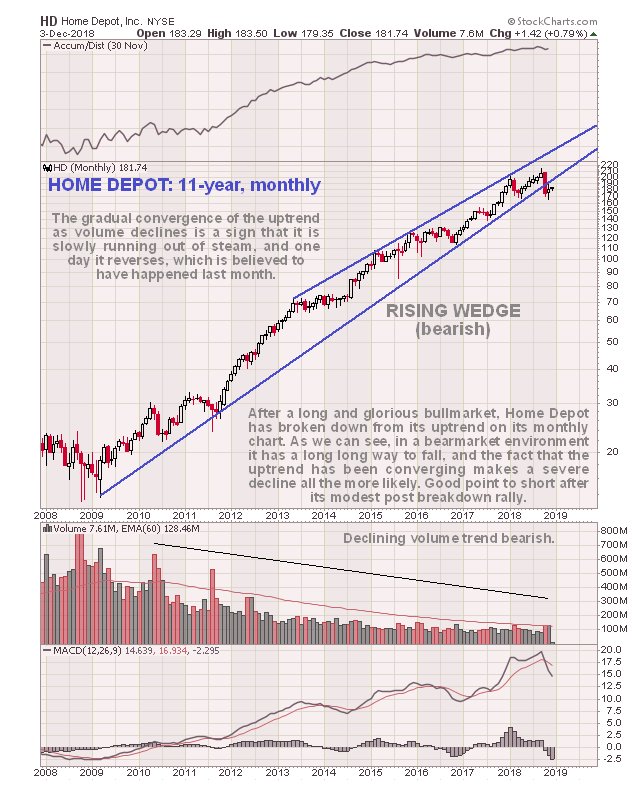

Another one that is looking vulnerable here is Home Depot, which also put in a “hanging man” yesterday just below its falling 50-day moving average and not far beneath resistance…

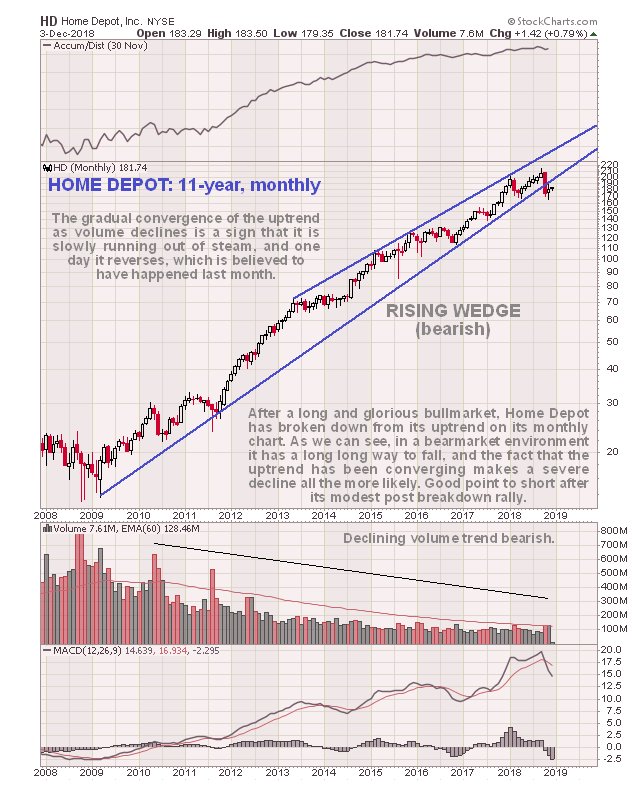

On Home Depot’s long-term 11-year chart we can see its long and glorious bullmarket from 2008 in its entirety. It has made huge gains during this period, rising about 20-fold, very good for its shareholders but probably not so good for its customers. No bullmarket lasts forever, however, and as we can see on this monthly chart, it started to break down from this uptrend last month, so the subsequent feeble recovery has thrown up a good opportunity to short it.

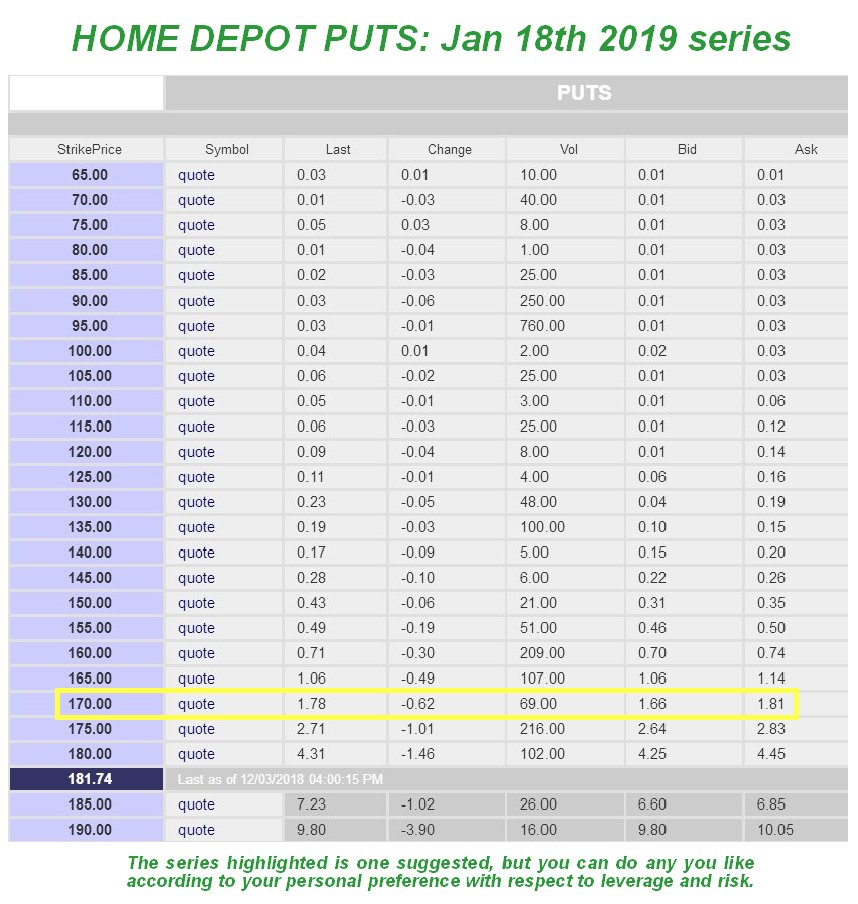

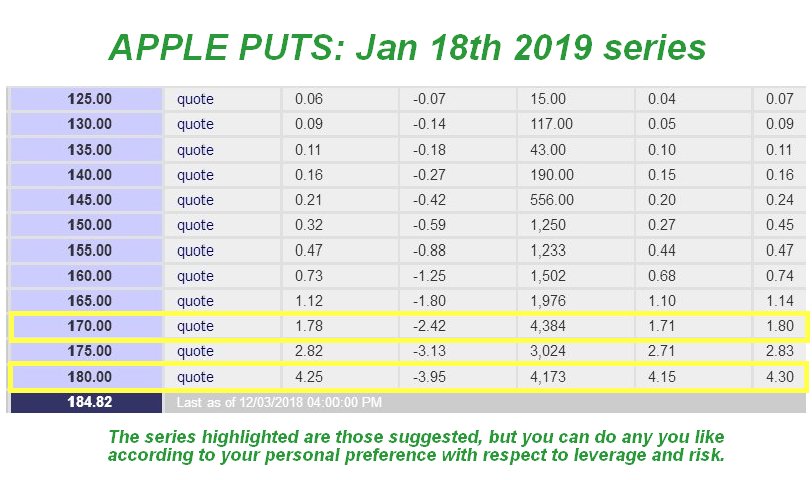

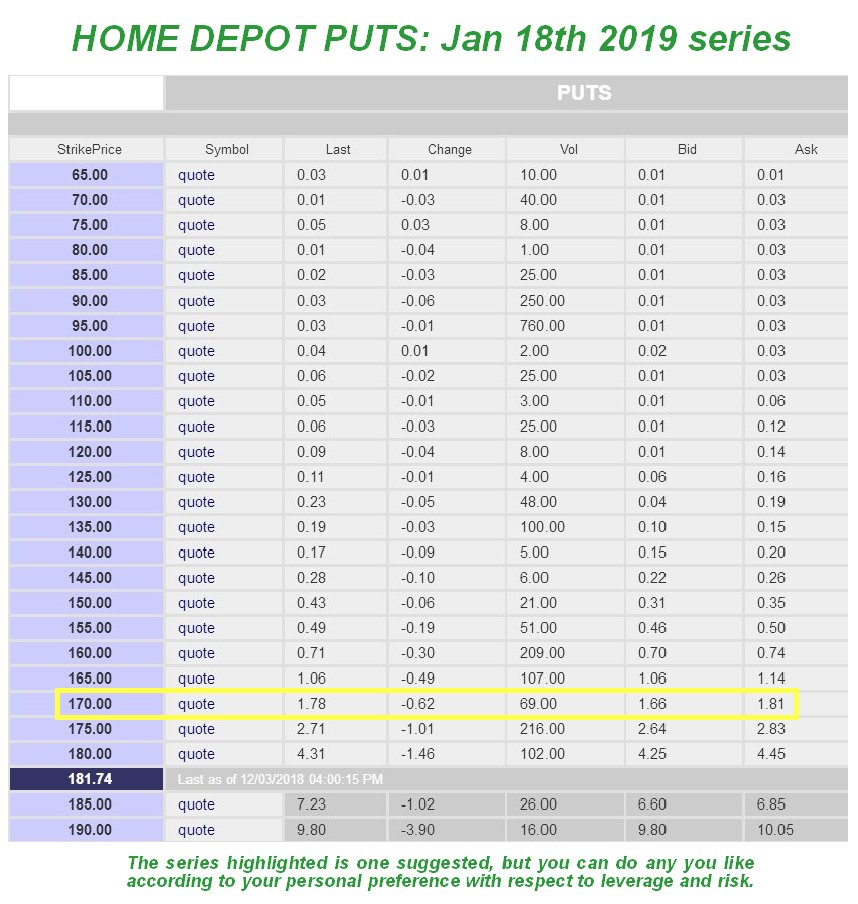

An appropriate Put series to go for here is the Jan 18th $170 Puts. The $160 series is attractive because it is cheap, but is much more risky because it is so far “out of the money”…

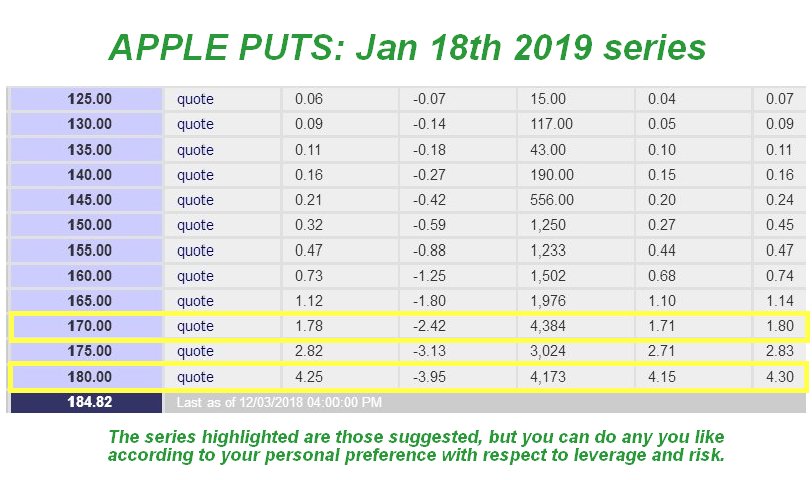

We have also been waiting on a bounce by Apple so that we can do Puts in it again (our small tranche of Dec $195 Calls are set to expire worthless). We have had a bounce of sorts, and it now looks ripe for shorting again, after it put in a pronounced bearish “hanging man” too yesterday, made more bearish by it also being a “doji”. Apple’s chart continues to look awful, which is hardly surprising as Apple’s future is looking increasingly grim, with sales of its overpriced products looking set to plummet in the face of stiff competition as the global economy tilts towards recession / depression. Suggested Puts are the Jan 18th $180’s (ask $4.30 last night’s close, will be marked up at open) or cheaper and with more leverage the Jan $170’s (ask $1.80 last night’s close, will be marked up at open).

End of report.

All prices for the close of trading on 3rd December 18.

Posted at 6.05 am EST on 4th December 18.