Now it is understood that most of you didn’t participate in this trade for various reasons, chief of which is that it was of course very risky, but for the benefit of those of you who did, and I know from feedback that some of you did, this is a brief review of this highly successful trade. The remainder of you can rest assured that we will soon be returning to our main theme of the Precious Metals sector, which continues to shape up for a massive bullmarket, possibly after the initial market crash phase.

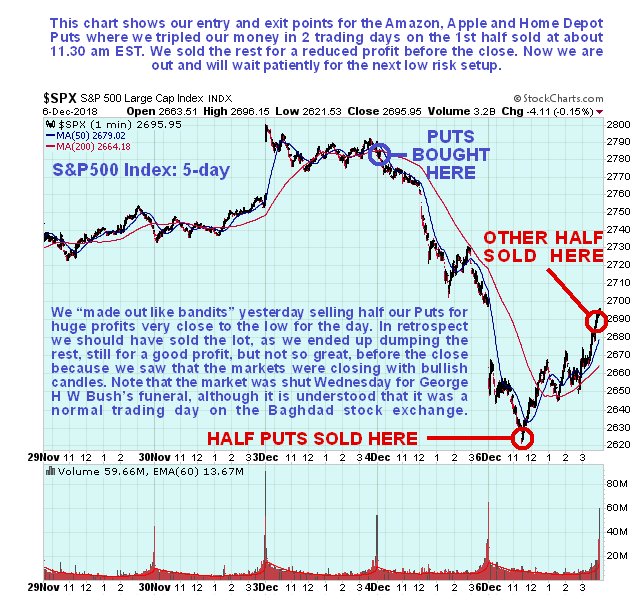

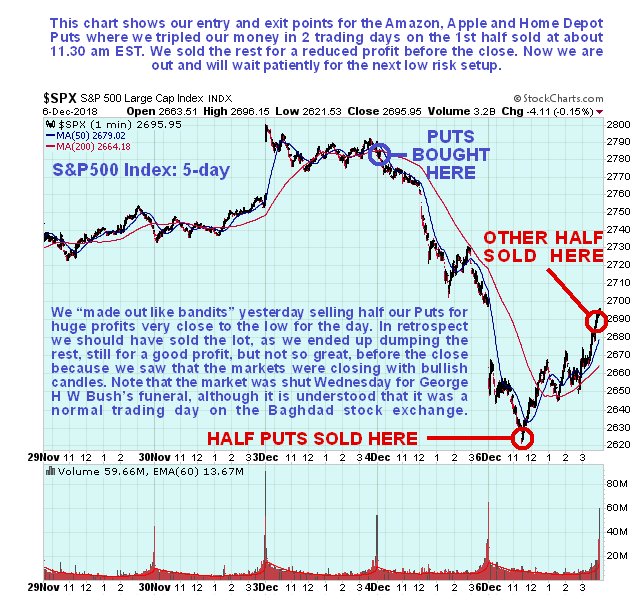

Looking at the 5-day intraday 1-minute chart for the S&P500 index, we can see that our entry point for the Amazon, Apple and Home Depot Puts that we did on Tuesday was near perfect, as we bought them at the start of the day before the rot set in, with the market tumbling at noon. The market was closed the next day (Wednesday) for the funeral of George H W Bush, although it is understood that the Baghdad Stock Exchange remained open as usual. We hung on and took massive profits on half of them at about 11.30 am EST yesterday right at the market bottom for the day, by which time the Amazon Puts that we bought at about $35 were at about $100, as an example. Then the market rallied and we decided to ditch the rest of them before the close, still for a good profit, although of course significantly reduced from earlier in the day. Nevertheless we still walked away with a whacking great profit.

The two Email alerts sent out yesterday read as follows…

The two Email alerts sent out yesterday read as follows…

1st Email alert dispatched at 11.27 am EDT…

“Puts alert

The market has plunged again today and our Puts, bought just a few days ago, have made huge gains. However the market is now closing on support at its October - November lows, which makes a bounce likely soon, probably about 2 hours before the close. So it may be prudent to take some money off the table here, and say, take profits on half of Put positions into strength now.

The Precious Metals sector is holding up very well and we must consider the possibility that the dollar is about to fail after Powell showed signs of losing his nerve last week regarding his rate hike agenda. If that happens then PMs are in position for a BIG rally - we will look at this later.”

2nd Email alert dispatched at 11.27 am EDT…

” Puts Alert 2 - Hammer candles at support - liquidate remaining Puts before close

Turns out we sold half our Puts exactly at the low for the day, if you acted quickly. The market has since reduced its losses, as expected, but in addition we are seeing possibly short-term bullish hammer candles in the Dow, and more especially the S&P500 index (and other indices). It is therefore considered prudent to sell the remaining Puts before today's close, if possible, and await developments. We sold the 1st half for very big gains in the space of a few days, and we still have good gains on the balance. TAKE PROFITS BEFORE THE CLOSE IF POSSIBLE, and we will review some of the charts later.”

The reason that we sold half of the Puts before midday yesterday can be seen on the 3-month chart for the S&P500 index below – after a big drop the market was arriving at a zone of significant support, which it was thought quite likely would hold, at least temporarily, and probably generate a bounce, which it certainly did. The reason that we dumped the rest of the Puts before the close was that a bullish looking candle appeared to be completing, which was close to being a bull hammer, so it was considered dangerous to stick around.

A more definite bull hammer appeared on the Dow Jones Industrials chart, suggesting that, for a little while at least, a bottom is in, which is another reason to take profits and await developments.

So, in conclusion, a highly successful trade. Yet there are two points to make at this juncture. One is that, after a successful trade like this, one can easily become emboldened and go storming back into a setup that is not so good. With these options trades it is better to be cautious, and lie in wait, sometimes for weeks, or even longer if necessary, until a sufficiently attractive setup appears. This is a market that “takes no prisoners” and if you get it wrong you are quickly killed. However, as you have seen with this, and with our earlier successful Apple trades (one modest Call trade expired worthless), there is big money to be made if you get it right. The other is that it appears that some of you received the 2 Email alerts yesterday very late, those of you using gmail, and I have been experiencing similar problems with gmail myself, with mails sometimes taking hours to arrive. The problem is not with the dispatching of the mails, which are generated by a direct instruction to the server. This situation with gmail is of course unacceptable and the solution is to use another mail service. The reason why this happens is unknown.

Now we are going to shift focus back to the Precious Metals, because there are signs that the Fed may lose their nerve over the rate rises, and if they do, the dollar will tank and the PM sector take off, which is certainly possible given the current COT structure and gold-silver ratio. So we are going to be paying close attention to this as we don’t want this train to leave to leave the station without us. However, at this stage this outcome is by no means certain, because the Fed may calculate that it can’t afford to back off on rates, because if it does it will be the Treasury market that tanks. If they stand firm then everything goes down, including gold and silver, and the only ways to make money will be inverse ETFs ands Puts, as we have already figured. Gold and silver are at a critical juncture here and we will be looking at their charts again shortly.

Posted at 6.30 am EST on 7th December 18.