If we are going to buy any stocks at a time like this it should be in those companies that are set to make money out of the Coronavirus crisis – and this one is. The reason is, despite the name (which is set to change), that the company is taking over Tracesafe, which is a self-quarantine monitoring technology suite known as IMSafe from WiSilica Inc. Tracesafe is a global health monitoring product that may be deployed by governments and corporations as they fight the global COVID-19 pandemic. Details may be read in

Blockchain Holdings to acquire Tracesafe system. In addition the company is understood to be doing a significant financing which it is understood is already oversubscribed.

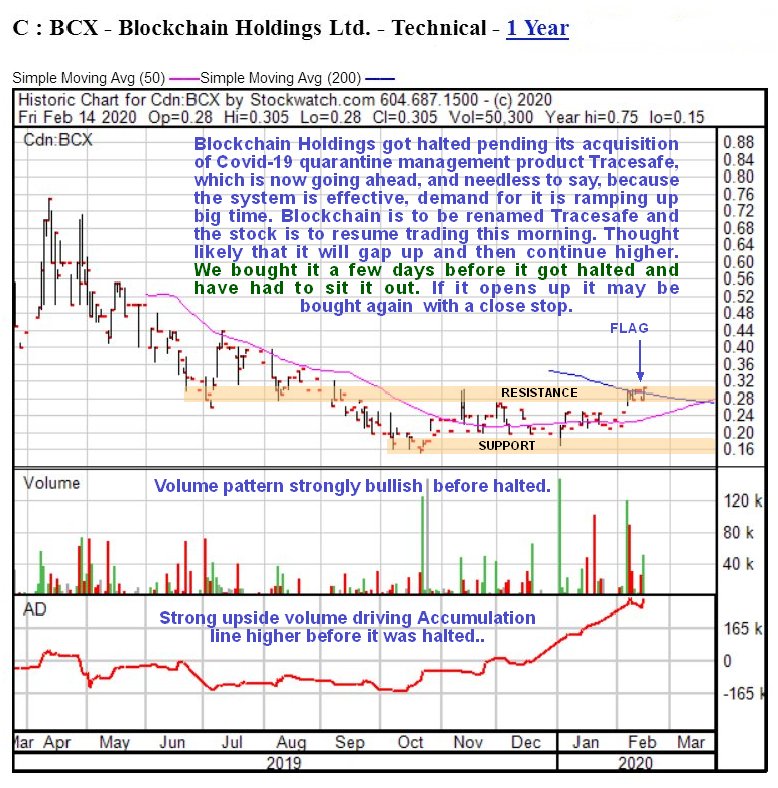

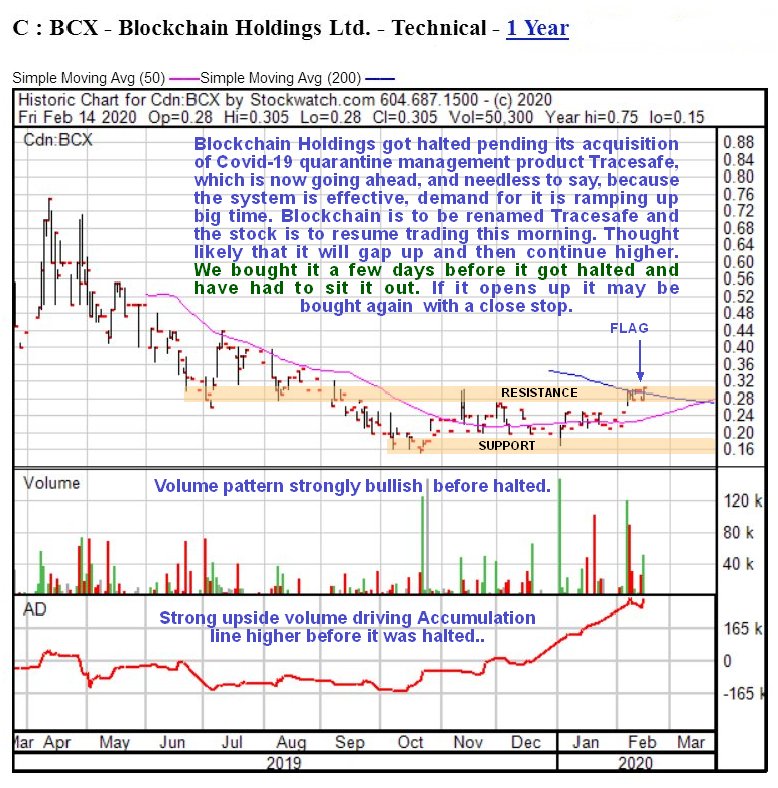

We bought Blockchain Holdings on 13th February and then got stuck with it when it got halted a few days later. Ordinarily we would expect it to open down when it starts trading today, in reaction to the market carnage of recent weeks, but not given the field into which the company is gravitating.

Amongst the positive news associated with the company we have this…

“Already,

Tracesafe disposable bracelets are being deployed and in active use by the Hong Kong government to manage and enforce their quarantine program for foreign visitors with initial deliveries completed. Based on the success of the program in Hong Kong, and confirmed orders in excess of 65,000 units, Tracesafe expects to roll out in multiple countries in the coming weeks and months. Tracesafe expects to make its next deliver of bracelets within the next 60 days, and estimates its working capital requirements for such deliveries to be approximately $300,000.”

So it looks like the stock could gap up when it starts trading this morning. We therefore stay long and it is rated a buy with a close stop if it does as expected and opens up.

Blockchain Holdings

website

Blockchain Holdings Ltd, to be renamed Tracesafe Inc., BCX.CSE, closed at C$0.305 on 14th February 20.

Posted at 9.25 am EDT on 23rd March 20.